CNBC’s Jim Cramer on Wednesday warned that growth stocks could take another beating if the October consumer price index reading shows that inflation is still running rampant.

“If we get a steaming hot CPI reading, you’re going to see more horror on your screen, so that’s why people sold ahead of it,” he said.

The CPI measures the prices for a basket of goods and services. Investors will parse through the October report, set for release Thursday morning, for any signs that inflation has cooled with the view that the Federal Reserve could then ease its brisk pace of interest rate hikes.

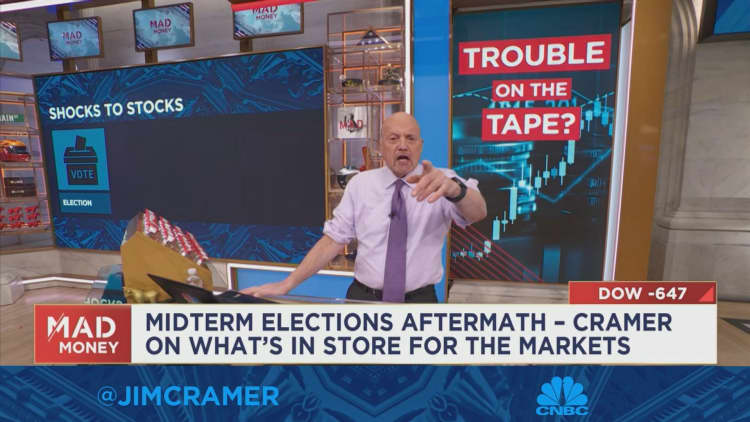

Stocks fell on Wednesday, weighed down by a crypto sell-off and uncertainty about which political party will gain control of Congress following the midterm elections. The market’s decline comes after three consecutive days of gains.

Cramer echoed his advice to investors in recent weeks to stay away from semiconductor and tech stocks, including names like Meta, Amazon, Apple, Netflix and Alphabet.

“When rates go up, you immediately get this kneejerk sell-off in virtually everything, but especially in tech,” he said, adding: “Some of these companies are doing much better than others, yet they all trade the same.”

Disclaimer: Cramer’s Charitable Trust owns shares of Meta, Amazon, Apple and Alphabet.