Financial institution of Japan Governor Kazuo Ueda arrives to perform an interview with a tiny team of journalists in Tokyo on May perhaps 25, 2023.

Richard A. Brooks | AFP | Getty Visuals

Analysts are split about the Bank of Japan’s moves immediately after the country’s main inflation came in higher than the central bank’s goal of 2% for the 15th straight thirty day period.

CLSA Japan strategist Nicholas Smith is of the watch that the BOJ has been “erroneous-footed” on inflation.

“They viewed the Fed say that inflation was transitory, and be designed to seem fools for executing so,” Smith reported in an interview with CNBC’s “Avenue Indicators Asia.”

“They determine to overlook that and proceed to forecast this fiscal calendar year, 1.8% inflation. Inflation has been over 2% for 15 months in a row.”

Japan’s core buyer price tag index climbed 3.3% 12 months-on-calendar year in June, in line with anticipations of economists polled by Reuters and a bit larger than the 3.2% recorded in May.

Main inflation in Japan strips out selling prices of fresh food items from the total shopper price tag index. Headline inflation level came in at 3.3% in June, rising marginally from 3.2% seen in May well.

The inflation numbers are critical to the BOJ’s financial policy considerations, in advance of its assembly subsequent Friday.

In a take note, Barclays economist Tetsufumi Yamakawa explained much of the current market continue to seems to look at soaring costs in Japan as “transitory,” attributing it to a “charge thrust” as an alternative of a “demand from customers pull.”

However, he sees a “step by step strengthening chance” that sustained inflation will materialize with the substantial wage hikes ensuing from the most recent wage negotiations, or the so-named “shunto.”

“We assume ‘shunto’ wage hikes to be scaled-down in fiscal 12 months 2024 than in fiscal year 23, but forecast an maximize of about +3%, which would be steady with +2% selling price balance concentrate on,” Yamakawa wrote.

Change in YCC stance

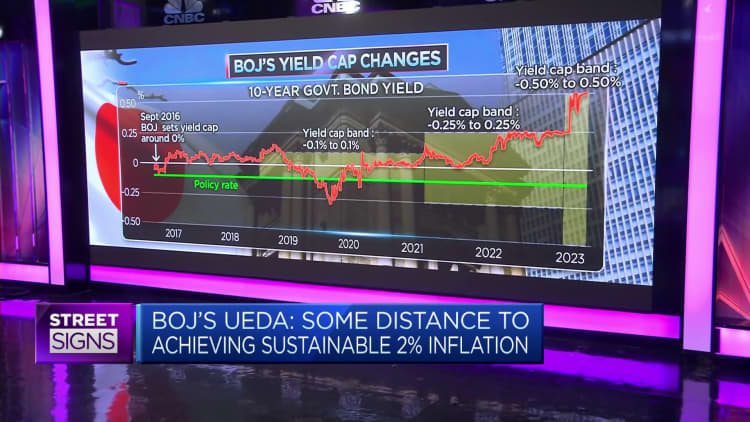

Given this, investors will be looking for indications that the BOJ will change its stance on its ultra-free monetary plan — or more specifically, its “produce curve handle” coverage.

Below the YCC policy, the central lender targets limited-expression interest prices at -.1% and the 10-year government bond generate at .5% higher than or underneath zero, with the intention of keeping the inflation focus on at 2%.

However, BOJ governor Kazuo Ueda signaled in a the latest Reuters report the BOJ’s extremely-loose financial coverage could be preserved for now, expressing “there was nevertheless some length to sustainably and stably attaining the central bank’s 2% inflation target.”

To Smith, there is “a great deal of probability” for the BOJ to change its stance on YCC at the following central bank conference next Friday.

According to Smith, the so-identified as “main-main” inflation level — which strips out fees of fresh foods and vitality — is “roaring up” at 4.2% in June. Which is the maximum due to the fact September 1981, he explained incorporating that “its own measure demonstrates that what they’re indicating is incorrect.”

The CLSA strategist explained the main driver of inflation is meals, coupled with energy rate hikes, wage will increase and the weak yen. Noting that wages have also witnessed the premier enhance in 30 years this year, Smith claimed inflation in Japan is probable to shock to the upside going ahead, pushed significantly by a wage rate spiral.

“If the BOJ will not do something, then the yen shoots by 150” against the greenback, he explained. “We know from encounter that intervention doesn’t work. I have witnessed 95 trillion well worth of fx intervention considering the fact that 1990, and the impact of that has been several hours, not times.”

Smith explained the BOJ’s bond purchases have been raising just to sustain the YCC coverage, pointing out that its buys of bonds have amounted to 15.8% of Japan’s gross domestic product given that the start of December.

Ueda has mentioned the BOJ is hitting the limit of what it can do since it presently owns a third of the bond market, he extra. “Now it owns 55% of the bond industry and it truly is starting up to look like Looney Tunes.”

Having said that, Yamakawa isn’t going to see the BOJ shifting its stance on monetary plan at the July financial coverage conference. Alternatively, he predicted the central lender will launch a period-out of YCC at its Oct conference, when the next quarterly outlook report from is introduced.