An oil pump at sunset in Daqing, Heilongjiang province, China, on July 13, 2006.

Lucas Schifres | Getty Photographs

China’s demand from customers for a lot of significant commodities has been expanding at “strong fees,” Goldman Sachs explained in a recent observe.

The investment decision lender observed that China’s desire for copper has risen 8% 12 months on year, even though hunger for iron ore and oil are up by 7% and 6%, respectively, all beating Goldman’s comprehensive-yr anticipations.

“This power in demand has mainly been tied to a combination of potent expansion from the green economic climate, grid and residence completions,” the Goldman report observed.

Even though China’s embattled home sector is nevertheless battling to recover, the expense bank mentioned that China’s inexperienced overall economy has shown “significant toughness” so considerably this yr, ensuing in a demand surge for metals related to the inexperienced changeover, these as copper.

Goldman’s economists attributed China’s inexperienced copper rush mainly to its onshore photo voltaic installations, which in 2023 so considerably have “amounted to the degree of all previous years’ installations.”

Molten copper flowing into molds at a smelting plant in Wuzhou, China.

He Huawen | Visible China Group | Getty Visuals

China’s working solar capability has arrived at 228 GW, additional than the relaxation of the entire world mixed, a June report by the World-wide Strength Keep an eye on explained. And the world’s second-premier economy is on monitor to double its wind and solar potential five decades in advance of its 2030 objectives.

In accordance to facts collated by Goldman Sachs, China’s green copper demand rose 71% in July from a calendar year back.

“The most significant toughness has arrive on the renewables aspect in which linked copper desire is up 130% y/y 12 months-to-day, led by surging photo voltaic similar need,” Goldman wrote in a different report dated Aug. 25.

Restoration in China’s producing sector is also boosting desire for foundation metals like aluminum.

“The advancement in producing developments so significantly in Q3 has also coincided with much better import ranges of foundation metals,” the report stated.

China’s industrial production grew by 4.5% in August as opposed to a year back, beating anticipations for 3.9% progress. And in that class, the value included of equipment production grew 5.4% yr on year.

Goldman predicted need development for these metals is set to continue on.

“We see a supportive underpin into following year for onshore aluminum and copper demand, given the present-day good motorists are sticky,” the report forecasts.

China’s oil need has also been mounting on the again of a “fast recovery” in oil-intensive products and services sectors these as transportation, even though the analysts said a dip could be on the horizon.

“China’s demand for oil has been supported by report inside mobility, as indicated by robust congestion and domestic flight information,” Goldman observed.

“In our perspective, this robust level is sustainable, though we anticipate expansion to decelerate substantially next 12 months.”

Commodities as a ‘better bet?’

The surge in commodities comes in spite of a wider, faltering macroeconomic advancement tale in China.

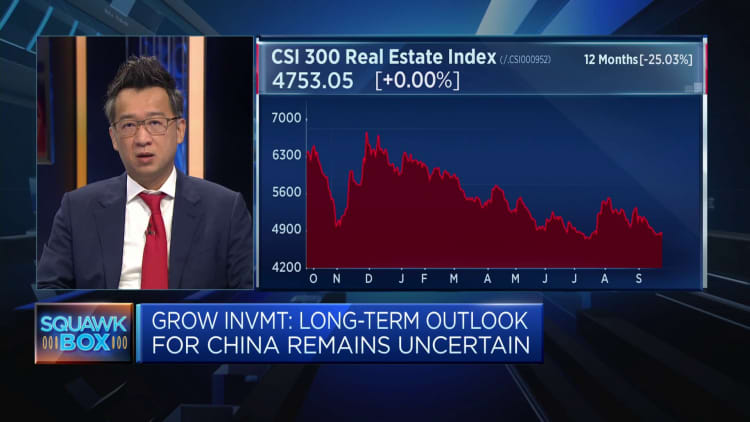

“You happen to be really viewing commodities responding to the [People’s Bank of China’s] monetary growth although the Chinese stock sector is nonetheless seeking to come across the bottom,” claimed Improve Investment’s main economist Hao Hong.

“So you might be looking at a substantial break up among the two asset lessons,” Hong explained to CNBC on Tuesday.

The PBOC a short while ago declared it will proceed to enhance macro plan changes, retaining stable credit growth and adequate liquidity.

“Traders appropriate now in the Chinese industry are looking at commodities as a greater guess on sort of a marginal advancement in the Chinese serious financial state heading ahead,” he noticed.