Eric Thayer/Bloomberg via Getty Images

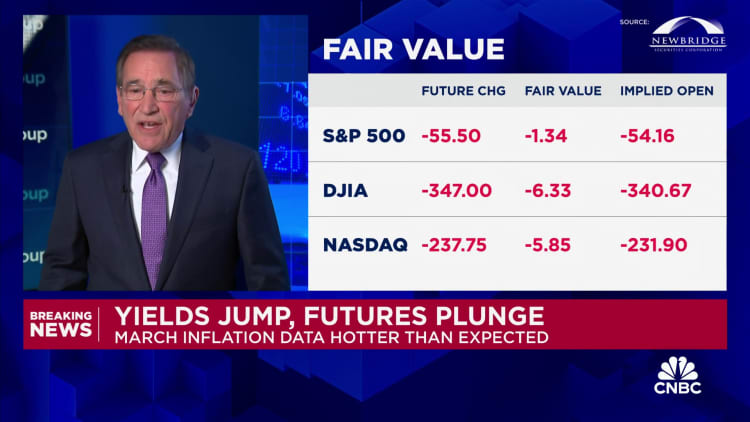

Inflation jumped in March as rates for consumer staples these kinds of as gasoline edged larger and those people for housing remained stubbornly high, suggesting inflation might be a little bit stickier than it seemed just a number of months in the past, economists claimed.

The buyer selling price index, a essential inflation gauge, rose 3.5% in March from a 12 months in the past, the U.S. Labor Division reported Wednesday. That’s up from 3.2% in February.

CPI steps how quick prices are modifying throughout the U.S. overall economy. It steps almost everything from fruits and vegetables to haircuts, live performance tickets and domestic appliances.

The March inflation studying is down noticeably from its 9.1% pandemic-period peak in 2022, which was the optimum stage considering the fact that 1981. Having said that, it stays over policymakers’ long-phrase focus on, all-around 2%.

Progress in the inflation battle has fairly flatlined in latest months.

“The disinflation has stalled out,” claimed Mark Zandi, chief economist at Moody’s Analytics.

“The huge rock in the way below is the expense of shelter,” Zandi explained.

Whilst housing costs have moderated, they account for the most significant share of the CPI inflation index and “are however escalating strongly,” he reported.

Inspite of progress getting stalled, broader evidence would not advise a renewed surge in inflation — however it may perhaps just take longer than expected to carry the fee back to concentrate on, economists reported. In simple fact, underlying inflation after stripping out shelter prices is previously back to focus on, Zandi reported.

“I nevertheless hold to the watch that inflation is moderating,” Zandi reported. “It is just getting frustratingly extensive to get there.”

Family paychecks can get far more things, although

Increased oil and gasoline rates just take a toll

Gasoline prices improved 1.7% from February to March, the Bureau of Labor Statistics mentioned. This figure is altered to account for seasonal buying styles.

Typical U.S. pump charges were $3.52 a gallon on April 1, up from $3.35 on March 4, according to weekly details posted by the Electrical power Information Administration.

The improve is mainly attributable to higher oil prices. They’ve firmed amid a frequently good outlook for the global economy, meaning greater international oil demand from customers, and controlled output among key oil-producing nations, which means there has not been a glut of oil, economists reported.

Tensions in the Center East could also be enjoying a job, Hamrick claimed.

Better gas charges might filter by means of to bigger rates elsewhere, because they variable into transportation and distribution expenditures for items and even solutions this kind of as foods shipping and delivery, he stated.

Larger power selling prices are what anxieties Zandi most relative to inflation readings. It truly is most likely the upward development will continue on in coming months, and the dynamic negatively impacts purchaser shopping for electric power and sentiment, he stated.

“Practically nothing does much more destruction to the economic climate far more immediately than mounting oil and gasoline rates,” he mentioned.

Other ‘notable’ spots of inflation

The BLS stated that motor motor vehicle coverage, health care care, recreation and particular treatment, in addition to shelter, had been “noteworthy” contributors to “core” inflation, a studying that strips out volatile strength and food charges.

Shelter, motor motor vehicle insurance coverage, health care treatment, attire and personalized care have been noteworthy contributors to every month inflation from February to March, the company mentioned.

The overall month to month CPI reading, .4%, was significantly higher than the approximately .2% that would be envisioned on a constant basis to convey inflation back to ordinary, economists stated.

“There is no advancement in this article we’re shifting in the improper path,” Hamrick mentioned.

“The standard issues spots persist,” stated Hamrick, who in addition known as out charges for electricity and automobile routine maintenance and repairs.

Selling prices have fallen in some classes

In the meantime, some buyer classes have observed enhancement.

Selling prices fell for applied autos and vehicles, new automobiles and airline tickets involving February and March, for instance. They’re also down over the earlier 12 months, by 2.2%, .1% and 7.1%, respectively, according to CPI facts.

Reduce rates for new and used vehicles should lead vehicle insurance policy and restore expenses to slide as well, economists stated.

Grocery costs are one more bright location, they said.

Though some groups, these as eggs and pork chops, have witnessed the latest upward movement, the total “meals at dwelling” index stood at % on a regular basis in equally February and March.

“Foodstuff price ranges have appear to a standstill,” Zandi reported. “For most People in america, the matter that bothers them the most about inflation is substantial food items price ranges.”

Source-and-need dynamics

At a large level, provide-and-demand from customers imbalances are what trigger out-of-whack inflation.

For case in point, the Covid-19 pandemic disrupted offer chains for merchandise. Americans’ getting patterns also at the same time shifted away from providers — these as entertainment and vacation — towards actual physical goods since they stayed at household far more, driving up demand from customers and fueling decades-high merchandise inflation.

On top of that, provide-and-need dynamics in the labor market pushed wage advancement to the maximum stage in a long time, putting upward strain on charges for products and services, which are extra wage-sensitive.

Now that source-chain problems are “really shut to mounted,” there is certainly “minimal scope” for products to contribute to disinflation transferring forward, claimed Sarah Dwelling, senior economist at Wells Fargo Economics.

“You need products and services to just take the mantle of disinflation,” because items have “petered out,” she added.

Housing falls into the providers class. It accounts for the greatest share of the purchaser price index, so disinflation in this group would probable have a substantial influence on inflation readings.

So significantly, housing inflation has remained stubbornly higher — even as economists have predicted it would start moderating any working day presented broadly constructive developments in charges for new tenant rental leases, for instance.

“It appears to be to be taking a little bit longer than people today thought,” reported Andrew Hunter, deputy main U.S. economist at Capital Economics.

“It is coming,” he explained. “It’s just a subject of when.”