A design in a multifamily and single household residential housing elaborate is shown in the Rancho Penasquitos neighborhood, in San Diego, California, September 19, 2023.

Mike Blake | Reuters

In idea, obtaining inflation nearer to the Federal Reserve’s 2% concentrate on does not seem terribly hard.

The major culprits are related to products and services and shelter expenditures, with many of the other elements showing obvious signals of easing. So concentrating on just two regions of the financial state doesn’t seem to be like a gargantuan activity in comparison to, say, the summer season of 2022 when fundamentally every thing was heading up.

In observe, even though, it could be tougher than it seems to be.

Price ranges in these two pivotal factors have proven to be stickier than foods and gasoline or even employed and new autos, all of which are likely to be cyclical as they rise and slide with the ebbs and flows of the broader economic climate.

In its place, acquiring much better control of rents, clinical treatment products and services and the like could take … very well, you could not want to know.

“You need a economic downturn,” stated Steven Blitz, chief U.S. economist at GlobalData TS Lombard. “You’re not going to magically get down to 2%.”

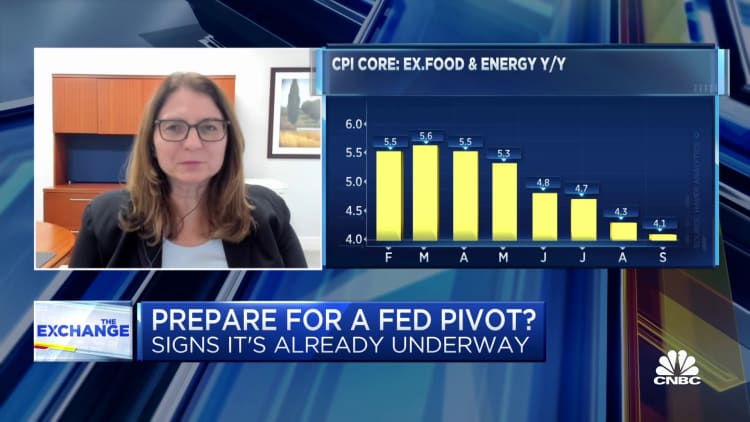

Annual inflation as calculated by the consumer rate index fell to 3.7% in September, or 4.1% if you kick out risky foodstuff and electricity prices, the latter of which has been growing steadily of late. While both equally figures are still perfectly forward of the Fed’s intention, they characterize progress from the times when headline inflation was jogging north of 9%.

The CPI components, even though, advised of uneven progress, assisted together by an easing in merchandise such as made use of-automobile prices and medical treatment products and services but hampered by sharp raises in shelter (7.2%) and companies (5.7% excluding electrical power providers).

Drilling down even further, hire of shelter also rose 7.2%, rent of key residence was up 7.4%, and owners’ equal hire, pivotal figures in the CPI computation that suggests what property owners consider they could get for their properties, greater 7.1%, which includes a .6% obtain in September.

Without having progress on all those fronts, you can find minor prospect of the Fed acquiring its goal whenever shortly.

Uncertainty forward

“The forces that are driving the disinflation amongst the numerous bits and micro parts of the index inevitably give way to the broader macro power, which is increasing, which is over-development growth and minimal unemployment,” Blitz claimed. “Finally that will prevail until eventually a economic downturn will come in, and that is it, you can find practically nothing truly a great deal more to say than that.”

On the brilliant facet, Blitz is amid those people in the consensus perspective that see any economic downturn being relatively shallow and shorter. And on the even brighter facet, quite a few Wall Avenue economists, Goldman Sachs between them, are coming all around to the view that the a great deal-predicted recession may not even transpire.

In the interim, though, uncertainty reigns.

“Sticky-rate” inflation, a evaluate of matters these kinds of as rents, numerous services and insurance plan fees, ran at a 5.1% rate in September, down a full percentage point from Might, according to the Cleveland Fed. Adaptable CPI, together with foods, electricity, motor vehicle fees and attire, ran at just a 1% fee. Equally symbolize progress, but continue to not a intention achieved.

Marketplaces are puzzling above what the central bank’s future stage will be: Do policymakers slap on yet another rate hike for good measure before yr-end, or do they simply stick to the rather new better-for-for a longer time script as they check out the inflation dynamics unfold?

“Inflation that is stuck at 3.7%, coupled with the sturdy September work report, could be adequate to prompt the Fed to certainly go for one particular extra rate hike this year,” said Lisa Sturtevant, main economist for Shiny MLS, a Maryland-primarily based serious estate providers organization. “Housing is the key driver of the elevated inflation numbers.”

Higher fascination rates’ major influence has been on the housing sector in phrases of product sales and financing costs. Still rates are continue to elevated, with worry that the high costs will discourage development of new flats and maintain source constrained.

Those aspects “will only direct to better rental price ranges and worsening affordability disorders in the lengthy operate,” wrote Christopher Bruen, senior director of analysis at the Countrywide Multifamily Housing Council. “Increasing charges threaten the strength of the broader position marketplace and financial system, which has not still thoroughly digested the rate hikes now enacted.”

For a longer period-operate worries

The notion that amount boosts totaling 5.25 percentage details have nonetheless to wind their way by way of the economic system is a person issue that could retain the Fed on maintain.

That, nonetheless, goes again to the idea that the financial state nevertheless needs to interesting right before the central financial institution can finish the final mile of its race to deliver down inflation to the 2% goal.

1 favourable in the Fed’s favor is that pandemic-associated things largely have washed out of the financial system. But other components linger.

“Pandemic-period outcomes have a purely natural gravitational pull and we’ve viewed that consider position about the course of the 12 months,” mentioned Marta Norton, chief investment decision officer for the Americas at Morningstar Wealth. “Nevertheless, bringing inflation the remainder of the distance to the 2% focus on calls for financial cooling, no quick feat, supplied fiscal easing, the strength of the shopper and the basic financial overall health in the corporate sector.”

Fed officers hope the economic system to slow this yr, though they have backed off an previously connect with for a mild recession.

Policymakers have been banking on the notion that when existing rental leases expire, they will be renegotiated at decrease charges, bringing down shelter inflation. Even so, the growing shelter and owners’ equivalent lease quantities are operating counter to that considering even while so-termed inquiring lease inflation is easing, claimed Stephen Juneau, U.S. economist at Bank of The us.

“For that reason, we should wait around for far more knowledge to see if this is just a blip or if there is anything additional elementary driving the increase these kinds of as bigger lease raises in greater metropolitan areas offsetting softer boosts in scaled-down cities,” Juneau mentioned in a note to consumers Thursday. He extra that the CPI report “is a reminder that we do not have excellent historic illustrations to lean on” for prolonged-term patterns in hire inflation.