The U.S. no extended has an inflation problem, in accordance to veteran economist Steve Hanke.

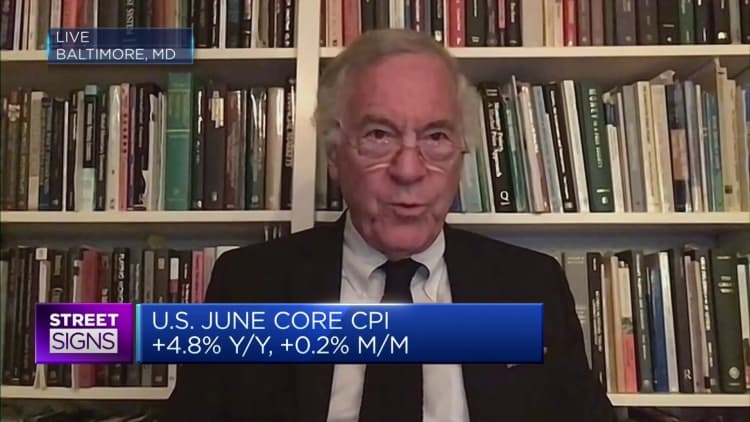

“I feel the inflation tale is history. One reason for that is that revenue supply has been contracting on a calendar year-above-calendar year foundation by minus 4% in the United States,” Hanke, a professor of used economics at Johns Hopkins College, informed CNBC’s “Road Symptoms Asia” on Thursday.

“We haven’t found that due to the fact 1938,” Hanke stated. “Cash offer alterations bring about modifications in the value index and inflation.”

Selling prices are exhibited in a grocery store on February 01, 2023 in New York Town.

Leonardo Munoz | Corbis News | Getty Visuals

U.S. inflation amount for June arrived in lower than expected at 3% on Wednesday, the smallest year-on-year boost in two decades. The main purchaser rate index, which strips out volatile food stuff and strength rates, rose 4.8% from a calendar year ago and .2% thirty day period-on-month.

The most recent details could give the Federal Reserve some wiggle room as the central lender navigates its desire fees plan route.

U.S. producer rate index is owing afterwards Thursday. If it also reveals charges falling that could further impact the Fed’s choice to end the fee hiking cycle soon.

Traders are betting you will find a 92.4% prospect that the Fed will keep charges unchanged at its July meeting, according to the CME FedWatch resource.

“When inflation was heading and roaring, the producer value index roared up 1st and then the consumer price index roared up. And then lastly the main gradually like a snail went up,” stated Hanke.

Forget all the propaganda we’re hearing — that the chairman of the Federal Reserve has a challenging trouble, that this is going to be a prolonged combat, factors are sticky and so forth. Things are not sticky.

Steve Hanke

Professor, Johns Hopkins University

“Now, we’ve turned the thing all-around and the producer rate indexes are slipping like a stone. The client selling price index, it really is falling fairly significantly like a stone. And the core is lagging way guiding,” he claimed, adding: “We’ll see all of that occur down as very long as they carry on with quantitative tightening.”

Central lender policymakers have a tendency to look far more at main inflation, which is even now working nicely higher than the Fed’s 2% yearly focus on.

But Hanke famous that if the Fed carries on “to maintain performing what they’re accomplishing,” it can attain the “2% array rather quick.”

“Fail to remember all the propaganda we are hearing — that the chairman of the Federal Reserve has a rough problem, that this is heading to be a extended combat, points are sticky and so forth. Factors aren’t sticky,” pointed out the professor.

— CNBC’s Jeff Cox contributed to this short article