Parliament constructing in New Delhi, India.

Vipin Kumar | Hindustan Occasions | Getty Photographs

India is established to release its interim budget for 2024 on Thursday, forward of the country’s hugely anticipated common elections.

Finance Minister Nirmala Sitharaman will be presenting the pre-election spending budget for the fiscal calendar year which runs from April 1, 2024 to March 31, 2025.

The interim funds is observed as a prevent-hole economical program during an election yr, aimed at conference rapid economical requires before a new federal government is shaped. The comprehensive-fledged union price range will only be unveiled immediately after the elections, which will take location among April and Might.

Normally, the interim finances will not contain massive and sweeping plan bulletins.

But this interim price range is even now significant, Nomura stated in a customer be aware, pointing out it could get rid of gentle on the final budget, because lots of analysts are anticipating the ruling Bharatiya Janata Party to get this election.

“The authorities is in election method and so there will be tacit concentrating on of its crucial constituents, with the interim price range probable to be a political assertion,” the bank’s economists explained.

In this article are the most significant takeaways analysts assume.

Fiscal deficit target

India’s fiscal deficit stands at 6.4% of gross domestic product for the 2023-2024 financial year. The government has reported it aims to slender it by 50 basis details to 5.9% through the fiscal 12 months 2024-2025.

“Will the federal government satisfy the 5.9% of GDP fiscal deficit focus on in FY24? Yes,” analysts at Goldman Sachs reported in a notice, noting that if investing remained muted in the existing quarter, the deficit could even arrive down to 5.8%.

Goldman also expects greater expending on important subsidies that contain the rural work system.

Even so, Nilesh Shah, managing director at Kotak Mahindra Asset Administration argued that the federal government would require to work toward meeting its divestment targets in advance of the recent quarter ends in March.

The governing administration desires to increase divestment targets by the selling of point out-run firms to help fulfill its fiscal deficit focus on.

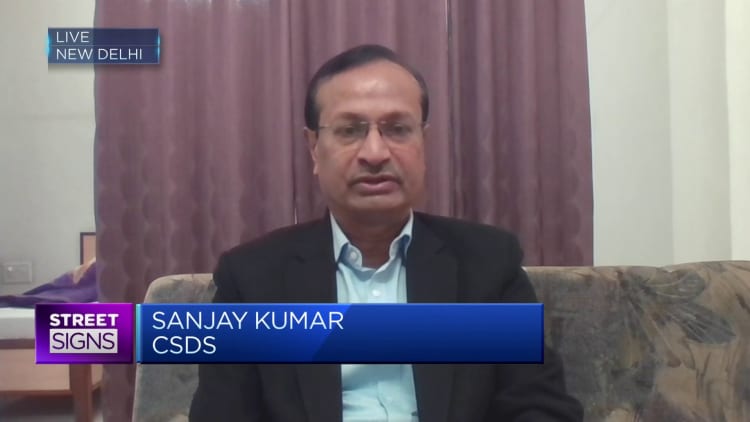

“Except the central governing administration picks up the divestment receipts in subsequent two months, there is a reasonably very good balancing demanded to meet up with 5.9%,” Shah warned.

“My emotion is that except the central governing administration picks up the divestment receipts in the subsequent two months, there is reasonably great balancing necessary to satisfy 5.9%,” Shah explained to CNBC in a mobile phone job interview.

India is reportedly established to pass up its divestment targets for a fifth consecutive calendar year.

Money spending

Goldman Sachs has predicted that India will develop into the world’s second-premier financial state by 2075.

As it is, India is now the fifth-major economic system globally, driving the U.S., China, Japan and Germany.

To overtake the rest of the countries to become the No. 2 overall economy right after China, India will have to enhance its infrastructure and develop superior street and railway connectivity.

“The target toward infrastructure is paramount, and that contains healthcare and schooling also,” Kranthi Bathini, equity strategist at WealthMills Securities said, elaborating that renewable energy and agriculture are higher on the agenda as perfectly.

At past year’s once-a-year funds, the government declared it was boosting infrastructure expending by 33% to 10 trillion rupees ($122.29 billion).

Nomura expects the federal government to increase cash paying out by roughly 36% in the fiscal yr 2024-2025, and about 16.5% in fiscal calendar year 2025-2026, highlighting it would maintain the central government’s cash paying at 3.4% of GDP.

“The target on public capex has been a deliberate coverage preference by the authorities to deal with India’s sizeable infrastructure deficit and a substitute for lacklustre private capex in the hope that the latter will be sooner or later ‘crowded in,'” Nomura reported.

In a report produced by India’s Finance Ministry on Monday, India claimed it’s poised to grow to be the world’s third-greatest economic system by 2027 with a gross domestic product of $5 trillion. The finance ministry also mentioned the economic climate could expand at or higher than 7% in the fiscal calendar year 2024.

Taxes

Will not expect substantial shifts in taxation as this is only an interim spending budget, analysts say.

Any introduction of tax benefits these as tax credits or exemptions for investments will be important for people awaiting this spending budget.

Goldman Sachs expects money tax and company tax to increase at all around 15% calendar year-on-year.

The financial commitment lender also predicted that oblique taxes could increase 11% calendar year-above-yr for the duration of fiscal calendar year 2024-2025, because the collection of items and products and services tax grew at a healthful speed.

“These form of bulletins can appear in this finances due to the fact it’s taking place just just before the elections,” Bathini claimed, elaborating that there will also be more concentration on rural improvement.

What is subsequent?

India’s general elections, due to consider position in April and May well, will come to a decision whether the Modi govt is reelected for its third time period. Optimism that there will be a further victory for India’s ruling BJP and that there will be policy continuity has so considerably driven up gains for India’s inventory marketplaces.

India’s benchmark Nifty 50 index breached 22,000 points in mid-January, just after hitting various document highs.

Analysts informed CNBC beforehand that the Indian stock markets will not likely rally significantly ahead of the elections, but it could transpire if the Reserve Lender of India cuts fascination charges in the second 50 % of 2024.

The Reserve Financial institution of India’s key lending repo rate stands at 6.5%.

“The future brewing discussion is on the timing of a shift in the RBI’s plan path,” said Radhika Rao, senior economist at DBS.

Rao expects the Indian central financial institution to stand pat on financial policy right up until June, before starting to slash desire rates from the third quarter this yr, while keeping a near eye on the U.S. Federal Reserve’s coverage.

Reduced lending premiums generally enhance liquidity and help threat-having sentiment in stock marketplaces.

— CNBC’s Naman Tandon contributed to this report.