Frank Slootman, CEO of Snowflake, on the working day of its 2020 IPO, Sept. 16th, 2020.

CNBC

Instacart filed an current IPO prospectus Monday and clarified how its contract will work with data storage and analytics enterprise Snowflake, right after the original submitting appeared to clearly show a remarkable decrease in shelling out on Snowflake’s technologies.

Snowflake CEO Frank Slootman is an Instacart board member, a connection that requires the grocery supply business to disclose specifics of the company ties concerning the corporations.

The primary prospectus confirmed that Instacart’s payments for Snowflake’s “cloud-based mostly info warehousing providers” jumped from $28 million in 2021 to $51 million in 2022, but have been expected to drop to $15 million this year. The clear slippage led to confusion and spurred employees at rival Databricks to suggest on the web that it was finding up that small business.

Snowflake published a 4-paragraph weblog article describing that the quantities were getting misconstrued and that in this situation, payment doesn’t equal utilization mainly because of how the contract is prepared. Instacart spelled out how that agreement operates in Monday’s submitting.

“These income payments, together with the payments we created in 2022, typically depict prepayments for long term companies which, in quite a few scenarios, span multiple fiscal durations,” Instacart wrote. “As this sort of, these payments are not indicative of real cloud-based info warehousing products and services provided to and employed by us in the period of time in which any these payment is produced, as the expenditures linked to use are acknowledged above time as providers are provided to us.”

To recognize use of the technology, the ideal quantity to search at is functioning costs. For each 2021 and 2022, Instacart explained it incurred operating expenses tied to the cloud engineering of $28 million.

Nevertheless, in get to see exactly where that range stands in 2023, an investor would nonetheless have to reference a footnote significantly later on in the submitting. There, Instacart suggests that in the to start with 50 percent of the 12 months it incurred $11 million in running expenses for use of Snowflake’s technology. On an annualized foundation, that would nonetheless propose a drop of 21%.

In Snowflake’s Aug. 30 site submit, the corporation claims it really is encouraging Instacart “optimize for effectiveness,” a phrase that indicates executing a lot more with a lot less. When that may clarify some or all of the drop, it truly is also accurate that Instacart has been pushing a lot more small business to Databricks, specifically for its promotion infrastructure.

Instacart is just not required to disclose its romantic relationship with Databricks, but equally firms released current posts about the implementation on their websites. They deleted people posts shortly following Instacart’s preliminary submitting.

Snowflake shares rose 2.2% on Monday, lifting its sector cap to $55.9 billion. Databricks is however private and was past valued in at $38 billion in 2021.

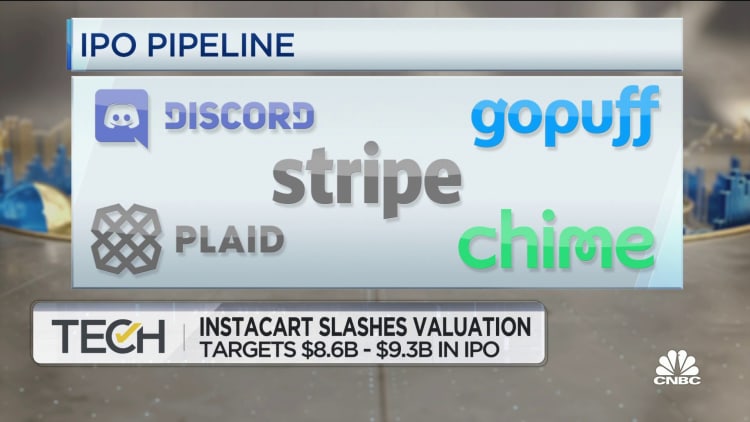

Instacart also said in the update that it’s seeking to sell shares in the initial general public presenting for $26 to $28, which would price the business at as significantly as $9.3 billion. That is a steep fall from its peak non-public marketplace valuation of $39 billion and displays what may perhaps be required in get to go community in an IPO current market that hasn’t observed a notable enterprise-backed supplying due to the fact December 2021.

Look at: Instacart slashes valuation