Soon after overtaking Hong Kong’s stock market place in December, India presently has the fourth biggest in the globe, and is now valued at around $4 trillion.

Javier Ghersi | Second | Getty Images

India’s market place capitalization can conveniently mature to $40 trillion in the up coming 20 decades, driven by stronger trader self esteem and strong economic advancement, analysts stated.

“We can quickly hit $40 trillion by that time,” stated Sujan Hajra, chief economist at Anand Rathi Share and Inventory Brokers, citing the country’s solid financial advancement and “significantly extra steady” currency.

Manish Chokhani, director of expense providers organization Enam Holdings, is even far more bullish and predicted Indian markets could surge to $60 trillion in the subsequent two decades.

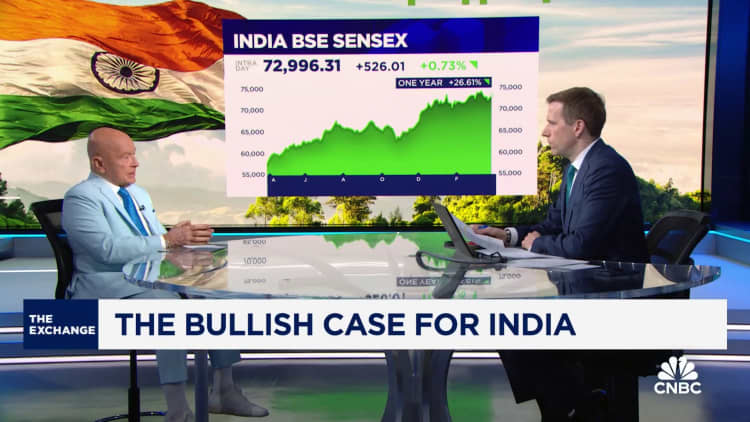

India’s benchmark Nifty 50 index soared 20% in 2023. Right after overtaking Hong Kong in December, the country’s marketplace is now rated the fourth major in the entire world, valued at over $4.6 trillion. On Monday, the Nifty 50 and BSE Sensex surged to clean closing highs of 22,666 and 74,742, respectively, Refinitiv information showed.

“India’s GDP progress has led to corporations growing their earnings and that is ensuing in the inventory sector overall performance,” said Atul Singh, CEO and controlling director of wealth management agency LGT Wealth India.

India’s Ministry of Statistics said the country’s economic climate grew 7.2% for financial 12 months 2023 and is estimated to improve 7.6% in fiscal calendar year 2024. The country’s money calendar year starts on April 1 and finishes on March 31.

In distinction, Singh noted that China’s financial expansion has not led to stock sector appreciation in the latest years. Last 12 months, China’s financial state grew 5.2%, matching the official goal of all around 5%. However, the benchmark CSI 300 has declined three several years in a row, shedding 11.4% last calendar year.

“So the progress in India’s stock market is pushed by serious earnings expansion … That course of action of nominal GDP progress changing into earnings growth and stock marketplace returns will stay intact even in the following 20 a long time,” Singh explained to CNBC in an interview.

India also has a “pipeline of new cash” that can go on to boost market place valuations, Hajra said. India saw 220 preliminary public offerings in 2023, the highest of any state according to EY.

“India has the premier quantity of stated corporations in the earth globally at around 6,000 and they like elevating equity before in their life cycle,” defined Hajra.

‘Opportunities are everywhere’

India’s markets have grow to be a lot more pricey soon after the current rallies. The benchmark BSE Sensex has a cost-to-earnings ratio of 25.44, as opposed to the Shanghai Stock Trade and Shenzhen Inventory Exchange’s ordinary P/E ratio of 12.25 and 21.12, respectively.

Even with individuals superior valuation multiples, analysts stated India ought to continue to be part of an investor’s main allocation.

Goldman Sachs’ Asia-Pacific portfolio strategist Sunil Koul advised traders to spend far more interest to significant cap shares as he predicts there will be a change away from modest and mid-cap shares.

“One particular of the vital views we have coming into the 12 months is that you must see a rotation in the marketplaces. It was the 12 months of mid and little-caps, and that appears to be shifting previously above the previous a person month,” Koul informed CNBC’s “Avenue Symptoms Asia” very last 7 days.

LGT Prosperity India’s Singh, having said that, claimed “opportunities are in all places.”

He advised spending awareness to the money companies sector as “there are terrific organizations that have a good deal of secular advancement,” he mentioned.