Sam Bankman-Fried, co-founder and main government officer of FTX, in Hong Kong, China, on Tuesday, May well 11, 2021.

Lam Yik | Bloomberg | Getty Images

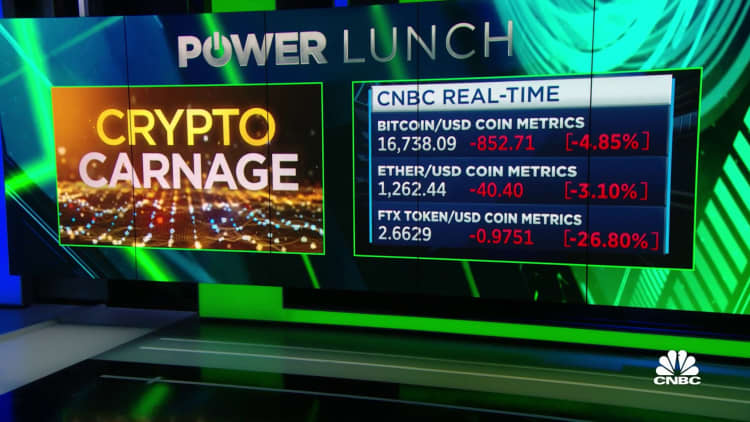

As Sam Bankman-Fried’s FTX enters individual bankruptcy safety, Reuters studies that amongst $1 billion to $2 billion of shopper money have vanished from the unsuccessful crypto trade.

Both equally Reuters and The Wall Road Journal uncovered that Bankman-Fried, now the ex-CEO of FTX, transferred $10 billion of client resources from his crypto exchange to the digital asset trading house, Alameda Study.

connected investing information

Alameda, also founded by Bankman-Fried, was viewed as to be a sister firm to FTX. Those people cozy ties are now less than investigation by a number of regulators, like the Office of Justice, as nicely as the Securities and Trade Commission, which is probing how FTX dealt with consumer funds, according to multiple experiences.

A great deal of the $10 billion sent to Alameda “has considering the fact that disappeared,” according to two people talking with Reuters.

Reuters disclosed that each resources “held senior FTX positions right until this 7 days” and added that “they have been briefed on the firm’s finances by leading team.”

One particular source believed the gap to be $1.7 billion. The other place it at a little something in the variety of $1 billion to $2 billion.

It appears that Reuters achieved Bankman-Fried by text concept. The former FTX chief wrote that he “disagreed with the characterization” of the $10 billion transfer, adding that, “We did not secretly transfer.”

“We experienced bewildering inner labeling and misinterpret it,” the textual content concept study, and when questioned particularly about the resources that are allegedly lacking, Bankman-Fried wrote, “???”

Unexpected emergency assembly in the Bahamas

Final Sunday, Bankman-Fried convened a assembly with executives in Nassau to appear at FTX’s publications and figure out just how considerably money the organization essential to include the hole in its equilibrium sheet. (Bankman-Fried confirmed to Reuters that the meeting took place.)

It experienced been a rough number of days of trade for FTX soon after Binance CEO Changpeng Zhao tweeted that his enterprise was marketing the past of its FTT tokens, the indigenous forex of FTX. That followed an short article on CoinDesk, pointing out that Alameda Analysis, Bankman-Fried’s hedge fund, held an outsized sum of FTT on its balance sheet.

Not only did Zhao’s community pronouncement bring about a plunge in the rate of FTT, it led FTX customers to strike the exits. Bankman-Fried mentioned in a tweet that FTX consumers on Sunday demanded roughly $5 billion of withdrawals, which he termed “the greatest by a enormous margin.” That was the day of SBF’s unexpected emergency assembly in the Bahamian money.

The heads of FTX’s regulatory and lawful groups have been reportedly in the place, as Bankman-Fried exposed various spreadsheets detailing how significantly cash FTX had loaned to Alameda and for what objective, in accordance to Reuters.

Those people documents, which seemingly mirrored the most new financial condition of the enterprise, showed a $10 billion transfer of purchaser deposits from FTX to Alameda. They also discovered that some of these resources — somewhere in the variety of $1 billion to $2 billion — could not be accounted for among Alameda’s property.

The money discovery method also unearthed a “back doorway” in FTX’s books that was developed with “bespoke software program.”

The two resources talking to Reuters explained it as a way that ex-CEO Bankman-Fried could make changes to the company’s fiscal report without having flagging the transaction either internally or externally. That mechanism theoretically could have, for instance, prevented the $10 billion transfer to Alameda from becoming flagged to possibly his internal compliance workforce or to external auditors.

Reuters suggests that Bankman-Fried issued an outright denial of implementing a so-referred to as again door.

Both FTX and Alameda Investigate did not right away react to CNBC’s request for remark.