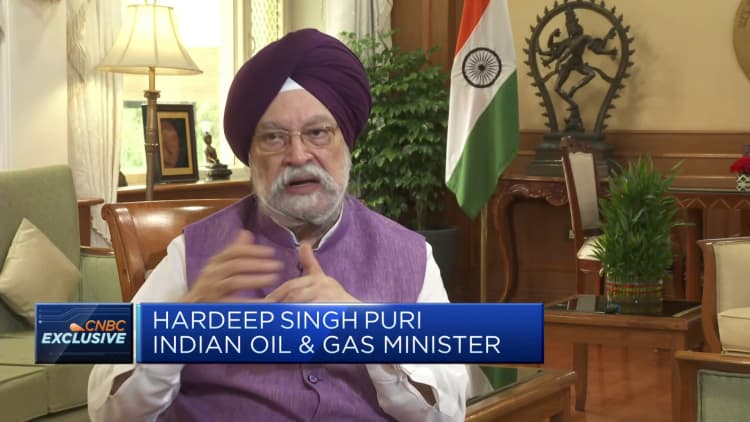

India is not extremely dependent on everyone for oil — not even Russia, India’s Minister of Petroleum and Purely natural Fuel told CNBC, including that his state has diversified its sources.

“India won’t get in excess of dependent on anybody,” Hardeep Singh Puri instructed CNBC’s Tanvir Gill when asked if his place was as well dependent on the Kremlin.

Because Russia’s invasion of Ukraine in February past calendar year, India’s refiners have been snapping up discounted Russian oil. Moscow has because leapfrogged to grow to be India’s leading supply of crude oil, accounting for about 40% of India’s crude imports.

Often substantial oil costs can become a self satisfying prophecy in conditions of ensuing in assembly of instant and short expression demands.

Hardeep Singh Puri

India’s Minister of Petroleum and Organic Gas

India is the world’s third major energy importer, and purchases much more than 80% of its crude oil from worldwide marketplaces.

Questioned if India was obtaining a $15 or $30 price reduction for every barrel on Russian crude, Puri stated: “Certainly, there have been bargains. But there have been reductions coming from all over.”

“If there is certainly a 30% discounted, the Russians are placing a ribbon about it and sending it to us cost-free. Which is what it usually means,” Puri mentioned.

India has also been getting much more from international locations in the Middle East, this kind of as Iraq, he extra.

“We are diversified. We applied to invest in from 27 sources — right now we are purchasing from 39 sources,” he mentioned, naming suppliers from Saudi Arabia, the UAE, and Kuwait amongst them.

According to knowledge from S&P World-wide in July, India’s crude oil resources occur mostly from Middle East and Russia.

There is more than enough oil offered in the environment. What you ought to be actually stressing about is irrespective of whether the shopper will have the resources or the funds to pay out for it.

Oil costs have risen 12% off their lows in June to hover at all around $79 degrees for each barrel currently.

World benchmark Brent traded .35% greater at $83.65 a barrel Friday, when the U.S. West Texas Intermediate futures climbed .38% to $79.35 for each barrel.

Brent vs. West Texas Intermediate futures

“Occasionally large oil rates can turn out to be a self fulfilling prophecy in terms of ensuing in assembly of fast and small term needs,” Puri explained, elaborating that in environment roiled by economic pressures, stimulus packages travel up inflation.

That explained, there is also sufficient oil source in the world, the Indian oil minister mentioned.

“There is sufficient oil readily available in the planet. What you really should be truly worrying about is irrespective of whether the purchaser will have the sources or the dollars to pay for it,” Puri mentioned, highlighting that is the “actual trouble” that a lot of countries encounter.

In an August report, the Worldwide Electrical power Agency forecast international oil demand will hit report-highs.

“Entire world oil demand from customers is scaling report highs, boosted by sturdy summer season air journey, greater oil use in power technology and surging Chinese petrochemical exercise,” the agency reported.