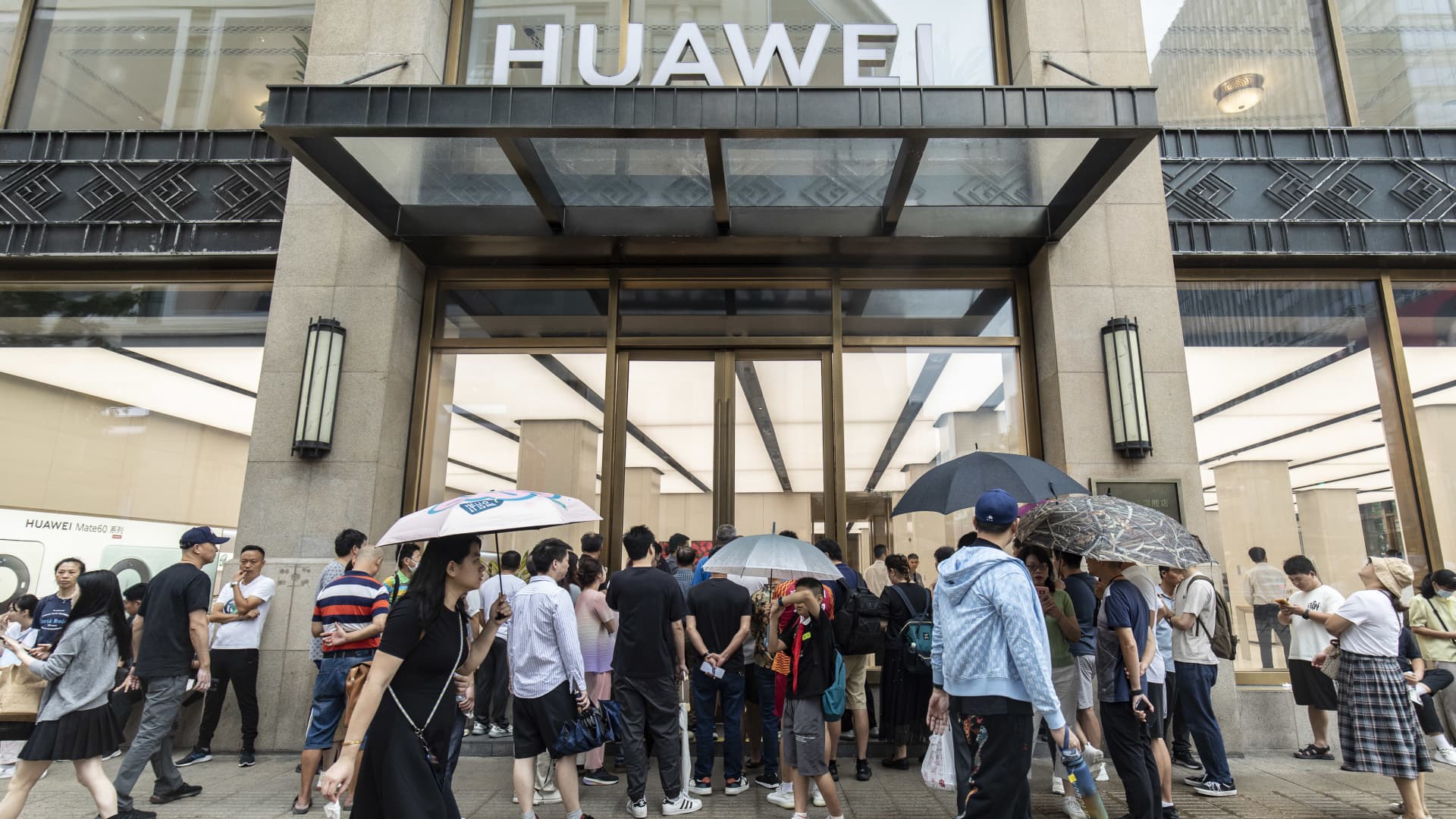

Chinese smartphone providers like Huawei are rebounding in their house sector, providing a enhance to domestic suppliers — and escalating the strain on Apple . It is really a reflection of a geopolitically-driven shift in the tech market. A apparent takeaway from past week’s meeting of the U.S. and Chinese presidents is that American restrictions on gross sales of higher-conclusion tech to China will not be going absent. Whilst the summit could reduce the possibility that tensions escalate in the around phrase, Morgan Stanley analysts reported that “‘competitive confrontation’ will probably continue to be for now.” That “does not suggest a total decoupling, but instead ongoing tech levels of competition and derisking absent from China,” the analysts said in a notice Thursday. Chinese President Xi Jinping referred to as on the U.S. to carry its sanctions and provide a non-discriminatory surroundings for Chinese firms, in accordance to a readout. But the U.S. claimed President Joe Biden emphasized the need to have to avoid highly developed U.S. tech from undermining countrywide stability. In reality, Raymond James analysts explained in a be aware Thursday their conversations with Washington, D.C., contacts supports expectations for more tech export controls. The Biden administration has also taken pains to emphasize the bulk of trade with China is not impacted by the limitations, and that it does not concentrate on client-associated programs. Huawei suppliers outperforming But investors are previously going. In a year in which detrimental sentiment has despatched the MSCI China index down by approximately 11% in U.S. dollar conditions, a Wind Details index of Huawei corporate companions and suppliers is up 36%. That is far more than double the 15.5% increase so significantly this 12 months for a Wind index of Apple suppliers. Telecommunications large Huawei was a comparatively early target of U.S. sanctions, halving its earnings from customer items this kind of as smartphones. The restrictions, imposed in 2019, involved accredited accessibility to the newest versions of Google’s Android functioning system. Huawei has as a substitute constructed out its very own running process. Reviews also indicated the company’s new Mate 60 Professional smartphone features obtain speeds affiliated with 5G — many thanks to an highly developed chip, made by Chinese semiconductor huge SMIC. Huawei smartphone sales surged by 83% in Oct from