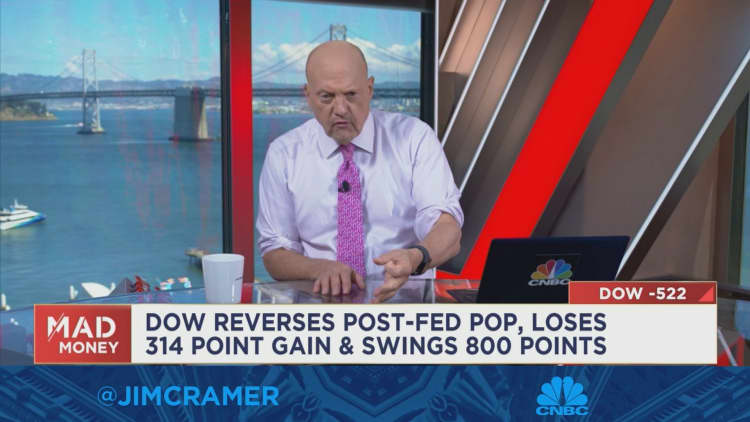

CNBC’s Jim Cramer on Wednesday advised investors to think of the bigger picture when it comes to the Federal Reserve’s battle against inflation and its effect on the stock market.

“The short-term camp is made up of people who either can’t handle any pain or don’t believe in [Fed Chair Jerome] Powell and want to get out,” the “Mad Money” host said.

“I think Powell wins the game and when he does, we’ll be on the field and the short-termers will be at the bottom of the stands,” he added.

The Fed raised interest rates by 75 basis points on Wednesday and signaled that it will continue its aggressive campaign against inflation.

Stocks ended the volatile trading session down as Wall Street digested the news.

Cramer acknowledged that there will be pain ahead for the market, and advised investors to bet with the Fed if they want their portfolios to stay intact in the long term.

People who believe in Powell’s vision — whom Cramer calls the silent majority — understand the central bank has to increase interest rates to avoid pain even further down the line, he said.

“The silent majority wants to be able to buy a house at a reasonable price without having a bidding war over it,” he said. “The silent majority knows that their stocks are going to be worth less when they retire if Powell doesn’t act now.”