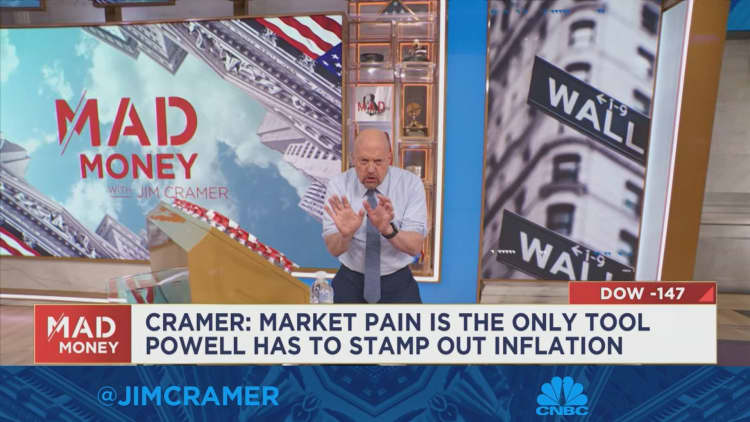

CNBC’s Jim Cramer on Thursday advised investors on where to look for stocks that can withstand a potential economic downturn.

“The Dow Jones Industrial Average is filled with relatively cheap stocks because traders assume these 30 old-line companies are the most vulnerable to a recession. But that’s not true: That’s wrong. The Dow components all know how to handle a recession,” he said.

Dow stocks that Cramer has touted as recession-resilient names in recent weeks include Johnson & Johnson and Procter & Gamble.

The Federal Reserve indicated that it doesn’t plan to stop raising interest rates anytime soon after its meeting on Wednesday, which has rocked the markets and increased Wall Street’s fears of a potential recession.

Stocks fell on Thursday for a fourth consecutive trading session, with the Dow falling the least of the major indexes, by percentage. The blue chip index slipped 0.46% while the S&P 500 and Nasdaq Composite lost 1.06% and 1.73%, respectively.

Cramer also reiterated his advice to sell volatile tech stocks in favor of financial, oil and health care names. Those stocks “can go up without causing inflation because they’re more conservative,” he said.

Disclaimer: Cramer’s Charitable Trust owns shares of Johnson & Johnson and Procter & Gamble.