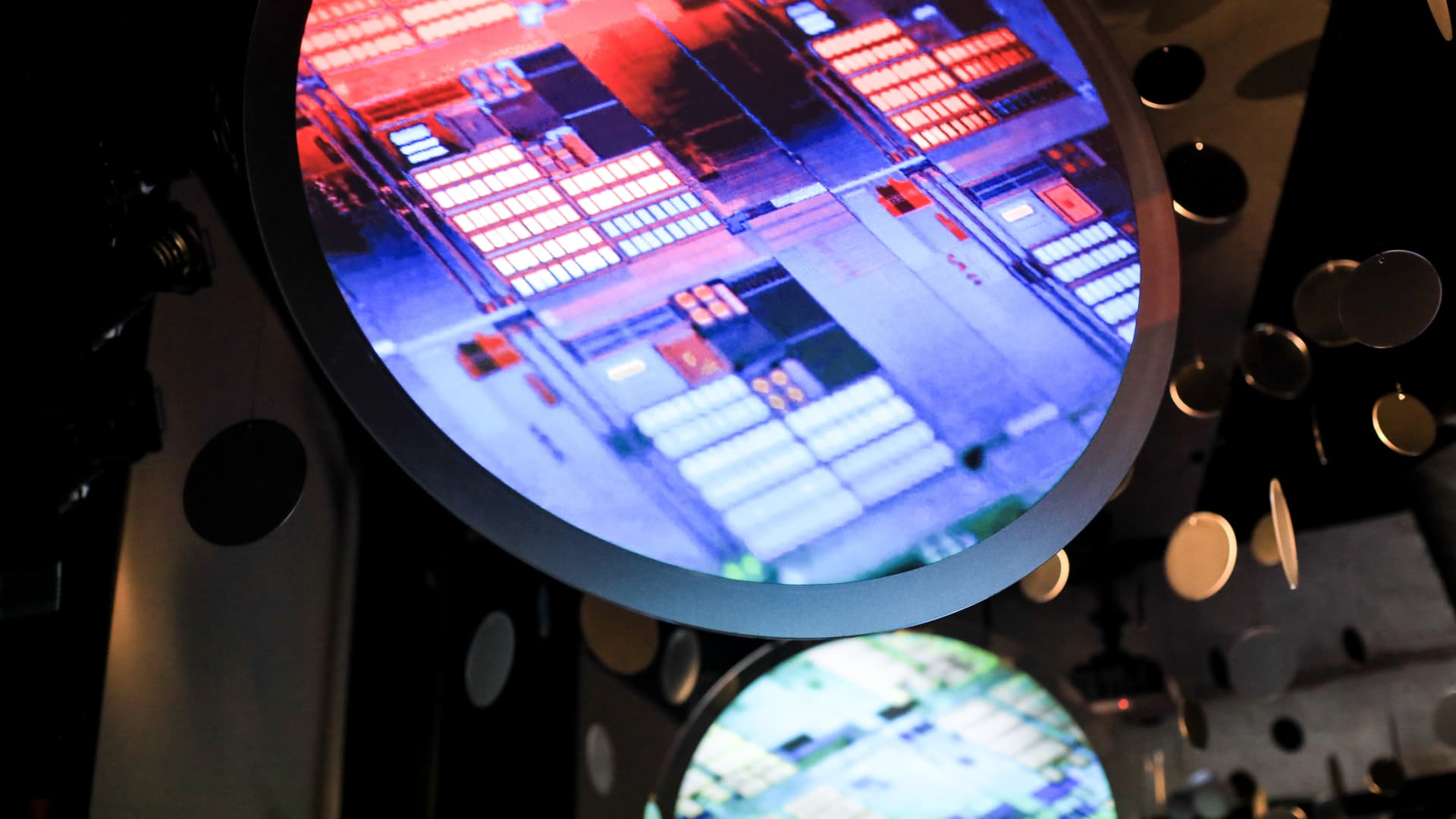

Tech shares in Asia endured a hard year in 2022, substantially like their peers in the U.S. and past, as they struggled with an inventory correction, offer chain disruptions and a world financial slowdown. But Goldman Sachs believes the region’s tech sector is headed for a “significant bottom” — and subsequent upturn — in the very first fifty percent of 2023, which could open the door for investors to bounce back again into Asia tech stocks. “We believe that that … important base and stock base-fishing will most likely occur in 1H2023,” Goldman’s analysts, led by Daiki Takayama, wrote in a observe on Jan 8. “In addition to monitoring the timing of the restoration, if near-term earnings and share price ranges proper rapidly, signs of an earnings bottom may well be verified as early as the earnings reporting year at the close of January and to start with 50 percent of February, which could fortify base-fishing sentiment. This is a optimistic circumstance in our view,” he additional. Traders trying to get to income in need to act early, in accordance to Takayama, who stated inventory price ranges will “rebound quickly.” TSMC among the top picks One particular of Goldman’s prime picks is chip behemoth Taiwan Semiconductor Manufacturing Company . “We like TSMC as we believe its sound engineering leadership and execution make it improved positioned vs. friends to capture the industry’s long-phrase structural development, notably in parts these types of as 5G, synthetic intelligence, higher efficiency computing, electric motor vehicles,” the lender said. TSMC — a vital Apple supplier — is arguably the world’s most essential semiconductor manufacturer . It has also been caught up in the center of the U.S.-China tech fight more than semiconductors, with the U.S searching for to lower China off from significant chips and resources when trying to re-shore semiconductor creation. In December, TSMC introduced the opening of a next chip plant in Arizona , upping its financial commitment in the condition from $12 billion to $40 billion. President Joe Biden and Apple CEO Tim Cook dinner have been both of those at the party where the expenditure was declared, underscoring the important part TSMC performs in the American semiconductor sector. Goldman has a value concentrate on of 600 Taiwan dollars ($19.70) on the purchase-rated stock, which signifies potential upside of 23.7% to its Jan. 11 closing cost. On Tuesday, the business recorded its to start with quarterly income skip in two many years . Fourth-quarter revenue at TSMC rose 43% to 625.5 billion Taiwan bucks, which fell shorter of estimates, in accordance to FactSet info. Yet, TSMC remains an analyst favored, with 90% of analysts covering the stock supplying it a purchase rating, in accordance to FactSet. They give it normal possible upside of 25%. — CNBC’s Michael Bloom and Arjun Kharpal contributed to reporting