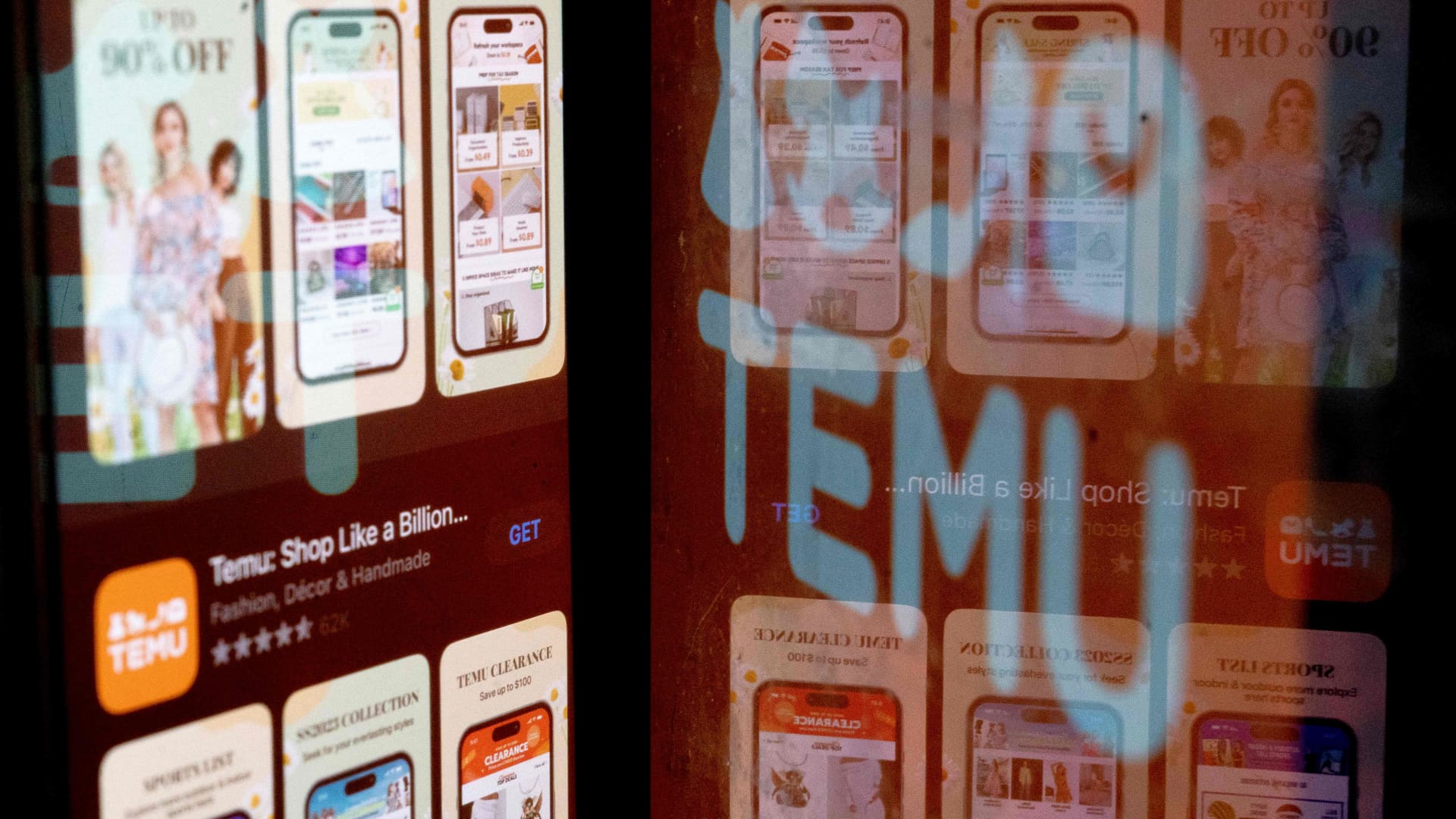

Cut price e-commerce firm Temu has had a whirlwind 2023.

Quietly launching its application in September 2022, it only took the firm a several months to prime app retailer charts, edging out Amazon, Walmart and even speedy-manner model Shein. By February 2023, the 5-thirty day period-previous business manufactured its Television set debut all through Tremendous Bowl LVII, airing two commercial places totaling an believed $14 million.

Temu’s level of popularity is largely because of to its ultra-affordable knockoffs. Users can get an Apple Look at dupe for $10, Yeezy knockoffs for $4.99 and gaming consoles for $20. On leading of the steep reductions, buyers are bombarded by coupons, totally free delivery countdowns, flash sales and discounted wheels.

Even though on its encounter the company appears to be a Boston-centered startup, it is really backed by a effectively-known title in the Chinese retail house, Pinduoduo.

“China is truly the linchpin in Temu’s technique,” said Neil Saunders, managing director of GlobalData Retail. “A whole lot of the solutions that are bought on Temu are manufactured in China. They’re transported right from China to the U.S. So those labor prices in comparison to manufacturing in the U.S. and elsewhere are definitely reduced.”

Temu’s increase in popularity has also courted scrutiny from the U.S. authorities, accusing the web-site of exploiting de minimis delivery principles to undercut U.S. vendors. Beneath de minimis guidelines, shipments valued beneath $800 are not subject to duty taxes and go through minimal customs checks.

Outside of that, a U.S. Home committee accused the retailer of violating U.S. import regulation by working with pressured labor to source its goods.

Temu and Pinduoduo did not respond to CNBC’s requests for remark

Observe the movie higher than to understand what’s behind Temu’s good results and what could disrupt the retailer’s large advancement in the U.S.