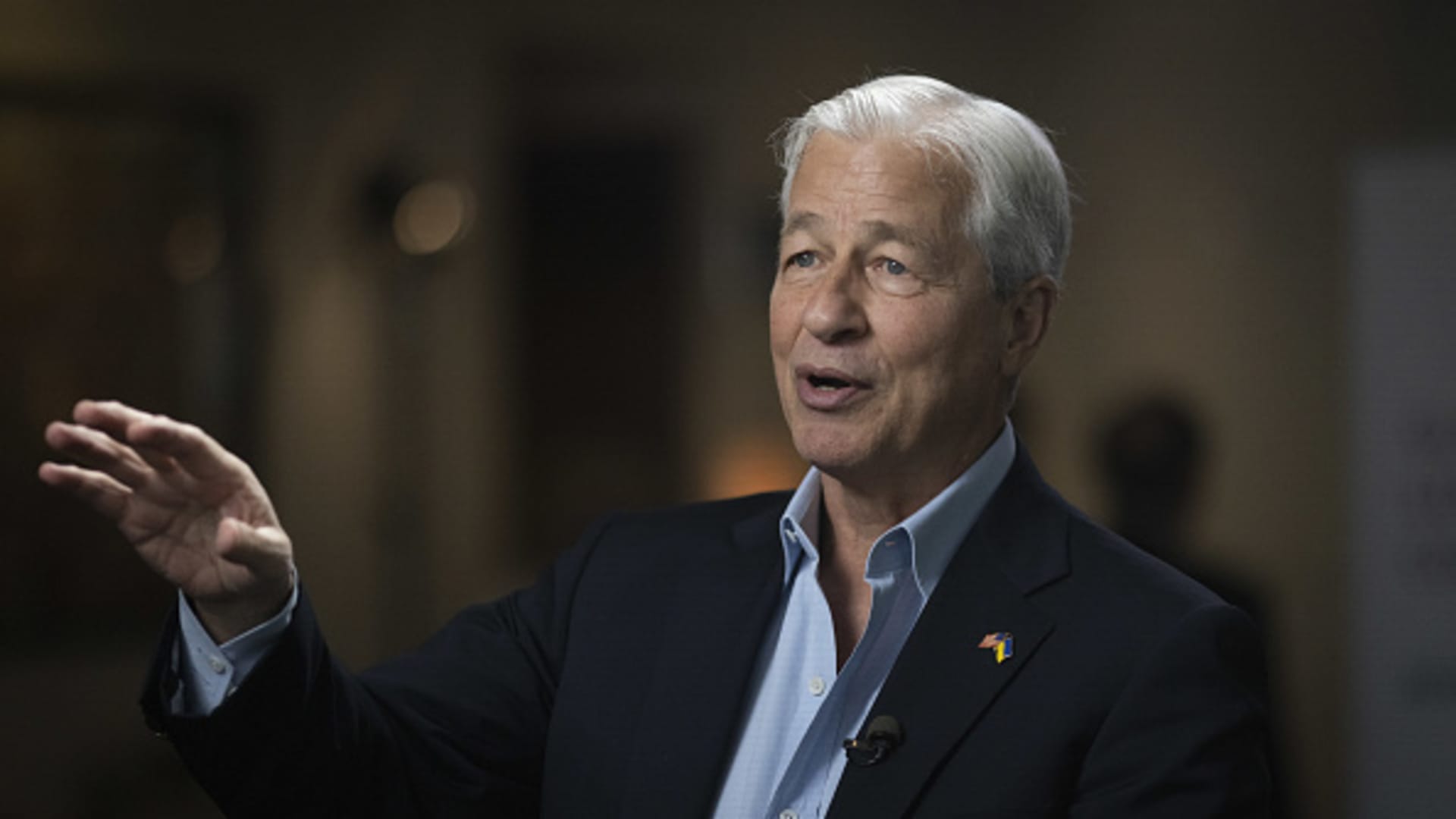

Jamie Dimon, chairman and main executive officer of JPMorgan Chase & Co., all through a Bloomberg Television interview at the JPMorgan World-wide Significant Yield and Leveraged Finance Convention in Miami, Florida, US, on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Illustrations or photos

The disaster that led to the downfall of 3 regional U.S. banks in the latest months is mainly more than immediately after the resolution of Initial Republic, according to JPMorgan Chase CEO Jamie Dimon.

JPMorgan emerged as the winner of a weekend auction for Initially Republic soon after regulators decided that time experienced operate out on a non-public sector answer. The Federal Deposit Insurance Corporation seized the lender and New York-based JPMorgan introduced early Monday that it was obtaining practically all of the deposits and most of the assets of First Republic.

“There are only so many banks that were offsides this way,” Dimon informed analysts in a call shortly immediately after the offer was declared.

“There may be an additional lesser just one, but this quite significantly resolves them all,” Dimon reported. “This section of the disaster is above.”

In the wake of the sudden collapse past month of Silicon Valley Bank, investors have punished other banking institutions that had comparable features to SVB. Organizations with the optimum proportion of uninsured deposits and unrealized losses on their balance sheet were most scrutinized. But the $30 billion injection of deposits into To start with Republic final month bought time for the marketplace, permitting banks to report first-quarter final results that in numerous cases showed a stabilization of deposits.

Shares of regional banks together with PacWest and Citizens Monetary slumped in premarket trading.

This story is establishing. Make sure you check out back for updates.