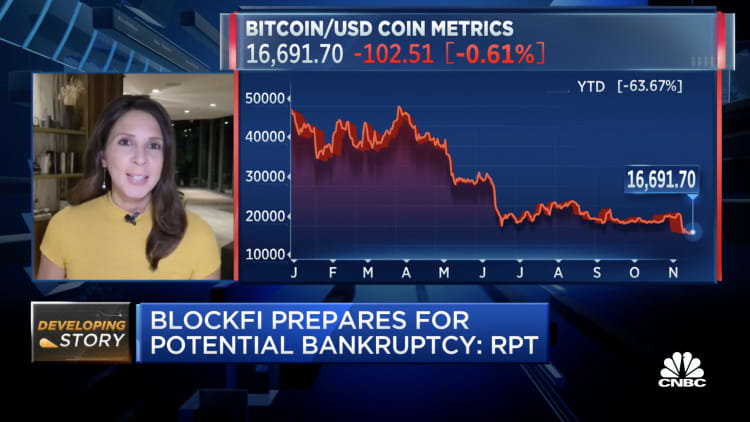

The BlockFi symbol on a smartphone arranged in the Brooklyn borough of New York, on Thursday, Nov. 17, 2022.

Gabby Jones | Bloomberg | Getty Images

There was supposedly a single gentleman who could conserve crypto — Sam Bankman-Fried. The former FTX CEO bailed out and took more than crypto firms as cryptocurrency markets withered with Terra’s spring crash. In Oct, FTX gained the bidding war for bankrupt crypto company Voyager Digital in a really beneficial offer.

With the collapse of FTX, the firms which Bankman-Fried saved now find by themselves in an uncertain state. Voyager place itself back again up for auction last week. These days, BlockFi submitted for individual bankruptcy in New Jersey, just after weeks of speculation that the FTX collapse had fatally crippled it.

The FTX “death spiral,” as BlockFi advisor Mark Renzi place it, has now spread to yet another crypto entity. BlockFi’s personal bankruptcy had been expected for some time, but in a comprehensive 41-web site filing, Renzi walks creditors, traders, and the court docket by way of his viewpoint at the helm of BlockFi.

According to Renzi, publicity to two successive hedge fund failures, the FTX rescue, and broader market uncertainty all conspired to power BlockFi into personal bankruptcy.

Renzi is keen to underscore that from his level of perspective, BlockFi would not “encounter the myriad difficulties apparently struggling with FTX.” Renzi pointed to a $30 million settlement with the SEC and the company’s company governance and possibility management protocols, creating that BlockFi is “well-positioned to go ahead despite the point that 2022 has been a uniquely horrible calendar year for the cryptocurrency industry.”

The “problems” that Renzi refer to might incorporate FTX’s perfectly publicized absence of monetary, possibility, anti-dollars laundering (AML), or audit techniques. In a courtroom submitting, freshly appointed FTX CEO John Ray explained he’d never witnessed “these kinds of a entire failure of company controls” as in FTX.

In fact, Renzi is eager to underscore BlockFi’s variations from FTX, and indeed argues that FTX’s intervention in summer season 2022 ultimately worsened results for BlockFi. Renzi is a taking care of director at Berkeley Investigate Team (BRG), which BlockFi has enlisted as a money advisor for their Chapter 11 proceedings.

Each BRG and Kirkland & Ellis, BlockFi’s authorized advisor, have experience in crypto bankruptcies. Kirkland and BRG the two represented Voyager for the duration of its failed auction to FTX. Equally companies have now gathered hundreds of thousands in expenses from BlockFi in planning get the job done for the individual bankruptcy, in accordance to court filings.

In the same way to filings in Voyager and Celsius Network’s bankruptcies, Renzi factors to broader turbulence in the cryptocurrency marketplaces, accelerated by the collapse of crypto hedge fund A few Arrows Funds, as the driving pressure guiding BlockFi’s liquidity crisis.

BlockFi, like Celsius and Voyager, available exceptionally substantial fascination costs on shopper crypto accounts. All a few firms were in a position to do so thanks to cryptolending — loaning buyer cryptocurrencies to investing firms in exchange for high desire and collateral. Three Arrows, or 3AC was “a person of BlockFi’s largest borrower consumers,” Renzi stated in a courtroom submitting, and the hedge fund’s bankruptcy pressured BlockFi to look for outside funding.

A new round failed for BlockFi. Traditional 3rd-social gathering buyers had been afraid off by “unfavorable” current market conditions, Renzi explained in a submitting, forcing them to convert to FTX just to make great on customer withdrawals. Contrary to Voyager or Celsius, BlockFi experienced not halted purchaser withdrawals at that issue.

FTX assembled and shipped a pacakge of financial loans up to $400 million. In return, FTX reserved the right to acquire BlockFi as soon as July 2023, the courtroom submitting mentioned.

Although FTX’s rescue package deal did in the beginning buoy BlockFi, dealings with FTX’s Alameda Analysis Confined even more undercut BlockFi’s security. As Alameda unwound and FTX moved nearer to individual bankruptcy, BlockFi attempted to execute margin calls and financial loan recollects on their Alameda exposure.

Ultimately, though, Alameda defaulted on “somewhere around $680 million” of collateralized financial loans from BlockFi, “the restoration on which is not known,” the courtroom filing explained.

BlockFi was forced to do what it had resisted undertaking through the Voyager and Celsius meltdowns. On November 10, the working day FTX filed for personal bankruptcy, BlockFi paused client withdrawals. Buyers, like at FTX, Voyager, and Celsius, are now left in limbo, with no entry to their cash.