Singapore technological know-how journey-sharing and food stuff shipping and delivery company company Get brand is exhibited on a smartphone monitor.

Budrul Chukrut | Sopa Photos | Lightrocket | Getty Images

Singapore-dependent journey-hailing and meals delivery large Get narrowed losses and broke even in its deliveries phase for the initially time since 2012, in the course of the 3rd quarter.

The firm posted an modified earnings right before curiosity, taxes, depreciation and amortization loss of $161 million, a 24% enhancement from the modified EBITDA decline of $212 million in the similar period a 12 months back. EBITDA is a measure of profitability that demonstrates earnings in advance of desire, taxes, depreciation and amortization.

Grab offers a variety of services which include journey-hailing, food shipping and delivery, package deal delivery, grocery shipping and mobile payments through GrabPay.

The organization said its delivery business broke even three quarters ahead of expectations, “largely thanks to optimization of our incentive invest, and contributions from Jaya Grocer.” In January, Seize acquired a majority stake in Malaysian mass-high quality grocery store chain Jaya Grocer to speed up its enlargement into grocery shipping and delivery.

Meals deliveries also claimed good modified EBITDA in the 3rd quarter, two quarters forward of its earlier guidance.

“We obtained main food items deliveries and general deliveries segment-modified EBITDA breakeven ahead of advice though narrowing our in general decline for the time period appreciably. We achieved this by being laser-targeted on our cost composition and incentive,” Anthony Tan, Grab co-founder and team CEO, reported in a assertion.

U.S.-detailed shares of Grab rose .64% to near at $3.15 a piece in Wednesday trade, outperforming the S&P 500 and Nasdaq Composite which declined .83% and 1.54%, respectively.

Grab went public in December 2021 soon after closing its SPAC merger. The inventory has plummeted 56% year to day.

Driving toward profitability

Grab’s month to month average energetic driver-partners in the quarter hit 80% of pre-Covid ranges. The enterprise also said incentives declined to 9.4% of GMV, in contrast with 11.4% for the same period last calendar year and 10.4% for the former quarter.

“This demonstrates our dedication to escalating profitably and sustainably,” mentioned Tan.

Seize elevated its full-year forecast and now expects earnings among $1.32 billion and $1.35 billion, up from the preceding selection of $1.25 billion to $1.30 billion. It also revised its modified EBITDA outlook for the second 50 % of the year and now expects a decline of $315 million, much better than the $380 million it formerly predicted.

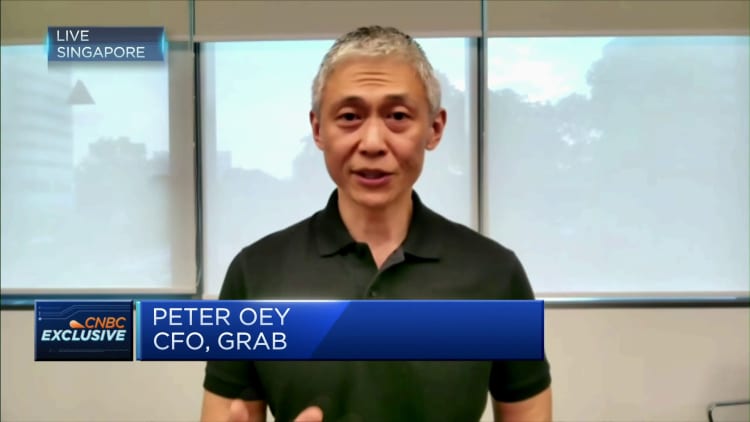

“We will intention to far better optimize our price tag structure by restricting discretionary paying,” Grab CFO Peter Oey claimed for the duration of the media conference.

“We started pausing or slowing choosing in different company departments. We have also been disciplined to improve charges in non-headcount overheads,” he added.