Google CEO Sundar Pichai speaks onstage during the yearly Google I/O builders conference in Mountain Watch, California, May 8, 2018.

Stephen Lam | Reuters

Google has been pouring income into its cloud-computing organization to contend with Amazon and Microsoft. These hefty investments are finally turning a profit.

Alphabet stated Tuesday that Google’s cloud business is worthwhile for the 1st time in the a few many years it truly is been reporting working metrics for the division.

The segment produced $191 million in operating earnings on $7.45 billion in income in the to start with quarter, in accordance to Alphabet’s earnings assertion. In the yr-ago quarter, the device documented a $706 million loss on $5.82 billion in profits.

The cloud company incorporates the Google Cloud Platform, which rents out cloud infrastructure and services that companies can use to establish and run their personal applications, as perfectly as Google Workspace efficiency software subscriptions. Cloud shoppers involve Deutsche Financial institution, Major League Baseball, PayPal and UPS.

Google has been vying to gain enterprise from big corporations and governing administration companies that are deciding between key tech suppliers as they move from conventional data facilities to the cloud and depend on much more compute-large purposes involving artificial intelligence. Amazon Net Services, the chief in cloud infrastructure, popularized the current market in the mid-2000s and has been successful just about every quarter considering that 2014. Microsoft, the 2nd-largest player in the room, does not report profitability figures for its Azure unit.

Alphabet started off disclosing cloud income in 2020, and the next calendar year began giving details on the scale of its operating losses.

Previous week Alphabet restated functioning earnings for cloud and its other segments, ensuing in lessen cloud losses in 2021 and 2022. The restated quantities present the cloud unit had a $186 million working decline in the fourth quarter, in comparison with $480 million right before the improve, for instance.

“Particular expenses associated with corporate initiatives supporting consumer-dealing with things to do, previously reflected in unallocated corporate fees, are now allocated to Google Products and services and centrally-managed shared exploration and improvement functions, including our shared developer tools, are now allocated dependent on an current evaluate of the relative profit derived from the products and services,” Alphabet claimed in a submitting.

“As a final result of these variations, extra of the beforehand unallocated corporate fees are allotted to our segments, and far more of certain previously allotted prices are allotted to our client-struggling with Google Solutions products and much less to Google Cloud business solutions.”

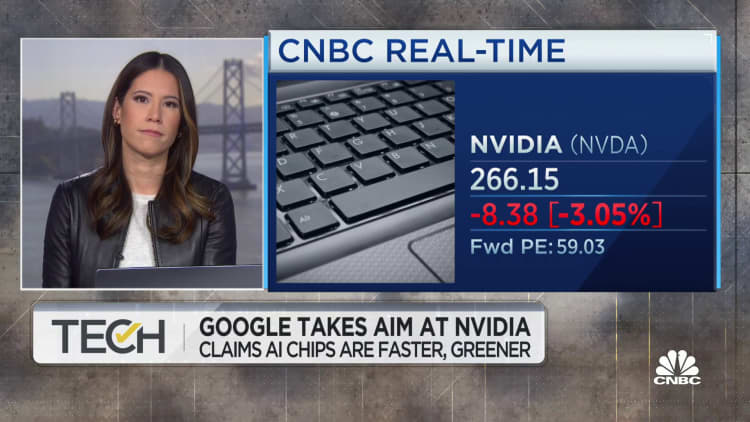

Look at: Google will take Purpose at Nvidia, claims AI chips are more quickly, greener