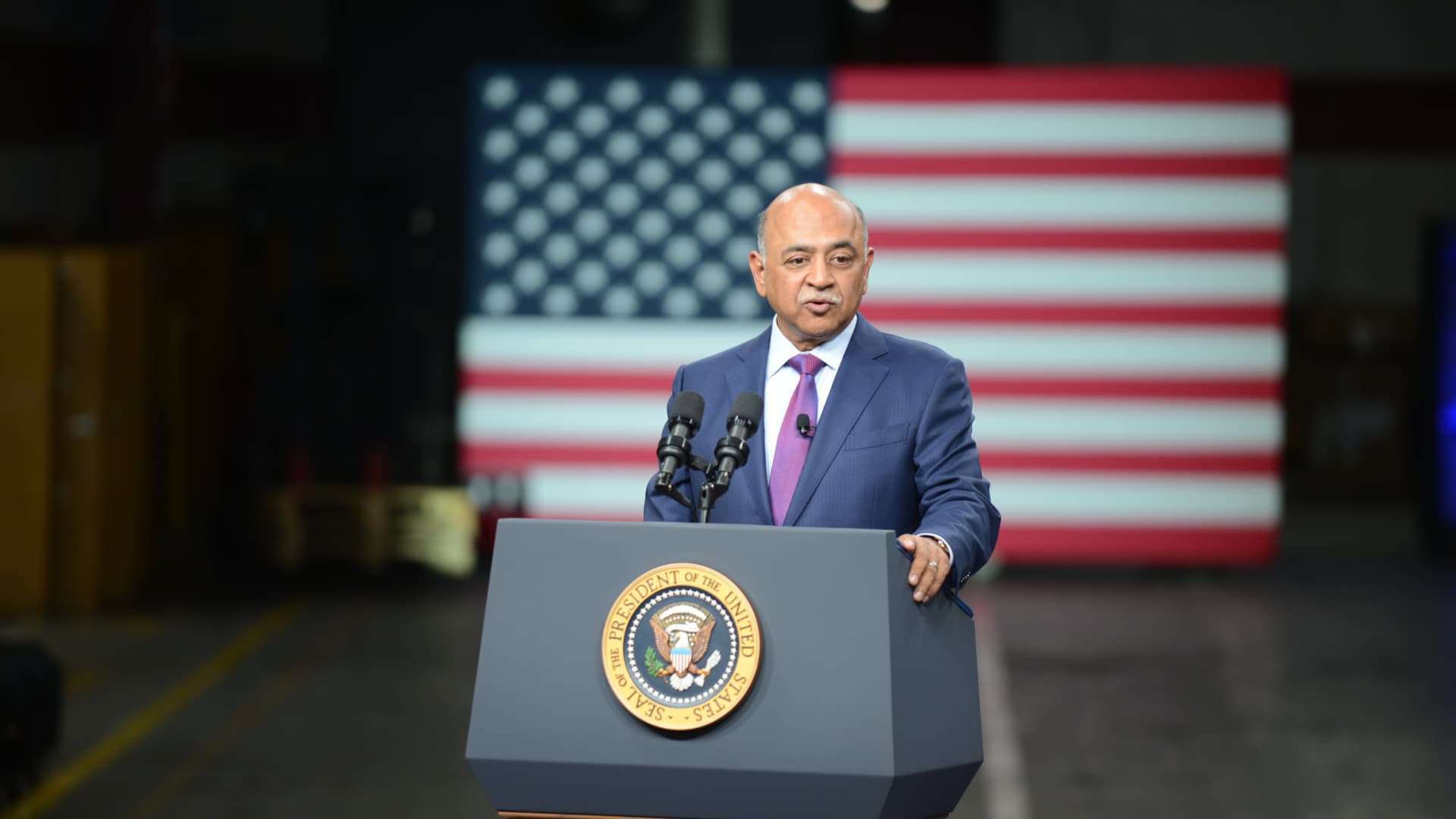

IBM CEO Arvind Krishna speaks at an IBM facility in Poughkeepsie, New York, on Oct. 6, 2022. IBM declared $20 billion in investments for the duration of President Biden’s go to that will go toward research and progress and the producing of semiconductors, mainframe technological innovation, artificial intelligence and quantum computing in the Hudson Valley.

Dana Ullman | Bloomberg | Getty Photographs

IBM shares rose as a lot as 6% in prolonged buying and selling on Wednesday just after the technological innovation conglomerate surpassed analysts’ estimates for the third quarter and lifted its development projection for the comprehensive 12 months.

Here’s how the company did:

- Earnings: $1.81 for every share, altered, vs. $1.77 per share as anticipated by analysts, according to Refinitiv.

- Income: $14.11 billion, vs. $13.51 billion as expected by analysts, according to Refinitiv.

Profits greater 6.5% from a yr before, according to a statement.

“With our 12 months-to-date effectiveness, we now be expecting comprehensive-12 months earnings development earlier mentioned our mid-one digit product,” CEO Arvind Krishna claimed in the statement.” In July the enterprise claimed it had anticipated development at the higher end of the design. The company stated overseas-exchange fees need to result in 7% less profits than it usually would have for the comprehensive calendar year. IBM reiterated its direction from July of all around $10 billion in free hard cash stream.

The corporation ended the third quarter with a $3.21 billion reduction from continuing functions, when compared with profits of $1.04 billion in the calendar year-ago quarter. IBM spun off its managed infrastructure companies company into Kyndryl in November 2021. Throughout the third quarter IBM paid out a a single-time non-hard cash pension settlement charge tied to the transfer of some pension obligations and belongings to third-celebration insurers. IBM noted an altered pre-tax margin of 13.9%, while analysts polled by StreetAccount experienced been wanting for 15.1%.

Profits from software program totaled $5.81 billion. That signifies expansion of nearly 7.5% 12 months more than calendar year and exceeds the $5.54 billion consensus estimate amid analysts polled by StreetAccount. Revenue from transaction processing program grew 23%.

Consulting revenue arrived to $4.70 billion, which was up 5.5% and over the StreetAccount consensus of $4.51 billion. Pre-tax margins in the consulting unit narrowed to 9.8% from 10.5%. Ongoing labor charge inflation factored into income for the unit, IBM claimed.

The infrastructure segment delivered $3.35 billion, up 14.8% and better than the $3.06 billion StreetAccount consensus. Earnings from IBM’s z Units line of mainframe computer systems jumped 88%. Product sales of the z16 mainframe personal computer commenced in the next quarter.

Throughout the quarter IBM declared the acquisition of consulting organization Dialexa and observability program startup Databand.ai, alongside with new servers containing its Power10 chips.

Notwithstanding the soon after-hours shift, IBM shares have fallen 8% so far this yr, although the S&P 500 U.S. stock index is down pretty much 23% in excess of the exact same period of time.

Executives will go over the success with analysts on a convention simply call beginning at 5 p.m. ET.

This is breaking news. Make sure you look at back for updates.

Correction: A prior version of this story had the incorrect figure for income development.

Enjoy: For a longer period sale cycles for cloud program firms have investors experience hesitant