Oil storage tanks stand at the RN-Tuapsinsky refinery, operated by Rosneft Oil Co., at night time in Tuapse, Russia.

Andrey Rudakov | Bloomberg | Getty Pictures

Goldman Sachs expects file need in oil markets to travel crude charges better in the around term.

“We count on rather sizable deficits in the next half with deficits of practically 2 million barrels for each day in the 3rd quarter as desire reaches an all-time substantial,” Goldman’s head of oil analysis Daan Struyven explained to CNBC’s “Squawk Box Asia” on Monday.

He additional that the financial institution forecasts Brent crude to rise from just above $80 for every barrel now to $86 per barrel by year-finish.

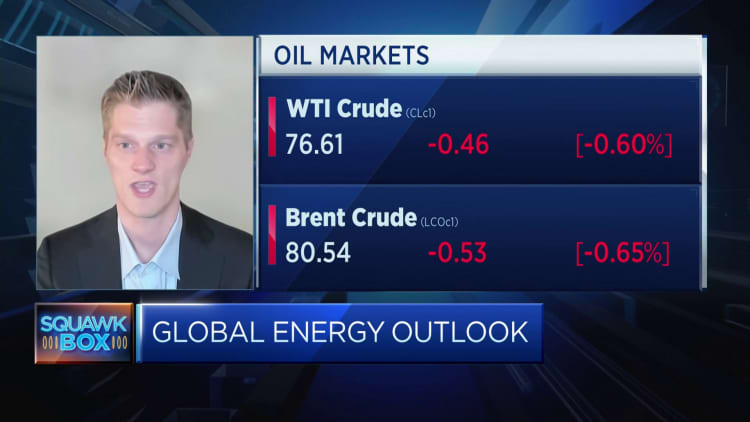

Global benchmark Brent futures traded .39% decreased at $80.75 a barrel, though U.S. West Texas Intermediate futures stood .42% at $76.75 per barrel.

‘Elevated demand from customers uncertainty’

When Struyven acknowledged that U.S. crude oil manufacturing has risen considerably over the past year to 12.7 million barrels for every working day, he said that tempo of growth will gradual all over the rest of 2023.

“We anticipate U.S. crude supply expansion to slow down quite substantially to a sequential tempo of just 200 barrels for every day from right here,” he explained, pointing to the decrease in rig counts. That metric, which tallies the amount of active oil rigs, is used as an indicator of drilling exercise and potential output.

The U.S. oil rig rely not long ago hit its most affordable stage in 16 months, down 15% from its late 2022 peak, a modern Goldman report observed, citing details from Baker Hughes and Haver.

Last 7 days, Baker Hughes claimed U.S. oil rigs fell by 7 to 530 the most affordable because March 2022.

Struyven suggested that the deficiency of an settlement pursuing the G20 energy ministers’ meeting signifies “pretty substantial” uncertainty about very long-run oil demand from customers.

The Team of 20 power ministers achieved in India about the weekend, but still left without having achieving a consensus on the phasing down of fossil fuels, complicating the transition toward clear electricity.

“Key position right here for buyers is, with the uncertainty about oil demand becoming so elevated, investors may well call for a quality to compensate for the for the elevated possibility from these elevated desire uncertainty,” Struyven mentioned.

The Intercontinental Electrical power Company in June had predicted that global oil demand is on observe to rise by 2.4 million barrels for every working day in 2023, outpacing the earlier year’s 2.3 million barrel per working day enhance.

Around the weekend, secretary basic of the Intercontinental Vitality Forum Joseph McMonigle experienced forecast that both India and China will make up 2 million barrels a day of demand decide on-up in the next 50 % of 2023.