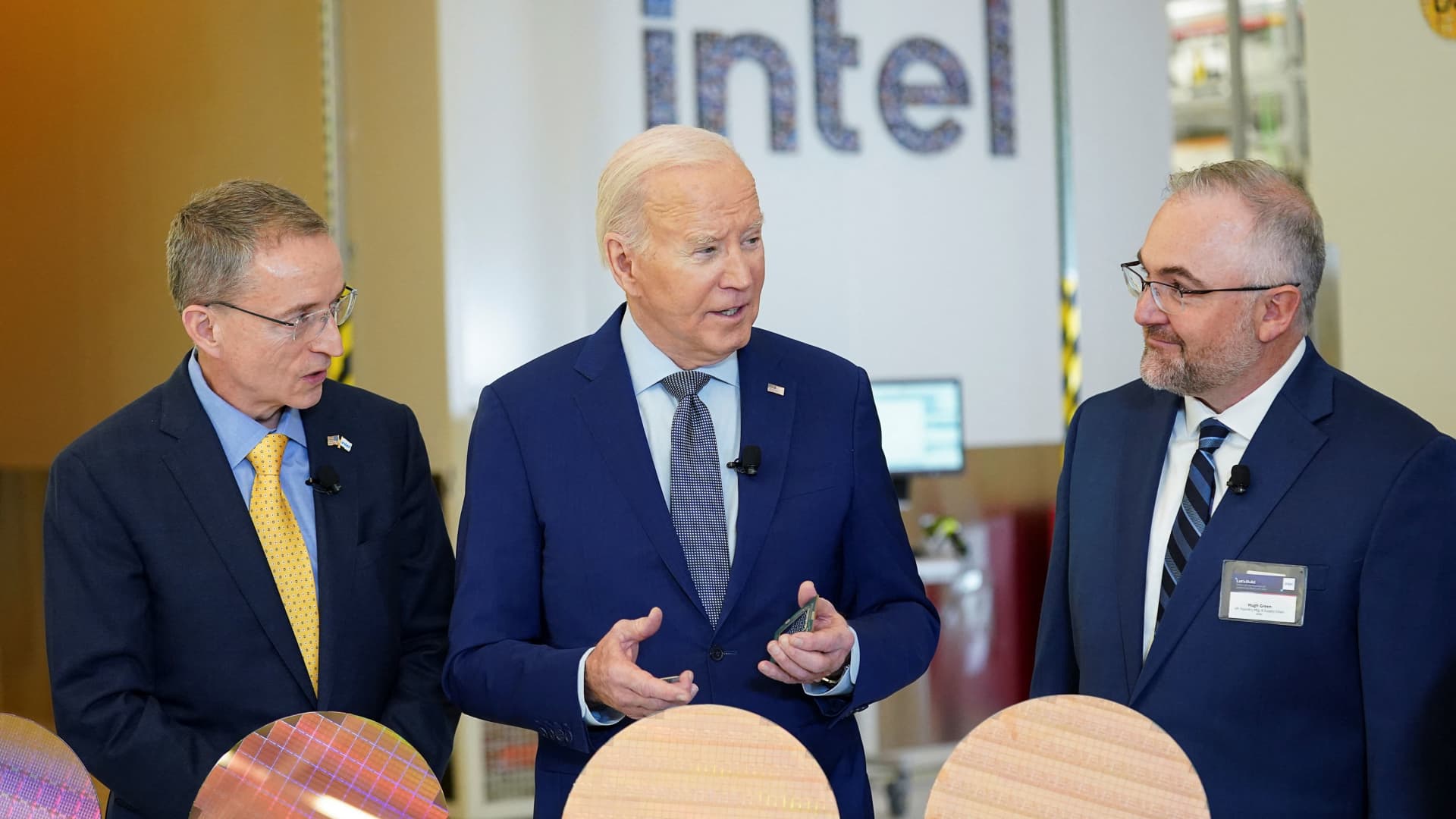

U.S. President Joe Biden tours the Intel Ocotillo Campus, in Chandler, Arizona, U.S., March 20, 2024.

Kevin Lamarque | Reuters

Intel shares fell 4% at just one position in prolonged investing on Tuesday right after the organization uncovered lengthy-awaited financials for its semiconductor manufacturing business enterprise, typically referred to as the foundry organization, in a SEC filing.

Intel claimed its foundry organization recorded an operating reduction of $7 billion in 2023 on income of $18.9 billion. That’s a wider reduction than the $5.2 billion Intel described in its foundry business enterprise in 2022 on $25.7 billion in sales.

This is the 1st time that Intel has disclosed profits totals for its foundry business on your own. Traditionally, Intel has both of those developed its have chips as nicely as carried out its have manufacturing, and noted last chip gross sales to traders. Other American semiconductor companies this kind of as Nvidia and AMD layout their chips but mail them off to Asian foundries — normally Taiwan’s TSMC — for producing.

Intel has been pitching buyers underneath CEO Patrick Gelsinger on a plan exactly where it would proceed to make its very own processors, but would also start an exterior foundry small business to make chips for other corporations. Intel’s function as a person of the only U.S. providers carrying out cutting-edge semiconductor producing on American soil was a large explanation why it secured approximately $20 billion in CHIPS and Science Act funding final month.

Substantially of Intel’s foundry revenue at this time arrives from its have operations, the chipmaker stated on Tuesday. Intel also restated its merchandise divisions to report its prices as if it were being a so-referred to as “fabless” firm that has to account for foundry as a price.

Intel claimed the recently arranged Goods division, which mostly is composed of processors for PCs and servers, reported $11.3 billion in running money on $47.7 in profits in 2023.

Intel said on Tuesday that it predicted its foundry’s losses to peak in 2024 and ultimately crack-even “midway” in between this quarter and the close of 2030. The company formerly stated that Microsoft would use its foundry companies, and that it has $15 billion of profits for foundry presently booked.

“Intel Foundry is heading to drive significant earnings progress for Intel over time. 2024 is the trough for foundry working losses,” Gelsinger stated on a call with investors on Tuesday.

Intel reported in a promo movie that a lot of the lack of profitability for its foundry enterprise was thanks to the “weight of past selections,” and separately, Gelsinger cited the company’s earlier “gradual” adoption of a technologies called EUV, which is utilised to make the most sophisticated chips.