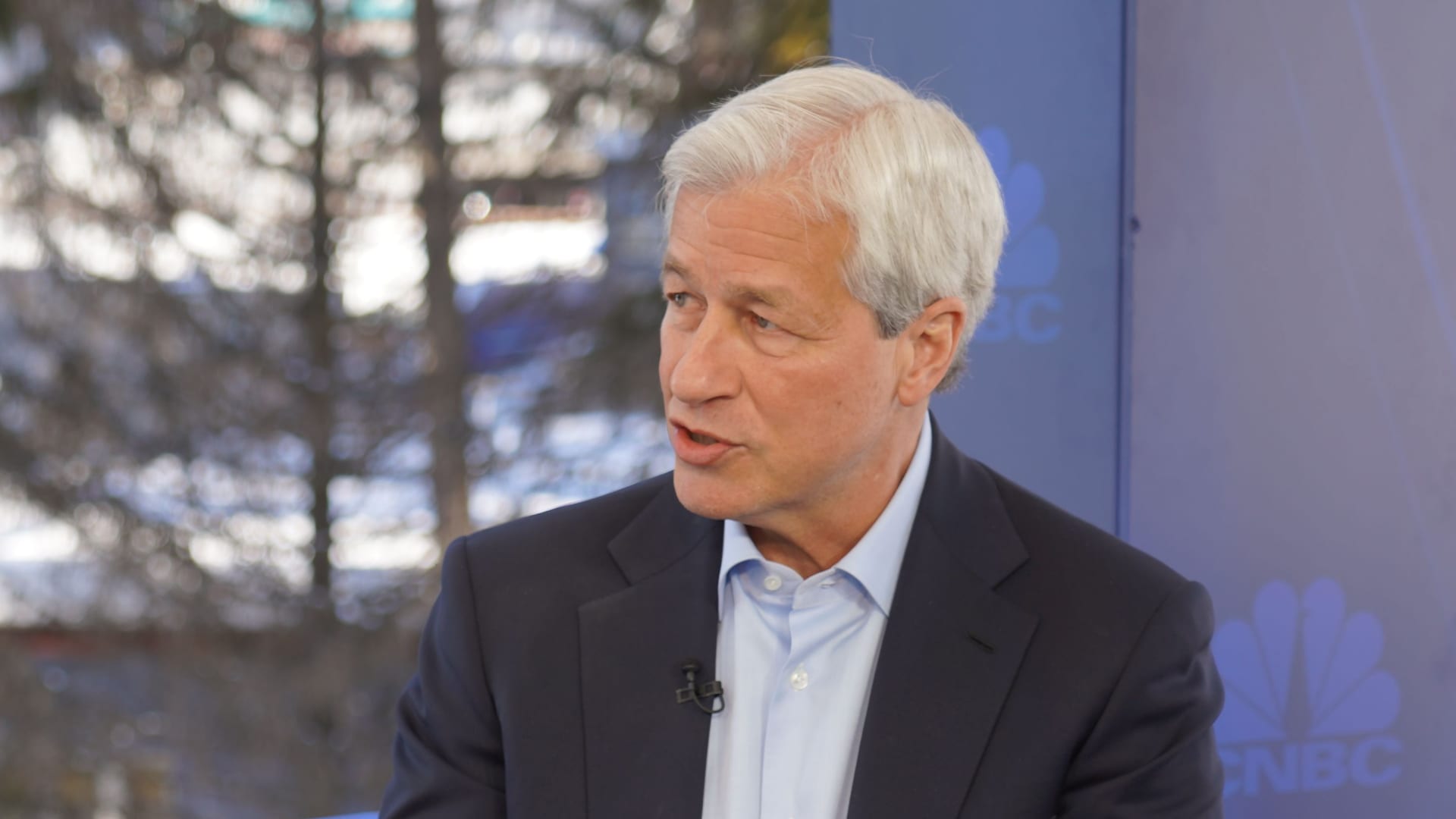

Jamie Dimon, CEO of JP Morgan Chase, appears on CNBC’s Squawk Box at the 2020 World Economic Forum in Davos, Switzerland on Jan. 22nd, 2020.

Adam Galica | CNBC

JPMorgan Chase CEO Jamie Dimon says he is preparing the biggest U.S. bank for an economic hurricane on the horizon and advised investors to do the same.

“You know, I said there’s storm clouds but I’m going to change it… it’s a hurricane,” Dimon said Wednesday at a financial conference in New York. While conditions seem “fine” at the moment, nobody knows if the hurricane is “a minor one or Superstorm Sandy,” he added.

“You better brace yourself,” Dimon told the roomful of analysts and investors. “JPMorgan is bracing ourselves and we’re going to be very conservative with our balance sheet.”

There are two main factors that has Dimon worried: First, the Federal Reserve has signalled it will reverse its emergency bond buying programs and shrink its balance sheet. The so-called quantitative tightening, or QT, is scheduled to begin this month and will ramp up to $95 billion a month in reduced bond holdings.

“We’ve never had QT like this, so you’re looking at something you could be writing history books on for 50 years,” Dimon said, adding that “a lot” about quantitative easing programs “backfired.”

Central banks “don’t have a choice because there’s too much liquidity in the system,” Dimon said. “They have to remove some of the liquidity to stop the speculation, reduce home prices and stuff like that.”

The other large factor worrying Dimon is the Ukraine war and its impact on commodities, including food and fuel. Oil “almost has to go up in price” because of disruptions caused by the worst European conflict since World War II, potentially hitting $150 or $175 a barrel, Dimon said.

“Wars go bad, [they] go South in unintended consequences,” Dimon said. “We’re not taking the proper actions to protect Europe from what’s going to happen to oil in the short run.”

This story is developing. Please check back for updates.