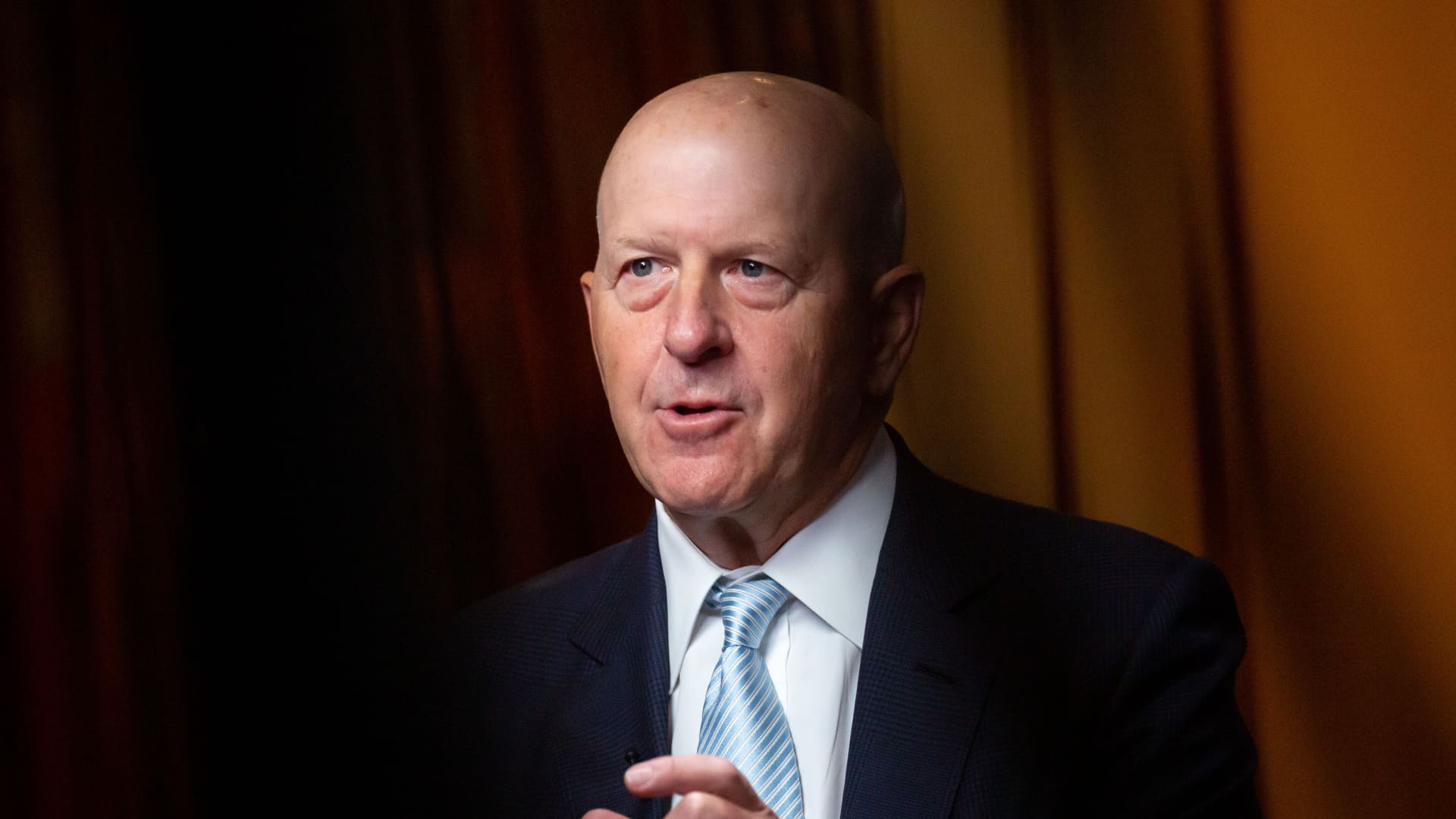

David Solomon, chief executive officer of Goldman Sachs Group Inc., during a Bloomberg Television at the Goldman Sachs Financial Services Conference in New York, US, on Tuesday, Dec. 6, 2022.

Michael Nagle | Bloomberg | Getty Images

Goldman Sachs said Wednesday that it agreed to sell its fintech lending platform GreenSky to a group of investors led by private equity firm Sixth Street.

The deal, which includes a book of loans created by Goldman, will result in a 19 cents per share reduction to third-quarter earnings, Goldman said in the statement. The New York-based bank is scheduled to disclose results Tuesday.

The move is the latest step CEO David Solomon has taken to retrench from his ill-fated push into retail banking. Under Solomon’s direction, Goldman acquired GreenSky last year for $1.7 billion, overruling deputies who felt the home improvement lender was a poor fit. Months later, Solomon decided to seek bids for the business amid his broader move away from consumer finance. Goldman also sold a wealth management business and was reportedly in talks to offload its Apple Card operations.

“This transaction demonstrates our continued progress in narrowing the focus of our consumer business,” Solomon said in the release.

The bank is now focused on its core strengths in investment banking and trading and its push to grow asset and wealth management fees, he added.

Goldman will continue to operate GreenSky until the sale closes in the first quarter of 2024, the bank said.

The expected hit to third quarter earnings includes expenses tied to a writedown of GreenSky intangibles, as well as marks on the loan portfolio and higher taxes, offset by the release of loan reserves tied to the transaction, Goldman said.

It follows a $504 million second-quarter impairment on GreenSky disclosed in July.

The Sixth Street group includes funds managed by KKR, Bayview Asset Management and CardWorks, according to the release.

Private equity groups have played key roles in several of the banking industry’s asset divestitures since the start of the year, providing funding for the PacWest merger with Banc of California, for example.

Read more: Goldman Sachs faces big writedown on CEO David Solomon’s ill-fated GreenSky deal