Inflation fell to its least expensive annual level in more than two many years in the course of June, the solution equally of some deceleration in costs and simple comparisons towards a time when value raises were being running at a a lot more than 40-12 months substantial.

The client price tag index improved 3% from a year in the past, which is the cheapest stage because March 2021. On a every month basis, the index, which actions a broad swath of costs for items and providers, rose .2%.

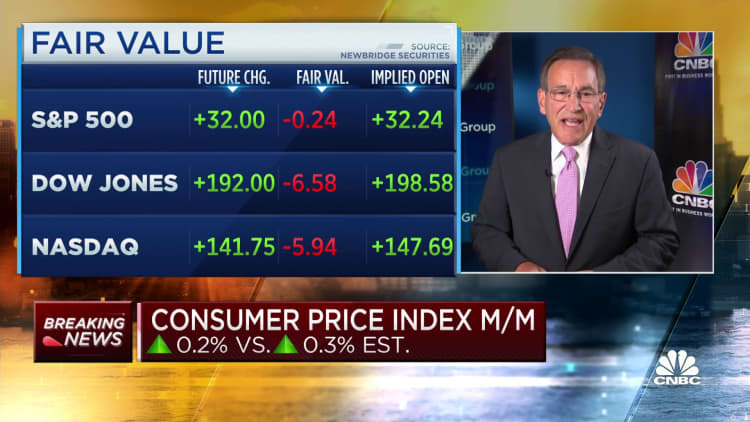

That in contrast to Dow Jones estimates for respective will increase of 3.1% and .3%.

Stripping out volatile foods and vitality costs, core CPI rose 4.8% from a year in the past and .2% on a monthly foundation. Consensus estimates envisioned respective improves of 5% and .3%.

In sum, the numbers could give the Federal Reserve some respiratory place as it appears to be like to bring down inflation that was working all-around a 9% once-a-year price at this time in 2022, the optimum because November 1981.

“There has been important development designed on the inflation entrance, and today’s report verified that whilst most of the place is working with hotter temperatures exterior, inflation is finally cooling,” reported George Mateyo, chief investment decision officer at Key Non-public Financial institution. “The Fed will embrace this report as validation that their policies are obtaining the preferred result – inflation has fallen whilst advancement has not nevertheless stalled.”

On the other hand, central bank policymakers tend to seem extra at main inflation, which is nonetheless working nicely higher than the Fed’s 2% annual goal. Mateyo said the report is unlikely to cease the central bank from increasing costs once again afterwards this month.

Fed officers count on the inflation level to continue falling, specifically as expenses ease for shelter, which will make up about just one-3rd of the weighting in the CPI. However, the shelter index rose .4% past month and was up 7.8% on an once-a-year foundation. That regular monthly obtain accounted for about 70% of the raise in headline CPI, the Bureau of Labor Data mentioned.

“Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully,” explained Lisa Sturtevant, main economist at Dazzling MLS. “Since premiums had been pushed so low by the Fed all through the pandemic and then improved so swiftly, the Federal Reserve’s charge boosts not only reduced housing desire — as supposed — but also severely confined supply by locking homeowners into houses they would have normally listed for sale.”

Wall Avenue reacted positively to the report, with futures tied to the Dow Jones Industrial Typical up almost 200 factors. Treasury yields ended up down across the board.

Traders are however pricing in a powerful chance that the Fed will enact a quarter share place charge hike when it fulfills July 25-26. Having said that, market place pricing is pointing toward that currently being the very last increase as officers pause to allow for the series of hikes to get the job done their way by means of the overall economy.

The muted enhance for the headline CPI arrived even although strength costs improved .6% for the thirty day period. Even so, the strength index reduced 16.7% from a calendar year back, a time when gasoline costs at the pump were being working around $5 a gallon.

Food charges greater just .1% on the thirty day period even though applied car rates, a major resource for the inflation surge in the early element of 2022, declined .5%.

Airline fares fell 3% on the thirty day period and now are down 8.1% on an yearly foundation.

The easing in the CPI assisted raise employee paychecks: Authentic average hourly earnings, adjusted for inflation rose .2% from May to June and greater 1.2% on a 12 months-about-12 months basis. Through the inflation surge that peaked previous June, worker wages experienced operate continually driving the charge of living will increase.

This is breaking news. You should test back again right here for updates.