Japan’s stock markets have outperformed Asian friends this calendar year to day, as traders cheer the prospect of legitimate company governance reforms that would compel Japan Inc into increased effectiveness and productivity, whilst raising shareholder returns.

Richard A. Brooks | Afp | Getty Images

For the initial time in decades, Japan stocks are back again in vogue.

In the final handful of months, the benchmark Nikkei 225 and Topix indexes touched their greatest stages in much more than 30 many years as international buyers pour into Japanese equities with a regularity hardly ever noticed in at the very least a decade.

Immediately after what turned out to be a bogus dawn a 10 years in the past, when “Abenomics” initially elevated hopes of company governance reform in Japan, quite a few appear to be to consider far better of the hottest steps by the Tokyo exchange.

“The latest Tokyo Stock Trade initiative is a recreation-transforming instant, since it truly is heading to challenge a ton of organizations that are trading on less than a person-time cost-to-ebook to enhance profitability and guidance their share price,” said Oliver Lee, a Singapore-primarily based consumer portfolio supervisor, at Eastspring Investments.

The Tokyo Exchange Team lately finalized its marketplace restructuring rules. Amongst the most up-to-date steps was one that directed detailed corporations to “comply or clarify” if they are investing down below a value-to-book ratio of 1 — an indication a corporation may possibly not be utilizing its money effectively.

The trade warned these kinds of corporations could confront the prospect of delisting as shortly as 2026.

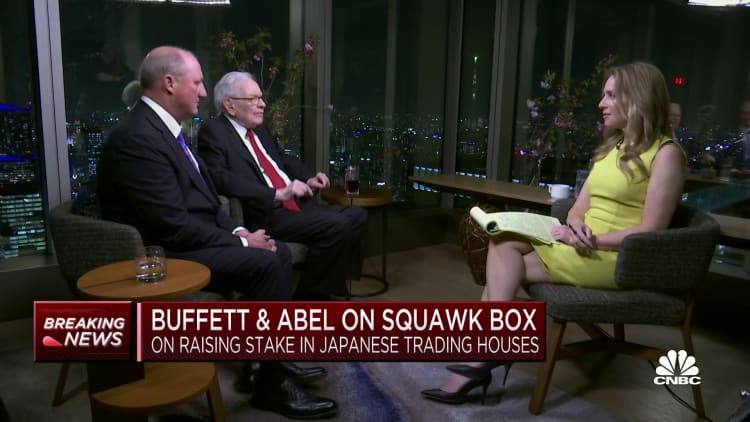

Section of the optimism in Japanese shares stems from how unique and tangible the Tokyo exchange’s demands are this time round. Warren Buffett’s bullish phone calls on Japanese equities has also served enhance self confidence between foreign traders.

There is hope this would press Japanese companies’ notoriously resistant administration — which commonly watch shareholders as enemies — for larger money performance and profitability. It could in convert lead to a domino effect between other Japanese companies as soon as the huge players get started to make alterations.

“Right until quite just lately, the dilemma was although there has been a rise in wholesome company activism, providers and supervisors ended up continue to not so proactive listening to shareholder proposals,” Yunosuke Ikeda, Nomura’s main equity strategist, explained to CNBC last week.

The scale for alter — or disappointment — is tremendous.

The trade reported in March that fifty percent the selection of its “prime” listings — the most liquid shares with the major market place capitalization — and about 60% of all those in the “normal” listings have a return on equity of fewer than 8% and are buying and selling at price tag-to-ebook price of considerably less than 1.

Selling price-to-reserve value is the ratio of the overall sector value of a company’s share value around its guide value — a company’s web assets. Return on equity is a gauge of a company’s profitability.

These businesses have to now show how they plan to enhance their funds effectiveness, because the knowledge details propose they may perhaps be trading beneath value of funds and hence not likely to be money efficient. Aspect of individuals rules have to have them to reveal how they have engaged investors and to commence publishing general public disclosures in English.

If a company will not meet increased listing criteria by the close of the ongoing transitional period of time and a even further calendar year-lengthy “improvement time period,” its securities might be put underneath supervision and could face the prospect of delisting inside 6 months.

