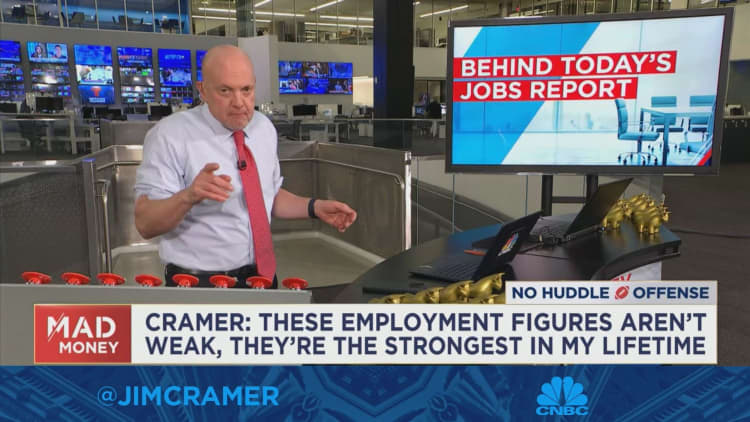

CNBC’s Jim Cramer on Friday said that the January jobs report shows that the economy will remain resilient, despite the Federal Reserve’s interest rate hikes.

“If the Fed Chief wants to raise interest rates quarter after quarter, this economy can actually handle it. And that’s the real takeaway from this amazing job growth number,” he said.

related investing news

The U.S. economy added 517,000 jobs in January, crushing the Dow Jones estimate of a 187,000 gain. That marks the biggest increase in nonfarm payrolls since July 2022.

Stocks teetered on the news but ultimately slipped to end the trading session. The S&P 500 fell 1.04%, while the Nasdaq Composite declined 1.59%. The Dow Jones Industrial Average shed 0.38%.

Cramer said that while stocks fell because the market is in “good news is bad news” mode – the stronger the economy is, the more the Fed will likely have to raise interest rates – the market still held up, more or less.

“My take is that the comeback from the initial negative reaction in the stock market today, before a move lower in the afternoon, has to do with faith. Faith in thinking that there won’t be a recession. Faith that if the Fed wants to hit us with one or two more rate hikes, we’ll be fine,” he said.

The strong economic data comes after the Fed on Wednesday raised interest rates by a quarter percentage point. Chairman Jerome Powell signaled that the central bank isn’t done raising rates despite economic indications that inflation is cooling down.

Cramer said that while the Fed still wants to tamp down inflation more, he believes a severe recession is “near impossible” with job growth being so strong.

“Anyone who thinks the Fed will have to swiftly cut rates later this year because the economy’s too weak [is] clearly fooling themselves,” he said.