The India chairman of conglomerate Hinduja Group said he’s bullish on India, which he called “the extremely terrific emerging, quickly going marketplace.”

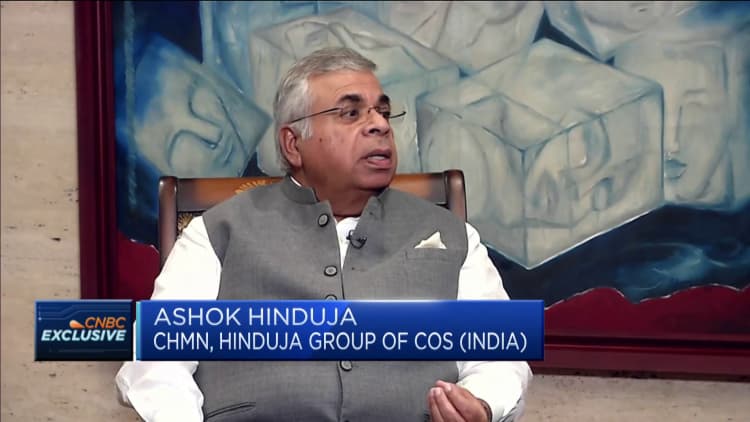

Speaking to CNBC on Thursday, Ashok Hinduja defined: “We see a recession coming in U.S., economic downturn coming in U.K., in Europe, problems in China, [a] dilemma in Southeast Asia below the worry of China-Taiwan. So seeking to the in general scene, we target now [on] India as an emerging market place.”

relevant investing information

The Hinduja Team is headquartered in India even though it owns corporations throughout quite a few industrial sectors and has a presence in practically 40 nations around the world, such as the United Kingdom, Switzerland and the United States.

Its flagship business enterprise is Ashok Leyland, 1 of India’s top industrial motor vehicle makers.

“India, politically, is very well settled,” the chairman told CNBC’s Tanvir Gill.

“The credit goes to our prime minister,” he explained, referring to Key Minister Narendra Modi. “He has managed, in the present scenario, relations with U.S., with Europe, with Russia, with China — though there had been challenges with China, but he has managed it perfectly, it’s beneath regulate.”

Tensions amongst India and China sharpened in 2020 immediately after their troops clashed on a shared border, and remain strained. Additional recently, Western nations have criticized India for raising its buys of Russian oil as that country’s invasion Ukraine rumbles on.

Personnel unload products from a truck in the primary market place spot in Gandhidham, India. India is a wonderful market place and the “ideal guess” in the global financial state, stated Ashok Hinduja, chairman of Hinduja Team, India.

Prashanth Vishwanathan | Bloomberg | Getty Photographs

Requested if rising desire rates and the chance of recession in the United States will impact India, Hinduja stated the affect would be considerably confined.

He pointed out that the U.S. and European stock marketplaces are reduce this calendar year, though Indian shares have been much more resilient.

The S&P 500 and the pan-European Stoxx 600 are both down far more than 17% this yr. India’s Nifty 50 is up around 1%.

Economic advancement abates

Hinduja claimed the govt in India is tackling corruption and claimed it will be creating infrastructure investments before the elections that are due prior to Might 2024.

“Infrastructure shell out will be there, economic development will come in, so we see, seeking to the worldwide scene, India is these days [the] ideal bet,” he said.

India’s yr-in excess of year financial expansion has been blistering in 2022, nevertheless its charge of development appears to have abated extra recently.

Last 7 days, the OECD claimed that on a quarter-to-quarter basis, India’s second-quarter GDP progress was the next worst between the G-20 team of major wealthy and creating nations around the world. Early this month, Goldman Sachs decreased its full-yr forecast for India gross domestic product or service development from 7.6% to 7%.

Foreign investment

According to a report by India’s ministry of finance, the region gained $17.3 billion in international immediate financial investment in the very first quarter, which puts it in advance of emerging peers Indonesia and Argentina, but powering countries such as Brazil and Mexico.

China’s foreign direct investment dwarfed India’s at 101.9 billion around the very same period of time, the report stated.

In the 2nd quarter, India’s international investment declined to $16.1 billion, the ministry claimed.