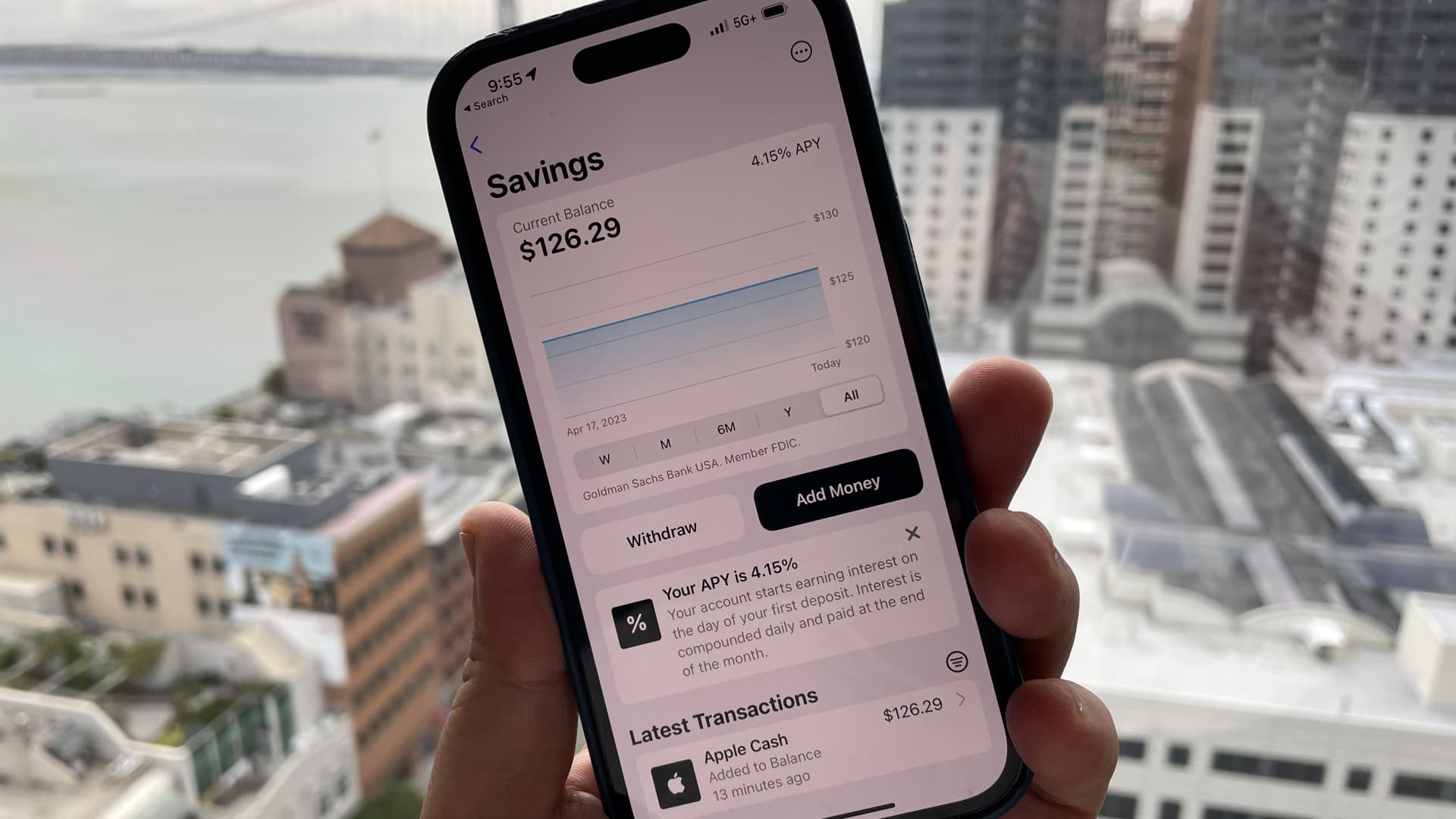

Apple now delivers a financial savings account administered through its Iphone application that makes it possible for people to accrue above 4% interest.

Environment up the price savings account is uncomplicated, despite the fact that consumers are required to have an lively Apple Card. Accounts are administered by Goldman Sachs.

linked investing information

After the account is opened, hard cash-again rewards from Apple credit score card purchases named Apple Hard cash can instantly be deposited into the curiosity-bearing savings account. People can also transfer income from their savings account to their Apple Cash account in situation they want to devote it or send it to a mate.

Users can place more income into the price savings account and obtain the present 4.15% annual generate, compounding every day. The yield will shift more than time as interest fees change.

The Apple Price savings account can hold up to $250,000 in deposits, which are insured by the FDIC. The aspect is now offered inside Apple’s Wallet application for all Apple Card holders in the U.S.

This is what you have to have to know:

How to signal up

Apple cost savings account

Apple

- Have an energetic Apple Card on your Apple iphone.

- Open up the Wallet application and faucet on your Apple Card.

- Press the button with 3 dots on the higher ideal corner, and select Each day Hard cash. Or there may perhaps be a marketing button to indicator up for the financial savings account on the entrance website page.

- Stick to the directions. It will inquire for your Social Security variety and for you to signal a number of agreements.

- By default, Apple will get started placing your Apple Card cash back again into your financial savings account, while it really is attainable to transfer it back again if you want to devote it or ship it to a friend.

How to incorporate income

Screenshot/CNBC

Screenshot/CNBC

- You can include revenue from a linked lender account to your savings account.

- If you have an Apple Card, you likely now have a bank account connected to make payments.

- Open up the Wallet App. On the very first site, there should really be a button with your price savings balance.

- Inside of the financial savings webpage, tap the Add Funds button to incorporate dollars from your linked financial institution account.

- You can also withdraw from your personal savings account to your joined financial institution account or your Everyday Money account.

- There’s no limit on how many transactions a user can make to consider income out or put funds into the savings account.