The federal government need to expand its assure to all bank deposits irrespective of size in order to slow bank operates, but it really should charge consumers for that coverage, hedge-fund supervisor Nelson Peltz reported Monday.

The Trian Fund Management founding lover explained to CNBC that consumers pulling revenue out of smaller banking companies is a “harmful scenario” and that he has talked to elected officials about growing the deposit insurance policy software that is at this time capped at $250,000 for each account. The transform would involve shelling out coverage rates to the Federal Reserve.

“I would put jointly a approach that applies only to U.S. banks in that the Fed receives an insurance policies quality for any revenue you depart in a U.S.-accredited financial institution over $250,000. So you’re developing money for the Fed, and in exchange for that they insure the overage,” Peltz said on CNBC’s “Squawk on the Road.”

Peltz’s concept arrives in the aftermath of large deposit outflows from U.S. regional financial institutions in modern months. The failure of Silicon Valley Lender appeared to be prompted by a bank operate after clients with huge accounts found concerns with the bank’s equilibrium sheet. Banks have been tapping the Fed’s crisis lending packages to tackle all those outflows.

The further insurance policy high quality could, for instance, appear out of the CD curiosity payments on significant deposits, Peltz explained. He extra that he thinks it would be much better if the costs had been consciously compensated by the customers rather than just remaining developed into the interest premiums by banks. There could also be restrictions for how considerably deposits sure banking institutions could consider.

“You would have income flowing in listed here from all in excess of the earth. Folks would truly feel secure,” Peltz said.

Federal regulators did phase in and guarantee uninsured deposits at SVB and Signature Lender following they unsuccessful previously this month, although federal officers have mentioned that protection does not lengthen to other financial institutions. Peltz argued that this implicit guarantee for deposits should really be created formal.

“They do it in any case. Let’s create some profits for them let us have the program smoothed out and give people today peace of head,” Peltz explained.

The hedge-fund supervisor is not the only individual contacting for increasing the insurance threshold. Previous Goldman Sachs government and Trump administration advisor Gary Cohn reported on CBS’ “Encounter the Country” on Sunday that regulators should think about increasing the insurance policy cap considerably and applying a tiered pricing technique to shell out for it.

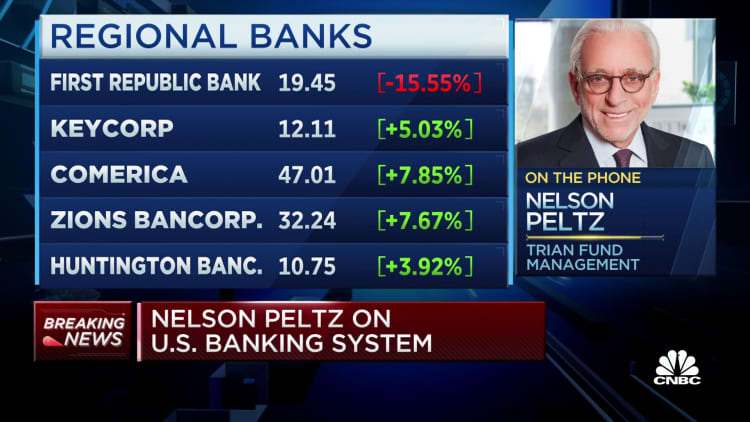

Regional financial institution shares were largely rebounding Monday, though 1st Republic was nonetheless less than force in spite of receiving $30 billion in deposits from other financial institutions.

Peltz mentioned it was vital to make improvements to the deposit insurance policies method even if the latest situation stabilizes.

“The peak of the panic is possibly behind us, but that won’t cease the following just one from coming,” Peltz mentioned.