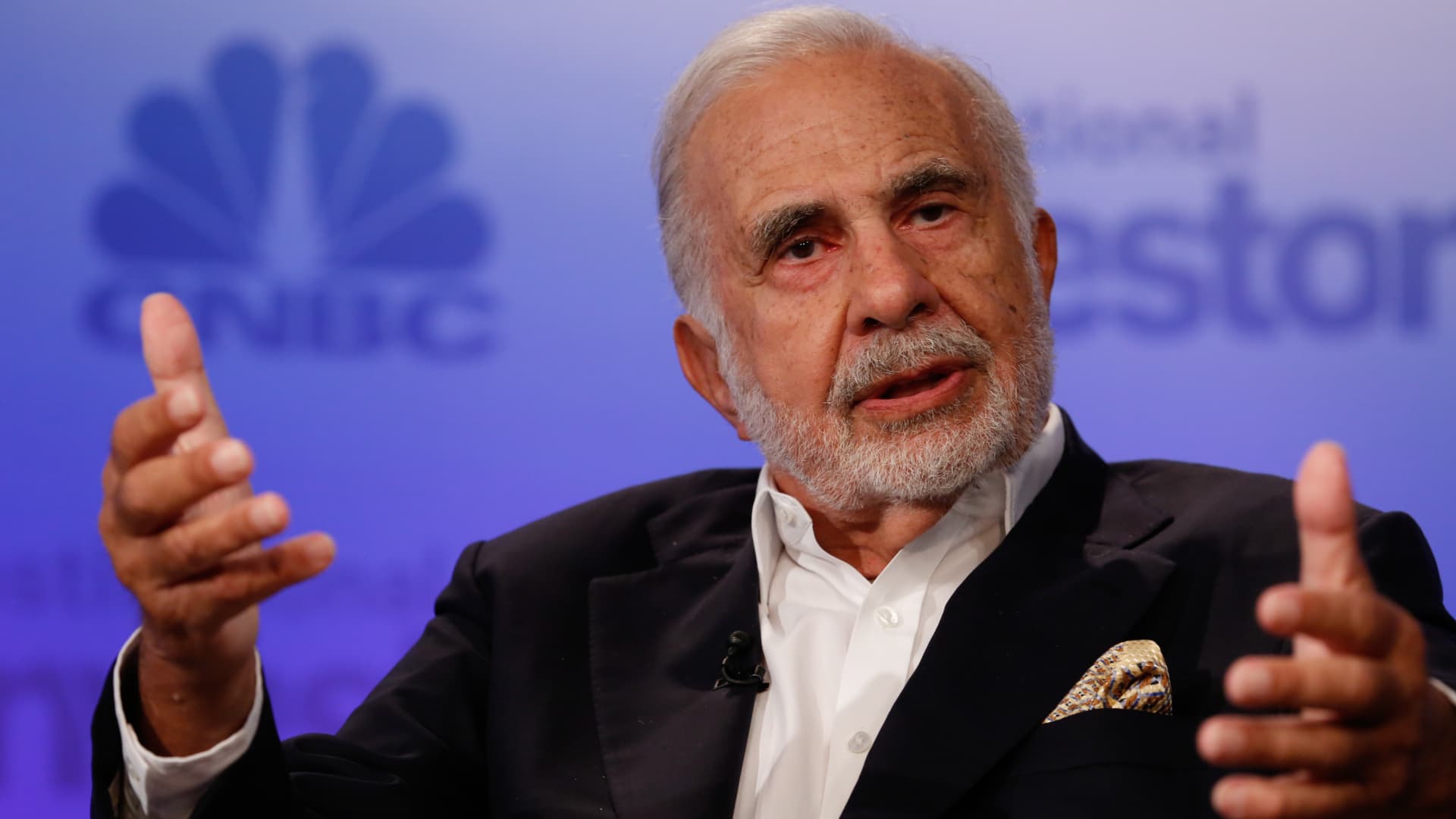

Noteworthy small vendor Hindenburg Research is going just after famed activist trader Carl Icahn.

The Nathan Anderson-led organization took a brief position versus Icahn Enterprises, alleging “inflated” asset valuations, amongst other explanations, for what it states is an unusually significant net asset value top quality in shares of the publicly traded holding enterprise.

“Total, we feel Icahn, a legend of Wall Road, has designed a typical oversight of using on much too significantly leverage in the encounter of sustained losses: a combination that not often finishes very well,” Hindenburg Study reported in a be aware launched Tuesday.

The shares fell 9% in premarket trading.

Icahn, the most properly regarded corporate raider in historical past, made his identify following pulling off a hostile takeover of Trans Environment Airways in the 1980s, stripping the corporation of its assets. Most recently, the billionaire trader has engaged in activist investing in McDonald’s and biotech company Illumina.

Headquartered in Sunny Isles Seashore, Florida, Icahn Enterprises is a keeping enterprise that entails in a myriad of companies which includes electrical power, automotive, food stuff packaging, metals and actual estate.

The conglomerate pays a 15.9% dividend, according to FactSet. Hindenburg stated it believes the large dividend produce is “unsupported” by the firm’s income flow and expenditure functionality.

CNBC has achieved out to Icahn for remark.

Shares of Icahn Enterprises are down .5% on the 12 months as of Monday’s close.