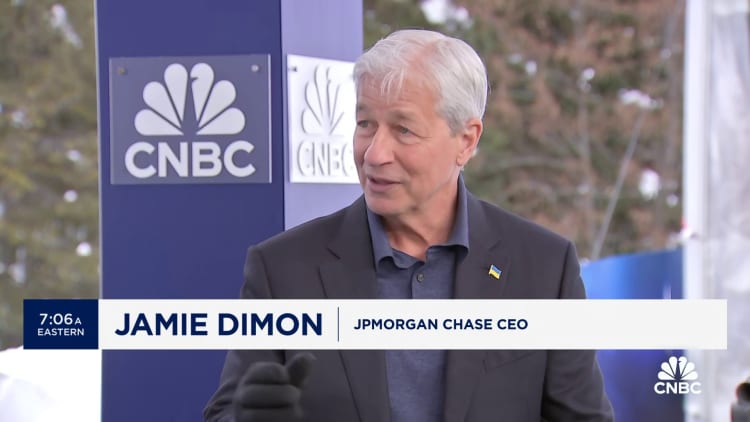

DAVOS, Switzerland — Bitcoin does very little, JPMorgan Chase CEO Jamie Dimon stated Wednesday on the sidelines of the Earth Economic Discussion board.

“I simply call it the pet rock,” he extra.

Dimon is a extended-time bitcoin critic. The bank main said in 2021 at peak crypto valuations that bitcoin was “worthless,” and he doubled down on that sentiment previous 12 months in Davos, Switzerland, when he instructed CNBC that the electronic currency was a “hyped-up fraud.”

Bitcoin is investing just higher than $42,700, up a lot more than 100% in the earlier 12 months.

“This is the last time I’m talking about this with CNBC, so assist me God,” Dimon claimed. “Blockchain is actual. It can be a engineering. We use it. It really is heading to go income, it is really likely to move info. It really is effective. We’ve been speaking about that for 12 a long time, much too, and it can be quite tiny.”

“I feel we waste much too quite a few phrases on that,” Dimon added.

The bank chief went on to distinguish bitcoin from the other course of cryptocurrencies, the types by which blockchain has enabled the use of wise contracts. Good contracts are a programmable piece of code prepared on a community blockchain, such as ethereum, which executes when particular circumstances are satisfied, negating the will need for a central middleman.

“There is certainly a cryptocurrency which could truly do some thing,” Dimon reported of smart chain-enriched blockchains. “You can use it to buy and market true estate and transfer details — tokenizing factors that you do a little something with.”

“And then you can find one particular which does absolutely nothing,” Dimon stated of bitcoin, even though he extra that there ended up actual use instances for the virtual coin, which incorporated upward of $100 billion a 12 months caught up in fraud, tax avoidance and sexual intercourse trafficking. “I protect your suitable to do bitcoin,” Dimon extra, stating, “I will not want to notify you what to do. So my personalized information would be never get associated. … But it is a free place.”

The world’s biggest cryptocurrency, with a sector cap of more than $830 billion, was cemented as an asset class last 7 days when the U.S. Securities and Exchange Commission approved the creation of bitcoin trade-traded resources.

Some of the greatest names in asset management, including BlackRock, Franklin Templeton and WisdomTree, have released their very own place bitcoin ETFs final 7 days. For the $30 trillion suggested prosperity management business, the floodgates could be about to open. Analysts at Common Chartered foresee fund inflows in the vary of $50 billion to $100 billion in 2024.

When requested what he designed of Larry Fink altering his see on bitcoin as BlackRock jumped into the spot ETF business enterprise, Dimon stated, “I don’t treatment. So just make sure you quit talking about this s***.”

“I do not know what he would say about blockchain vs . currencies that do anything as opposed to bitcoin that does almost nothing,” Dimon included. “But you know this is what will make a market. Individuals have viewpoints, and this is the past time I’m at any time heading to condition my feeling.”