The new economic actions laid out by the U.K. govt “will probably maximize inequality”, according to a spokesperson from the Global Financial Fund.

Yuri Gripas | Reuters

LONDON — The new financial steps laid out by the U.K. governing administration “will likely improve inequality,” the Global Monetary Fund said in a uncommon statement.

Though the fiscal package — which bundled significant tax cuts for Britain’s greatest earners — aims to assist people and businesses cope with the energy shock, the IMF does “not recommend massive and untargeted fiscal packages at this juncture,” a spokesperson said in a statement late Tuesday.

associated investing news

The so-termed “mini-budget” on Friday was not accompanied by a forecast from Britain’s unbiased Place of work for Finances Responsibility, which generally analyses the affect major fiscal moves would probably have on the economy.

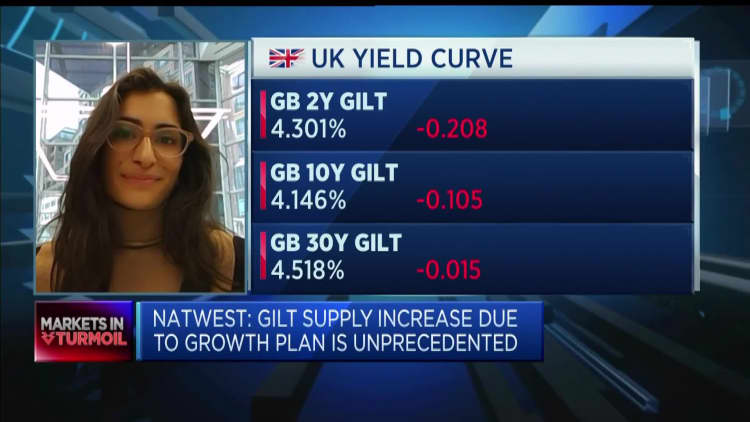

Markets had been strongly influenced by the new measures, with U.K. bonds sinking and the British pound plummeting to a file small on Monday.

The IMF also appeared forward to the upcoming comprehensive spending plan announcement, established to be laid out by Finance Minister Kwasi Kwarteng on Nov. 23, stating it gives the U.K. governing administration “an early opportunity … to take into consideration methods to offer assistance that is more targeted and re-examine the tax measures, especially people that advantage significant earnings earners.”

“Massive unfunded cuts are credit damaging”

The Bank of England will very likely provide a “substantial policy reaction” subsequent Kwarteng’s fiscal announcement, in accordance to its Chief Economist Huw Capsule, who spoke at the Barclays-CEPR International Monetary Plan Discussion board in London on Tuesday.

Even though no moves will be produced in advance of the bank’s upcoming scheduled meeting in November, the recent announcements “will act as a stimulus,” Tablet claimed, as reported by Reuters.

Credit history ratings company Moody’s, in the meantime, said “big unfunded cuts are credit history destructive,” prompting fears of more substantial price range deficits and better curiosity charges in the U.K.

“A sustained self confidence shock arising from current market problems above the credibility of the government’s fiscal technique that resulted in structurally greater funding expenditures could much more completely weaken the UK’s personal debt affordability,” Moody’s stated, according to Reuters.

The “mini-budget” declared by the new U.K. federal government on Friday was a “new solution for a new era targeted on development,” in accordance to Kwarteng, and provided canceling the prepared improve in company tax from 19% to 25% and scrapping the 45% income tax bracket compensated on incomes over £150,000 ($160,000), bringing the best charge down to 40%.

The pound has observed some restoration from its document very low of $1.0382 at the commence of the week, and sat at about $1.0666 on Wednesday morning.