a calendar year in the past, Counterpoint Analysis reported in a observe Tuesday. Honor, a Huawei spin-off, observed revenue climb by 10%, even though Xiaomi smartphone income rose by 33%, the report claimed. The report did not break out Apple profits, only expressing a broad group of “other people” observed October smartphone revenue fall by 12% from a 12 months back. Shenzhen-stated Lihexing sells smartphone tests tools to Huawei and expects the enterprise to ship at minimum 70 million telephones up coming calendar year, Nomura analysts mentioned in a report Tuesday, citing a conference with Lihexing administration before in the week. The stock is up by additional than 80% so far this yr. In the most optimistic scenario, Lihexing expects Huawei could ship 90 million smartphones in 2024, the Nomura report stated. “For the mid-/extended-expression, management expects more revenue streams from EVs and charging stations, thanks to its prolonged-long lasting marriage with Huawei,” the analysts claimed, noting Lihexing does not system to enhance market penetration in Xiaomi and other Android model phones “because of to minimal profitability and intensified levels of competition.” For context, Shanghai-primarily based CINNO Investigate expects a 2% decrease in Apple Iphone product sales in China this yr to 45.5 million models. Huawei sells a range of mass market phones in addition to premium models. On the electrical automobile front, Huawei has targeted on offering in-vehicle tech while partnering with brands to make the automobile. Shanghai-detailed Sokon producers the hybrid and pure battery-powered vehicles for Huawei beneath the Aito brand name, officially introduced in late 2021. In the past week, Huawei claimed it had currently delivered 120,000 models of the Aito M5 on your own. Shares of Sokon have climbed by more than 100% so considerably this 12 months. Nomura analysts also stated they met with Guangdong Topstar Technology, which turned a provider of Huawei, Xiaomi and other individuals this calendar year in the industrial robotic place. The Shenzhen-outlined stock is up by about 10% so far this 12 months. Nomura does not nonetheless have rankings on the Lihexing or Topstar. But Chinese investment decision banking huge CICC has an outperform rating on the two Sokon and Topstar. Shenzhen-shown BYD shares and Shanghai-shown Foxconn Industrial World-wide-web shares are in both Wind’s Huawei and Apple indexes. — CNBC’s Michael Bloom contributed to this report.