Coinbase’s arguments in its authorized case in opposition to the U.S. Securities and Exchange Fee have been strengthened following a essential court ruling went partly in favour of cryptocurrency company Ripple, the U.S. exchange’s legal chief advised CNBC on Friday.

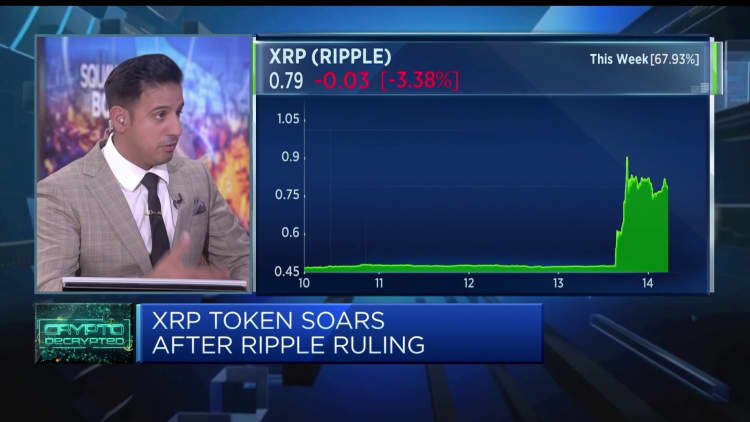

On Thursday, a U.S. decide ruled that XRP token buys through exchanges were being not securities transactions. The SEC sued Ripple, the corporation behind the XRP token, in 2020, alleging that the company broke securities laws.

related investing news

The ruling was cheered by the cryptocurrency group and notably by exchanges, which truly feel the result will help generate some far more regulatory clarity.

Just one these types of exchange is Coinbase, which was sued in June by the SEC on prices of operating an unregistered trade and broker.

But the hottest XRP courtroom feeling has given confidence to Coinbase in its scenario from the SEC.

“For exchanges, for tokens that are detailed on exchanges, for normal traders, there’s no concern that this ruling strikes a blow to the concept that somehow securities are staying traded when people go on to exchanges and trade the assets,” Paul Grewal, chief lawful officer at Coinbase, told CNBC in a Tv set job interview on Friday.

“I feel we will earn. Now, I considered we would acquire before this conclusion. We assume this final decision has only additional strengthened the situation,” he extra.

Element of Coinbase’s optimism stems from the conclusion concerning XRP not getting a stability. If XRP isn’t designated these kinds of, there is hope that hundreds of other cryptocurrencies will also not be matter to security legislation.

“I feel it would be a oversight to think that, in just about every occasion, and in every single transaction, the securities guidelines do not apply. That is never ever been Coinbase’s place, I you should not assume it must be anyone’s fair posture. But if you literally changed the letters XRP with the letters for any other token, in this final decision, the logic however holds,” Grewal reported.

On the other hand, an additional part of the judgement truly deemed it a securities transaction to sell XRP especially to advanced buyers or institutional purchasers.

Coinbase has been attempting to grow its have institutional buying and selling system. Grewal shrugged off this section of the situation, simply because it related specifically to how Ripple bought XRP to institutional shoppers.

“I imagine all investors, institutional and retail, can consider terrific comfort from the actuality that, when it will come to trade investing, exactly where there is arm’s duration dealing, the court has designed it really apparent, these tokens are not getting traded as securities,” Grewal said.

SEC slammed

Whether or not cryptoassets are securities is an essential query with various implications. If they are deemed securities, then they would require to register with the SEC and would have rigid disclosure needs. It would also give the SEC the electrical power to oversee these belongings and relevant corporations, this sort of as cryptocurrency exchanges.

The SEC has managed that most cryptocurrencies are securities — but the conclusion on XRP appeared to weaken its argument.

The crypto field has had heated terms for the SEC around the earlier thirty day period, accusing the agency of regulating by imposing, relatively than by doing the job with the industry.

Pavlo Gonchar | Lightrocket | Getty Illustrations or photos

Tyler Winklevoss, the co-founder of cryptocurrency exchange Gemini that is also subject to a SEC lawsuit, named the regulator a “failed institution.”

Coinbase’s Grewal said he did not assume the SEC was waging an ideological struggle against the cryptocurrency marketplace, but that all actions have been completed in “superior faith.” Nonetheless, he included, “they have been erroneous.”

“What there has been I assume, is a failure of management to follow sensible engagement with the industry and with other stakeholders, fairly than resorting to court,” Grewal reported, contacting for “new principles to offer with a new technological know-how.”