CNBC’s Jim Cramer on Tuesday advised investors to pick up shares of Johnson & Johnson as a long-term play.

“I like the way J&J’s been trading over the last couple months, and after the quarter we saw this morning I think it is precisely the kind of stock that you need to buy as we head into 2023, which should be a much better year,” he said.

Johnson & Johnson beat top- and bottom-line expectations in its third-quarter results reported before the opening bell on Tuesday. The company lowered its earnings outlook due to the impact of the strong U.S. dollar.

Shares of the company closed down 0.35% after seesawing throughout the trading session — which means there’s now an opportunity for investors to pick up some shares, according to Cramer.

“J&J is a textbook recession-proof stock. … It’s exactly the kind of name you want to own when the Federal Reserve decides to slam the brakes on the economy,” he said.

He did acknowledge that the strong dollar and cost inflation remain serious macroeconomic headwinds to the company. However, those issues will likely become less prominent over the course of 2023, he said, noting that commodity costs have already come down.

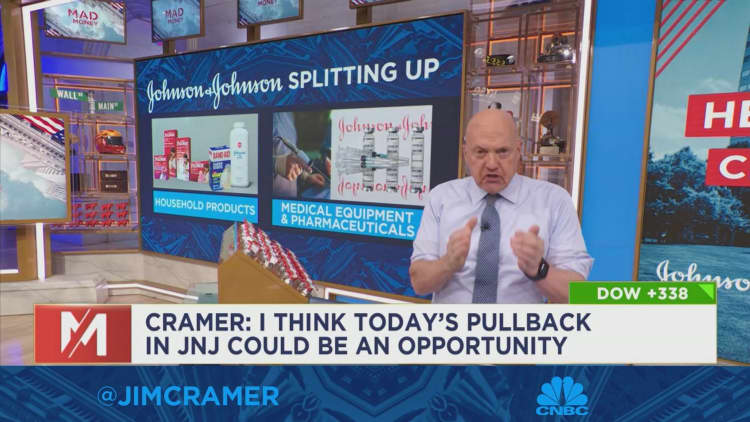

Adding to his bull case for Johnson & Johnson is the company’s spinoff of its consumer health segment, which is on track for finalization next year. “I’m confident it’s going to be a tremendous catalyst,” he said.

Disclaimer: Cramer’s Charitable Trust owns shares of Johnson & Johnson.