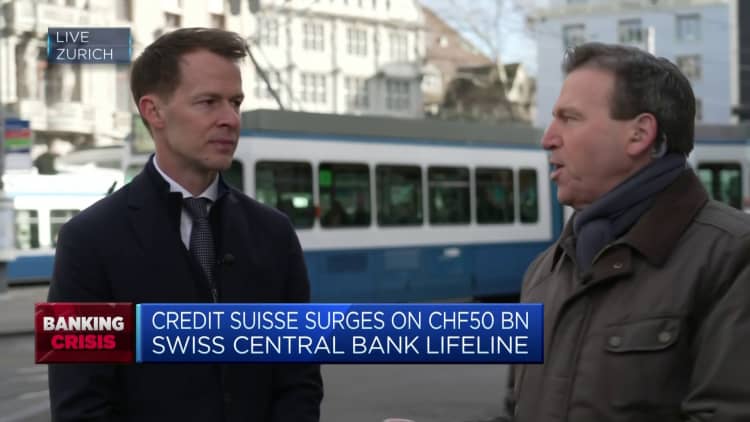

The symbol of Swiss financial institution Credit rating Suisse is noticed at an business setting up in Zurich, Switzerland February 21, 2022.

Arnd Wiegmann | Reuters

Credit history Suisse acquired a liquidity lifeline from the Swiss Nationwide Lender right after its share value plunged to an all-time small, but the embattled lender’s route to the brink has been a very long and tumultuous a single.

The announcement that the lender would access a mortgage of up to 50 billion Swiss francs ($54 billion) from the central lender arrived after consecutive sessions of steep losses, and designed Credit history Suisse the to start with key financial institution to obtain such an intervention because the 2008 World-wide Economic Crisis.

Wednesday’s close at 1.697 Swiss francs per share was down practically 98% from the stock’s all-time higher in April 2007, although credit rating default swaps — which insure bondholders against a enterprise defaulting — soared to new record highs this 7 days.

The troubled bank’s stock has been in persistent decline due to the fact the crisis, towards the backdrop of expense banking underperformance and a litany of scandals and hazard management failures.

Scandals

Credit score Suisse is at the moment undergoing a huge strategic overhaul in a bid to handle these long-term difficulties. Latest CEO and Credit rating Suisse veteran Ulrich Koerner took more than from Thomas Gottstein in July, as inadequate financial commitment lender functionality and mounting litigation provisions ongoing to hammer earnings.

Gottstein took the reins in early 2020 following the resignation of predecessor Tidjane Thiam in the wake of a bizarre spying scandal, in which UBS-bound former prosperity administration boss Iqbal Khan was tailed by non-public contractors allegedly at the route of previous COO Pierre-Olivier Bouee. The saga also observed the suicide of a private investigator and the resignations of a slew of executives.

The previous head of Credit Suisse’s flagship domestic lender broadly perceived as a steady hand, Gottstein sought to lay to rest an era plagued by scandal. That mission was brief-lived.

In early 2021, he uncovered himself working with the fallout from two huge crises. The bank’s publicity to the collapses of U.S. loved ones hedge fund Archegos Capital and British source chain finance business Greensill Funds saddled it with significant litigation and reimbursement expenditures.

These oversight failures resulted in a large shakeup of Credit Suisse’s financial commitment banking, hazard and compliance and asset management divisions.

In April 2021, previous Lloyds Banking Team CEO Antonio Horta-Osorio was introduced in to clear up the bank’s culture after the string of scandals, announcing a new approach in November.

But in January 2022, Horta-Osorio was forced to resign right after staying found to have 2 times violated Covid-19 quarantine guidelines. He was changed by UBS executive Axel Lehmann.

The bank commenced a different pricey sweeping transformation undertaking as Koerner and Lehmann set out to return the embattled lender to extended-time period security and profitability.

This bundled the spin-off of Credit history Suisse’s financial commitment banking division to type U.S.-based CS First Boston, a substantial lower in exposure to threat-weighted property and a $4.2 billion funds elevate, which saw the Saudi Countrywide Financial institution acquire a 9.9% stake to develop into the premier shareholder.

March insanity

Credit Suisse noted a whole-year internet reduction of 7.3 billion Swiss francs for 2022, predicting another “substantial” loss in 2023 ahead of returning to profitability in 2024.

Reports of liquidity fears late in the year led to huge outflows of assets under management, which hit 110.5 billion Swiss francs in the fourth quarter.

Following still a different sharp share price tag fall on the again of its once-a-year outcomes in early February, Credit score Suisse shares entered March 2023 investing at a paltry 2.85 Swiss francs for each share, but things have been about to get worse continue to.

On March 9, the enterprise was compelled to hold off its 2022 yearly report following a late contact from the U.S. Securities and Exchange Commission relating to a “technical evaluation of beforehand disclosed revisions to the consolidated hard cash stream statements” in 2019 and 2020.

The report was sooner or later released the pursuing Tuesday, and Credit rating Suisse mentioned that “product weaknesses” have been discovered in its economic reporting processes for 2021 and 2022, even though it verified that its formerly announced economical statements ended up nevertheless exact.

Acquiring currently experienced the international threat-off jolt resulting from the collapse of U.S.-centered Silicon Valley Financial institution, the mixture of these remarks and confirmation that outflows had not reversed compounded Credit history Suisse’s share price losses.

And on Wednesday, it went into freefall, as top trader the Saudi Nationwide Lender explained it was not ready to give any much more income to Credit rating Suisse thanks to regulatory constraints. Even with the SNB clarifying that it continue to considered in the transformation project, shares dived 24% to an all-time low.

On Wednesday evening, Credit history Suisse declared that it would exercise its selection to borrow up to 50 billion Swiss francs from the Swiss Countrywide Lender beneath a protected loan facility and a quick-term liquidity facility.

The Swiss National Financial institution and the Swiss Fiscal Sector Supervisory Authority claimed in a statement Wednesday that Credit score Suisse “fulfills the cash and liquidity demands imposed on systemically essential banking companies.”

The assistance from the central bank and reassurance on Credit score Suisse’s monetary placement led to a 20% pop in the share price tag on Thursday, and might have reassured depositors for now.

However, analysts suggest thoughts will stay as to exactly where the marketplace will place the stock’s legitimate benefit for shareholders in the absence of this buffer from the Swiss authorities.