A jobseeker normally takes a flyer at a job honest at Brunswick Community College or university in Bolivia, North Carolina, on April 11, 2024.

Allison Joyce | Bloomberg | Getty Photos

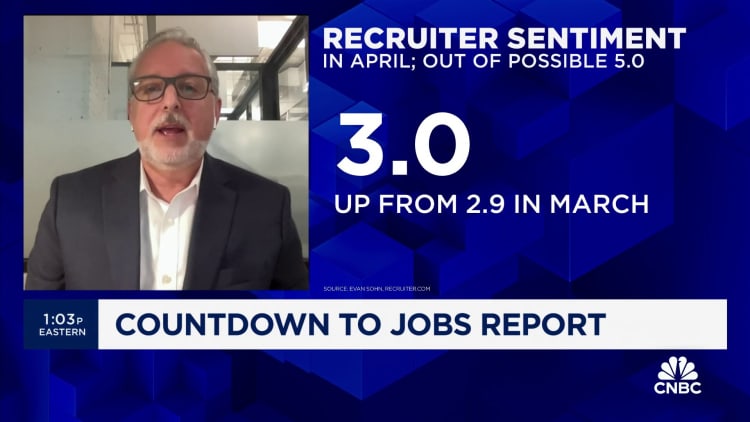

Employing probable continued at a brisk pace in April as traders seem for any cracks in the labor marketplace that could sway the Federal Reserve.

Nonfarm payrolls are predicted to display a gain of 240,000 for the month, according to the Dow Jones consensus that also sees the unemployment level holding continual at 3.8%.

If that top-line amount is correct, it essentially would reflect a tiny step back again from the normal 276,000 positions a month made so significantly in 2024. In addition, this kind of expansion could insert to the Fed’s reluctance to decrease desire charges, with the labor sector buzzing along and inflation continue to higher than the central bank’s 2% concentrate on.

“There are definitely still tailwinds left,” mentioned Amy Glaser, senior vice president of organization operations at work staffing web page Adecco. “For April, the title of the sport is continuous-Eddie as resiliency proceeds, and then we are hunting forward to some of the seasonal tendencies we would hope heading into the summertime.”

April’s work opportunities industry showcased much more toughness in health and fitness treatment and leisure and hospitality, Glaser additional. All those have been two of the big sectors for employment development this yr, with health care adding about 240,000 work opportunities so much and leisure and hospitality contributing 89,000 positions.

However, progress in the coming months could unfold to parts these as schooling, manufacturing and warehousing, portion of the standard seasonal traits as educators search for option employment in the summer and students head out trying to get work, she claimed.

“I don’t expect to see significant surprises this month dependent on what I’m viewing on the floor,” Glaser said. “But we have been surprised just before.”

Beating anticipations

In fact, the labor current market has been whole of surprises this 12 months, topping Wall Street estimates at a time when numerous economists expected selecting to have slowed down. The 303,000 attain in March shattered forecasts and were being aspect of a glut of info displaying that the labor overall economy stays powerful, wages carry on to rise and inflation has not moved significantly after receding sharply in 2023.

That has pushed the Fed into a box as officials are reluctant to begin chopping desire rates right until they get far more convincing proof that inflation is under management.

Policymakers will be seeing many items in tomorrow’s report for proof that occupation growth is not serving to gas value pressures.

If the payrolls development misses expectations by a tiny and wage pressures diminish although extra people today enter the labor force, that would be an ideal circumstance for the Fed, said Drew Matus, chief sector strategist at MetLife Financial commitment Management.

“The Goldilocks situation is an unemployment amount increase with a participation price increase,” Matus stated. “What that’s suggesting is you will find a very little bit of weakness that should translate into a lot less wage pressure and take some of the issues about sustained sticky large ranges of inflation off the desk.”

Traders on the lookout

Marketplaces also will be seeing the wage figures carefully.

Consensus estimates set ordinary hourly earnings growth at .3% on the month, near the March go, and the annually boost at 4%, or just down below the 4.1% the month in advance of. On the other hand, Matus stated the wage numbers could be distorted by immigration designs as very well as California’s minimum amount wage enhance this year to $16 an hour.

Fed Chair Jerome Powell reported Wednesday that wage pressures have eased over the past 12 months as the labor market place has moved into much better equilibrium involving offer and need.

“Inflation has eased substantially more than the past calendar year, whilst the labor industry has remained powerful, and that’s really excellent information,” he explained at his news conference immediately after the central bank’s newest assembly. “But inflation is still much too substantial.”

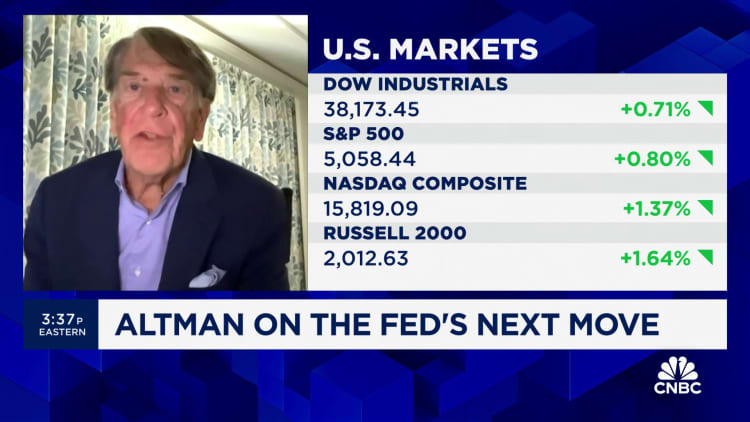

Marketplaces have been in a condition of flux as uncertainty around the Fed’s rate route has grown, although Wall Road was in rally method Thursday, the working day ahead of the Bureau of Labor Figures report drops at 8:30 a.m. ET.

“What you’re viewing in marketplaces displays the uncertainty about the path ahead. What’s heading to be much more vital to the Fed, unemployment or inflation?” Matus explained. “If unemployment starts off going larger, is the Fed going to treatment as significantly about inflation as they do these days? Or vice versa? And I will not assume even with all the details the Fed’s given us, that we know. I do not think anybody knows and I feel that’s why you happen to be looking at the market place behave the way it is.”