FTT, the token native to crypto exchange FTX, misplaced most of its price immediately after rival Binance, the world’s major cryptocurrency firm, introduced options to obtain the corporation.

The coin traded at all over $22 on Monday and sank beneath $5 Tuesday afternoon in New York. The selloff wiped out far more than $2 billion in value in the space of 24 several hours.

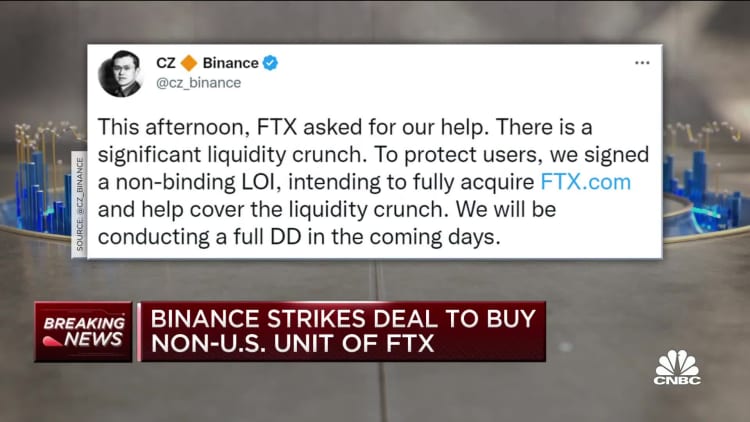

Binance CEO Changpeng Zhao, acknowledged as CZ, wrote in a tweet to his far more than 7 million followers that he expects FTT to be “hugely unstable in the coming times as issues create.”

Cryptocurrencies as a class sank on Tuesday, with bitcoin and ethereum the two plunging much more than 10%. Shares of crypto trade Coinbase also knowledgeable a double-digit percentage drop, even though Robinhood, which traders use to acquire and provide crypto, fell by about 19%.

“It’s almost certainly the most extraordinary offer I have ever found in the record of the crypto industry,” stated Nic Carter, a associate at Castle Island Ventures, which focuses on blockchain investments. “It consolidates generally the two biggest offshore exchanges into a person entity, an complete coup for CZ and Binance — and definitely a catastrophe for FTX.”

The settlement concerning the two corporations is non-binding and follows what FTX CEO Sam Bankman-Fried called “liquidity crunches” at his business, which was valued at $32 billion in a financing round before this year.

The acquisition impacts only the non-U.S. organizations for FTX. The U.S. division will keep on being independent of Binance. Even so, according to a 2021 audit, the U.S. component of FTX accounted for just 5% of full earnings. FTX is based in the Bahamas, where by Bankman-Fried resides.

Like several crypto firms, FTX established its have token known as FTT, which could be procured like bitcoin although it was not as broadly offered. Owners of FTT have been promised lessen buying and selling expenses and the skill to make interest and rewards like waived blockchain costs. Even though investors can earnings when FTT and other coins enhance in benefit, they’re mainly unregulated and are specially susceptible to current market downturns.

In 2019, Binance announced a strategic investment in FTX and stated that as part of the offer it experienced taken “a extended-phrase position in the FTX Token (FTT) to aid enable sustainable development of the FTX ecosystem.”

For the reason that of Binance’s central placement in crypto and its substantial possession of FTT, the business had unique sway above FTX and the market’s view on the organization. Trader self-assurance in FTX was rocked about the weekend when Zhao tweeted that Binance would promote its holdings of FTT.

Zhao mentioned Binance had about $2.1 billion worthy of of FTT and BUSD, its possess stablecoin.

“Due to new revelations that have came to light-weight, we have made the decision to liquidate any remaining FTT on our books,” he explained.

FTT, which peaked at about $78 in September 2021, was trading at shut to $25 the working day in advance of Zhao’s tweets. It plunged beneath $16 on Monday and then fell off a cliff following the deal received declared Tuesday. According to CoinMarketCap, the value of FTT’s circulating offer is about $735 million, down from $2.9 billion on Monday.

Bankman-Fried claimed that in the 72 several hours major up to Tuesday morning, there had been roughly $6 billion of internet withdrawals from FTX, according to Reuters. On an regular working day, web inflows are in the tens of thousands and thousands of dollars.

“The fact that Sam was willing to do this offer suggests that FTX was deeply impaired in terms of the run on the lender that began in the previous 48 hours,” explained Carter. “We never know specifically what the situation was, no matter if they have been lending out or gambling with consumer deposits.”

FTX did not react to CNBC’s a number of requests for remark.

Previously on Tuesday, FTX experienced halted withdrawals from its platform, right after spooked investors attempted to pull their money — in a transfer that resembled the collapse of other crypto firms this yr, which includes Celsius, Voyager Electronic and A few Arrows Funds.

News on FTT sparked problem about Alameda Research, Bankman-Fried’s buying and selling company and sister business to FTX. A report very last week on the point out of Alameda’s funds confirmed a large portion of its equilibrium sheet is concentrated in FTT and its several functions leveraged the token as collateral. Alameda has disputed that claim, saying FTT represents only aspect of its full stability sheet.

“If the cost of FTT goes way down, then Alameda could encounter margin phone calls and all types of stress,” reported Jeff Dorman, chief investment decision officer at electronic asset company Arca. “If FTX is the financial institution to Alameda then everyone’s likely to be in difficulties.”

— CNBC’s Kate Rooney and Tanaya Macheel contributed to this report.