Inventory futures fell soon after the Federal Reserve hiked costs by an additional 25 foundation details and investors’ fears of contagion in the regional financial institution space returned.

S&P 500 futures shed .59%. Nasdaq 100 futures declined .46%, and futures linked to the Dow Jones Industrial Average dropped 183 factors, or .55%.

Shares of PacWest tanked by far more than 50% in soon after-hours buying and selling. The decrease came immediately after Bloomberg, citing people today common, documented that the California lender has been examining strategic choices, which includes a crack up or a attainable sale. Regional financial institution shares offered off hard, with Western Alliance tumbling virtually 30% and Zions Bancorporation dropping just about 12%. Valley National Bancorp shed 12.5%.

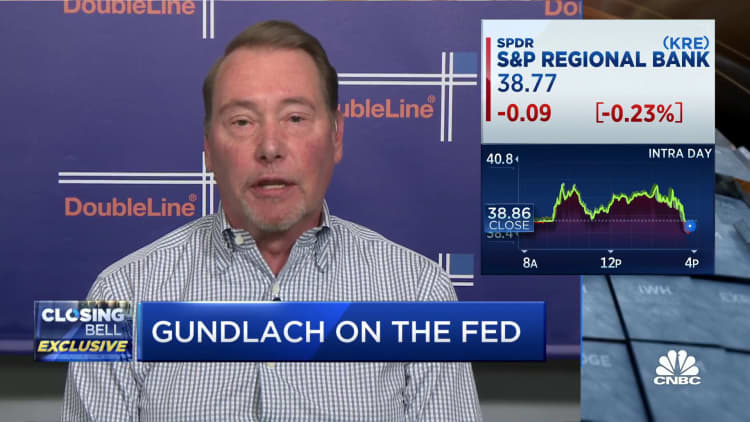

There probable is not going to be a respite for the embattled regional banking sector till the Fed cuts curiosity rates, stated Jeffrey Gundlach, CEO of DoubleLine. Due to the fact the closure of Silicon Valley Bank in March, Initially Republic has joined the ranks of unsuccessful establishments and was just lately taken more than by JPMorgan Chase.

“Leaving premiums this substantial is likely to keep on this anxiety,” Gundlach stated on CNBC’s “Closing Bell” Wednesday. “I imagine with a really large degree of probability you can find likely to be further regional bank failures.”

Without a doubt, as the Fed pushed via its 10th level hike in this cycle and the central bank seemed to soften its language on potential raises, Chair Jerome Powell stated that it may be as well quickly to slash.

“We on the committee have a perspective that inflation is heading to arrive down not so quickly,” he reported in his submit-conference press convention. “It will get some time, and in that world, if that forecast is broadly suitable, it would not be proper to reduce rates and we will not likely reduce charges.”

Stocks closed decreased on Wednesday, with the Dow shedding 270 factors, or .8%, and the S&P 500 dropping .7%. The Nasdaq Composite dropped roughly .5%.

Looming ahead are vital financial experiences that will advise the Fed’s upcoming measures from here. Initial jobless claims are owing Thursday. Friday’s main event will be April’s payrolls report, which economists polled by Dow Jones forecast will increase by 180,000.

In phrases of earnings, buyers will be observing Moderna, which issues results ahead of the opening bell Thursday. Apple is slated to write-up earnings immediately after the market’s shut, along with Lyft, DraftKings and Coinbase.