Inflation was flat in October from the previous month, offering a hopeful indicator that stubbornly higher price ranges are easing their grip on the U.S. financial state.

The shopper rate index, which steps a broad basket of frequently utilised goods and companies, increased 3.2% from a year in the past even with getting unchanged for the month, in accordance to seasonally altered numbers from the Labor Section on Tuesday. Economists surveyed by Dow Jones experienced been looking for respective readings of .1% and 3.3%.

Headline CPI had greater .4% in September.

Excluding volatile food and power selling prices, core CPI amplified .2% and 4%, towards the forecast of .3% and 4.1%. The annual stage was the least expensive in two yrs, even though continue to effectively above the Federal Reserve’s 2% concentrate on.

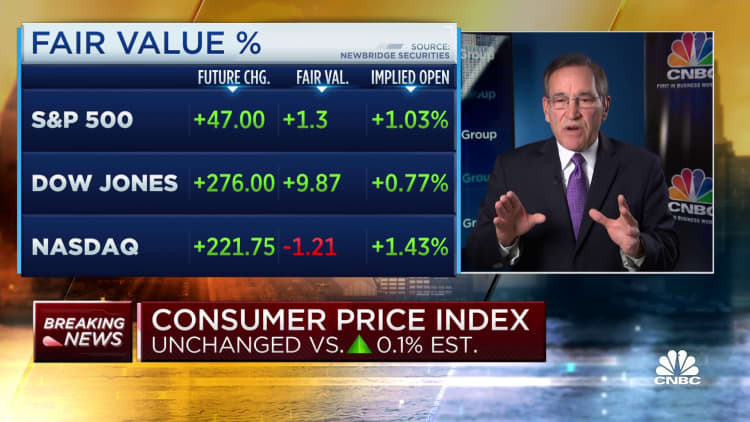

Markets spiked on the information. Futures tied to the Dow Jones Industrial Regular had been up 300 points as Treasury yields fell sharply. Traders also took any potential Fed curiosity price hikes pretty much fully off the desk, according to CME Group facts.

“The Fed appears clever for successfully ending its tightening cycle as inflation proceeds to sluggish. Yields are down considerably as the previous of investors not convinced the Fed is done are probably throwing in the towel,” said Bryce Doty, portfolio supervisor at Sit Mounted Revenue Advisors.

The flat examining on headline CPI came as electricity selling prices declined 2.5% for the month, offsetting a .3% boost in the food items index.

Shelter expenditures, a important element in the index, rose .3% in Oct, 50 % the achieve in September as the year-in excess of-calendar year increase eased to 6.7%. Within just the category, proprietors equal hire, which gauges what property owners could command for hire, increased .4%.

Motor vehicle expenditures, which experienced been a key inflation part in the course of the spike in 2021-22, fell on the month. New car selling prices declined .1%, when made use of automobile price ranges ended up off .8% and have been down 7.1% from a calendar year in the past.

Airfares, a further closely viewed part, declined .9% and are off 13.2% per year. Motor vehicle coverage, however, saw a 1.9% boost and was up 19.2% from a year ago.

The report arrives as marketplaces are closely looking at the Fed for its following techniques in a fight from persistent inflation that started in March 2022. The central lender finally greater its essential borrowing level 11 instances for a complete of 5.25 proportion points.

Whilst markets overwhelmingly believe that the Fed is accomplished tightening financial policy, the information of late has sent conflicting alerts.

Nonfarm payrolls in Oct increased by just 150,000, indicating the labor market lastly is showing indicators that it is reacting to Fed endeavours to proper a offer-demand from customers imbalance that has been a contributing inflation element.

Labor costs have been expanding at a substantially slower speed above the earlier 12 months and a 50 percent as efficiency has been on the rise this yr.

Genuine common hourly earnings — adjusted for inflation — improved .2% on a every month foundation in Oct but were being up just .8% from a calendar year in the past, according to a different Labor Division release.

More broadly talking, gross domestic product or service surged in the third quarter, climbing at a 4.9% annualized tempo, though most economists expect the growth price to gradual significantly.

Even so, other indicators demonstrate that shopper inflation expectations are continue to mounting, the most likely item of a spike in gasoline selling prices and uncertainty brought about by the wars in Ukraine and Gaza.

Fed Chair Jerome Powell final week added to marketplace nervousness when he mentioned he and his fellow policymakers remain unconvinced that they’ve done more than enough to get inflation back down to a 2% once-a-year level and would not hesitate to raise premiums if additional development is just not designed.

“Despite the deceleration, the Fed will very likely keep on to discuss hawkishly and will continue to keep warning investors not to be complacent about the Fed’s solve to get inflation down to the very long-run 2% target,” explained Jeffrey Roach, main economist at LPL Fiscal.

Even if the Fed is finished mountaineering, you can find much more uncertainty over how long it will continue to keep benchmark charges at their greatest degree in some 22 yrs.