The inflation rate cooled in May to its least expensive once-a-year charge in more than two yrs, possible having strain off the Federal Reserve to continue boosting interest fees, the Labor Department documented Tuesday.

The buyer price index, which actions improvements in a multitude of items and services, amplified just .1% for the thirty day period, bringing the yearly degree down to 4%. That 12-month boost was the smallest due to the fact March 2021, when inflation was just starting to increase to what would develop into the maximum in 41 a long time.

Excluding volatile food items and electricity costs, the picture was not as optimistic.

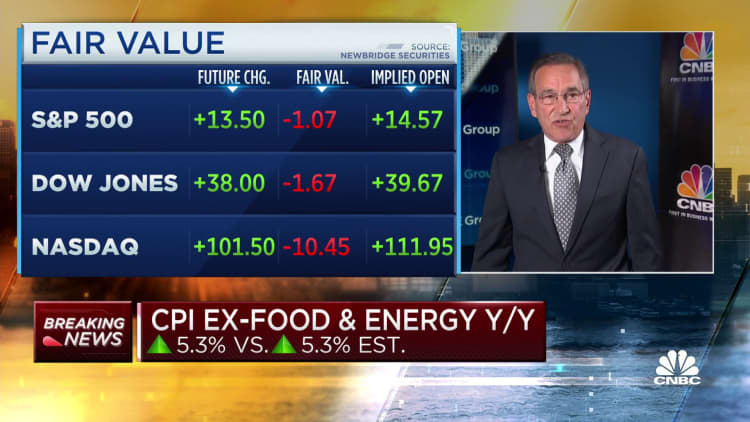

So-called main inflation rose .4% on the month and was however up 5.3% from a calendar year back, indicating that whilst rate pressures have eased rather, customers are even now less than hearth.

All of all those quantities had been particularly in line with the Dow Jones consensus estimates.

A 3.6% slide in vitality prices aided maintain the CPI achieve in check for the month. Food selling prices rose just .2%.

However, a .6% maximize in shelter selling prices was the biggest contributor to the boost for the all-merchandise, or headline, CPI looking at. Housing-connected expenses make up about 1-3rd of the index’s weighting.

In other places, utilized motor vehicle selling prices enhanced 4.4%, the same as in April, whilst transportation expert services have been up .8%.

Marketplaces showed minor response to the launch, in spite of its envisioned prominence in the determination the Federal Reserve will make at this week’s conference relating to desire fees. Inventory sector futures had been a little favourable, even though Treasury yields fell sharply.

Pricing did shift notably in the fed resources sector, with traders pricing in a 93% possibility the Fed will not raise benchmark rates when its assembly concludes Wednesday.

“The encouraging development in customer prices will deliver the Fed some leeway to keep fees unchanged this month and if the trend carries on, the Fed will not most likely hike for the relaxation of the year,” reported Jeffrey Roach, chief economist at LPL Economic.

The tame CPI examining was excellent news for staff. Regular hourly earnings modified for inflation rose .3% on the month, the Bureau of Labor Data mentioned in a individual release. On an annual basis, serious earnings are up .2% following functioning adverse for considerably of the inflation surge that commenced about two many years ago.

The customer price tag index report highlighted a growing discrepancy in between the core and headline figures. The all-goods index typically operates forward of the ex-meals and power measure, but that has not been the case recently.

The year-over-year discrepancy among the two actions stems from fuel costs that were being surging at this time in 2022. In the end, prices at the pump would exceed $5 a gallon, which had never ever took place just before in the U.S. Gasoline costs have fallen 19.7% about the previous 12 months, Tuesday’s BLS report confirmed.

Meals price ranges, nonetheless, were nonetheless up 6.7% from a yr in the past, though eggs fell 13.8% in Might and are now a little bit detrimental on a 12-month foundation immediately after surging in earlier months. Shelter costs have risen 8% and transportation companies are up 10.2%. Airline fares also have been in retreat, declining 13.4% calendar year around calendar year.