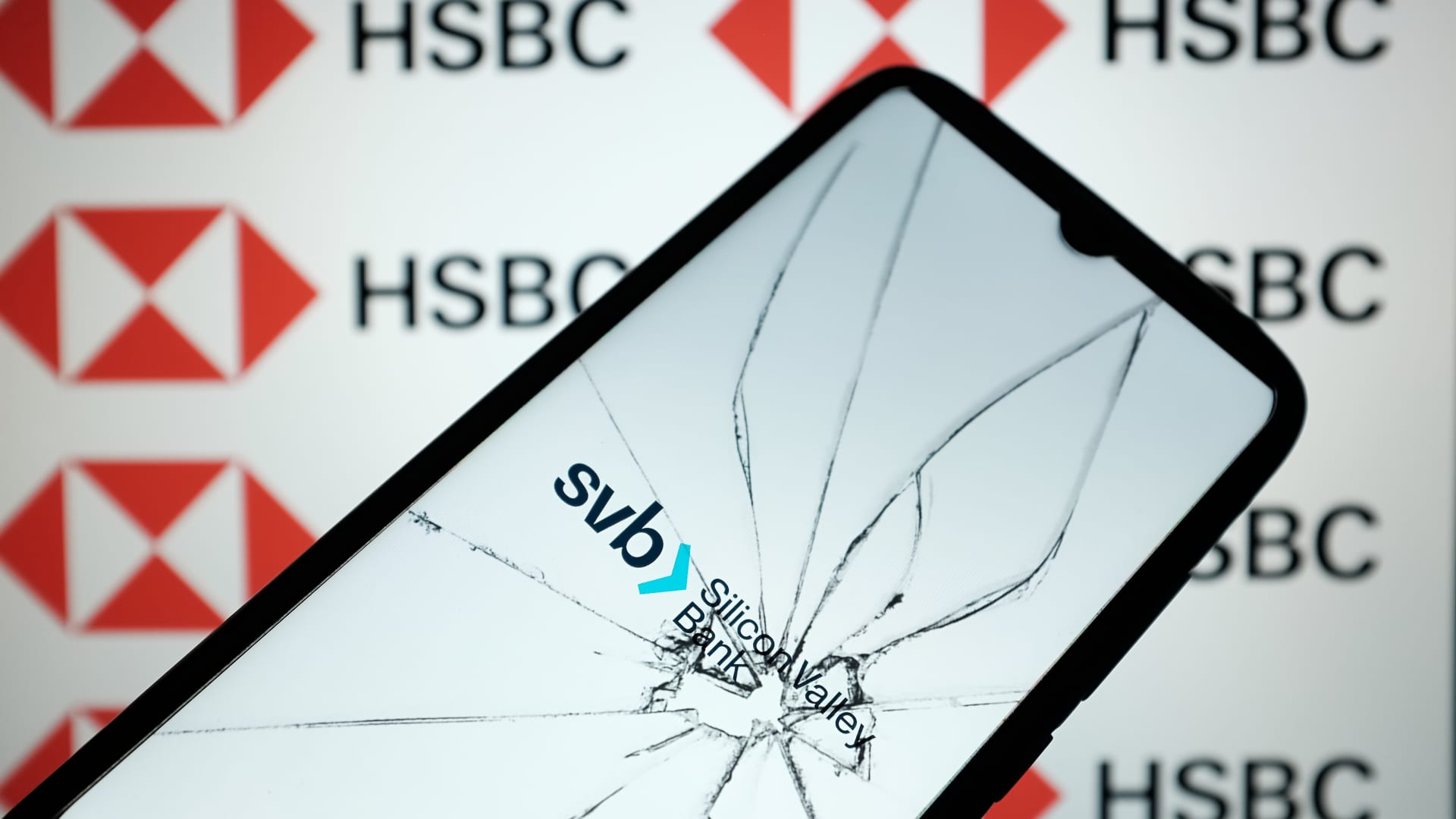

HSBC came to the rescue of Silicon Valley Bank United kingdom in a very important offer for the full banking sector. But if you had explained to its CEO — just a number of days beforehand — that this would be taking place, he would not have thought you.

“I was likely about my ordinary organization on Friday. If somebody had reported to me [that] we would be attaining a further bank inside two or three times, I wouldn’t have thought it,” Ian Stuart, CEO of HSBC Uk Financial institution, instructed CNBC’s “Squawk Box Europe” Thursday.

It was all really speedy. Silicon Valley Bank — a U.S. financial institution with shoppers mainly in the tech and health and fitness-treatment startup planet — was considered bancrupt by American regulators on Friday. That lifted alarm bells across the pond, where by SVB had a subsidiary.

Therefore, the Lender of England introduced Friday that, “absent any significant even more details,” it would be positioning Silicon Valley Bank United kingdom into an insolvency technique.

“Woke up on Saturday morning, saw the announcement and by just after 10:30 a.m. we were in touch with the regulator giving our assist, myself and our worldwide CEO Noel Quinn the two in speak to. And it went a small bit silent, I imagine at that place we were being just attempting to offer you any assistance we could,” Stuart claimed.

More than 200 firms — depositors with SVB Uk — wrote Saturday to the U.K.’s Treasury asking for assistance. They explained that some would not be equipped to comply with payroll deadlines without having accessing their deposits with SVB British isles.

“We bought access to the info lender early on Sunday. We experienced about five several hours to do because of diligence and by about 6pm on Sunday — and we had heaps of meetings in the course of the day — as much as we have been anxious it was a competitive circumstance, and I can honestly tell that even up to about 10, 11 p.m. at night time, I nonetheless thought it was a aggressive scenario and all-around about that time, we were being in actually near dialogue with the regulator.”

Other money institutions ended up also in the mix and evaluating the likelihood of shopping for SVB Uk, such as OakNorth Financial institution, The Lender of London and Abu Dhabi expenditure company Royal Group.

It really is a fantastic prospect.

“It was not until eventually … early hrs of Monday morning that we considered, ‘right, I think we have obtained a lender,’ and we began getting ready comms at that place,” Stuart claimed.

HSBC Uk introduced at 7 a.m. London time Monday that it was purchasing Silicon Valley Lender British isles for £1 ($1.21). The offer guarded £6.7 billion in deposits.

“We have a U.K. lender that is well run, extremely very good folks, superior high-quality items and, of course, five hrs just isn’t a whole lot of time to do owing diligence, but what we made the decision was, ‘Are there any black holes? No, not that we could see,'” Stuart said.

“Was it really worth — your phrases, not mine — a gamble. We imagined it was a smart solution, we did not inquire for govt guidance, we didn’t question for anything out of the standard,” he reported, including that the deal will assistance HSBC speed up its strategic approach by two or three several years.

“It can be a great prospect,” he said.