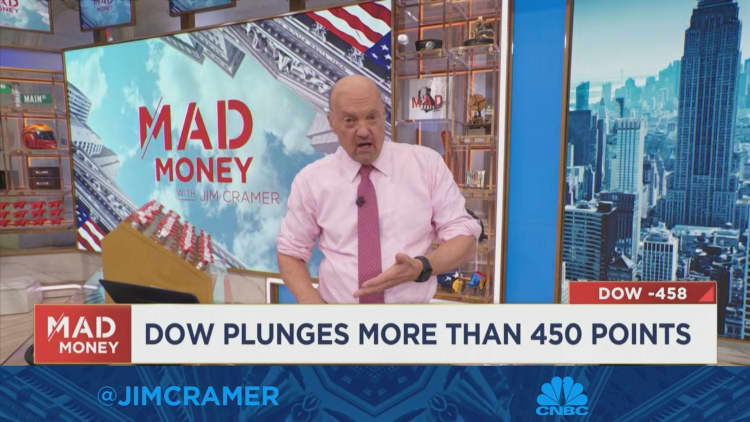

CNBC’s Jim Cramer on Thursday claimed that there are three critical places the place inflation needs to arrive down for the Federal Reserve to quit inflicting discomfort on the inventory marketplace.

“They are beating inflation in so numerous locations. Sad to say, they are not successful on food items, they are not successful on housing, and they are not winning on wages and they require to strike that trifecta in advance of this will stop,” he explained.

Persistent inflation this yr pushed by Russia’s invasion of Ukraine, Covid shutdowns and worker shortages has pushed up prices for every thing from gasoline at the pump to food stuff at the grocery shop. The food items index has climbed 11.4% more than the previous year. Residence prices in July remained up yr-above-year, even as its upward rate cooled.

At the exact time, firms have lifted employee wages, from time to time by a important total, to account for the impact of inflation on their staff. Jobless promises fell very last 7 days to their lowest amount in months, indicating the labor market place is however strong.

“The very good news? The Fed would like to get this performed authentic quickly and genuine speedy and I believe they will,” Cramer said.

He extra that when the inventory market place will continue on to encounter ache, it shouldn’t scare investors away from generating cautiously selected buys.

“We have acquired so a lot of stocks of organizations with healthier balance sheets and good dividends, and you have my blessing to purchase them,” he stated.