“Delisting or any punishment or any enforcement is rather unlikely, but the good news in Japan is there is the peer pressure issue,” said Nomura’s Ikeda. “If rival providers are performing fantastic advancements in corporate governance, other individuals will are likely to stick to that move.”

Very long tail of Abenomics reform

The aims are obvious.

In a doc printed conclusion-March, the Tokyo bourse operator wants to make sure corporations obtain sustainable progress and boost corporate worth around the mid- to lengthy-time period by concentrating on the charge of capital and profitability centered on the harmony sheet, fairly than just product sales and gain ranges on the earnings assertion.

In other words and phrases, they want to see actual strategic adjustments built in tandem with shareholders.

These reforms are element of a broader, multi-year structural overhaul that can trace their genesis to Abenomics — an intense established of economic guidelines that the late Shinzo Abe introduced in the early 2010s, when he was key minister.

Corporate governance is the “3rd arrow” of the three main tenets of Abenomics — monetary easing and fiscal stimulus are the other two. The much-touted financial policy was aimed at reviving economic growth and combating the persistent deflation that has plagued the world’s 3rd-premier overall economy since the 1990s.

Although the initial euphoria in Japanese stock marketplaces more than Abenomics was short-lived back in the early 2010s, traders now see a potential for a elementary re-ranking of Japanese equities ought to these most up-to-date corporate governance reforms consider root.

Superior corporate governance has been attracting additional international traders like the recent ones like Warren Buffett’s Berkshire Hathaway…

Asli M. Colpan

professor of corporate strategy, Kyoto College

“Investing in Japan equities is not investing in Japan macro, it is not investing in themes,” claimed Shuntaro Takeuchi, a San Francisco-centered Japan fund manager with Matthews Asia.

“It is really investing in a lot more of a earnings growth option coming from margin enhancement, return on equity enhancement, whole return improvement.”

The Buffett influence

Recognized as “sogo shosha,” Japan’s trading houses are akin to conglomerates and do small business in a wide variety of products and supplies, and helped launch Japan’s economic climate on to the worldwide phase.

When their diversified functions were being element of the attract for Buffett, some traders have criticized their complicated operations, and highlighted their growing publicity to dangers overseas as they expanded internationally.

Buffett’s Could disclosures aided spur 10 straight weeks of net foreign buys of Japanese equities. Foreigners bought a web $57.8 billion worthy of of Japanese equities in the previous 10 months till June 3, according to Japan Ministry of Finance details.

“There is a pressure from traders, primarily international ones to comply,” claimed Asli M. Colpan, a professor of corporate approach at Kyoto University’s Graduate University of Management and Graduate Faculty of Economics.

“Superior corporate governance has been attracting much more worldwide buyers such as the the latest ones like Warren Buffett’s Berkshire Hathaway and much more international traders are putting a lot more pressure for compliance — forming a virtuous cycle,” she additional.

Cash rich, simple wins

And that is previously commencing to notify.

“As a final result of revenue growth, the cashflow era and accumulation is now at a stage that much more than 50% of corporates are net cash and may possibly be hoarding far too a lot money on their harmony sheet,” claimed Matthews Asia’s Takeuchi.

We’re possibly just midway through that journey of corporate reform.

Oliver Lee

Eastspring Investments

“But a greater component in the prolonged time period is no matter whether they will keep the concentration on profitability by cutting underperforming business enterprise units and restructuring,” he included.

These are extra tough conclusions to undertake, but would in the long run be the actual gauge of corporate Japan’s hunger for reform, higher efficiency and productivity.

However, the broader course of prolonged-expression structural transform in Japan is crystal clear.

In a earth that is combating stubbornly large inflation and confronting anemic expansion prospective buyers, which is just introducing on to the attraction of the Japanese equity markets — with the enable of Japan’s accommodative financial coverage, its comparatively additional average inflation just after many years of chronic deflation, the weak yen, and fairly cheap valuations.

“We are likely just halfway by means of that journey of corporate reform,” Lee explained.