CNBC’s Jim Cramer on Tuesday said that recent economic data shows the Federal Reserve could start taking a softer approach to inflation.

“This rampant inflation may not be as malignant as the hawks seem to believe, and that means the Fed might ratchet down the next” interest rate increase, he said.

In September the Fed interest rates by 0.75 percentage points for the third consecutive time and indicated it would continue to do whatever it takes to tamp down inflation.

However, Cramer said that two data points suggest the economy’s cooling:

- The Chicago Purchasing Managers Index in September fell to its lowest level since 2020.

- Job openings tumbled by more than 1.1 million in August, marking the biggest single-day drop since April 2020.

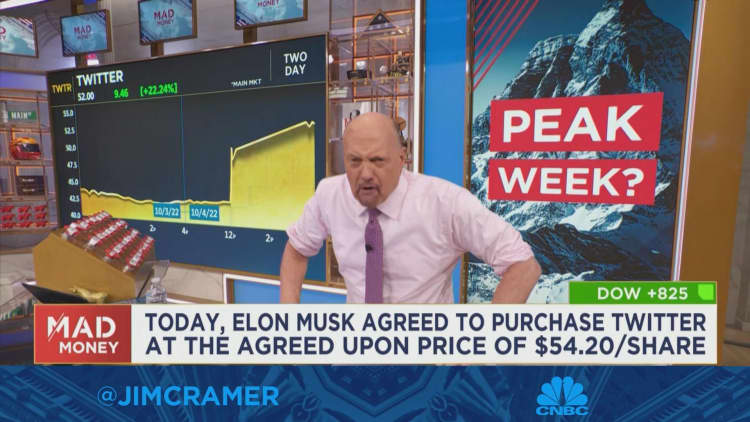

Stocks rose sharply on Tuesday following the release of the job openings report, continuing the rally from the prior trading session. The S&P 500 saw its largest two-day rally since March 2020.

Cramer also credited the U.S. dollar’s declining value for his hope that the Fed could take a less aggressive approach for its next rate hike.

The dollar retreated on Tuesday as the 10-year Treasury yield slumped after Australia’s central bank took a smaller-than-expected interest rate increase. The U.S. dollar had surged in recent months, putting pressure on domestic companies that conduct business overseas.

“Maybe a weakening dollar can help offset the domestic weakness, softening the blow of a potential recession and bolstering the earnings of our exporters,” Cramer said.