Previous U.S. President Donald Trump speaks soon after attending a wake for New York Metropolis Law enforcement Section (NYPD) officer Jonathan Diller, who was shot and killed while producing a regime website traffic cease on March 25 in the Significantly Rockaway portion of Queens, in Massapequa Park, New York, U.S., March 28, 2024.

Shannon Stapleton | Reuters

Many years of trade deficits and a robust dollar developed way too quite a few “losers” in the U.S. economy who turned to Donald Trump’s protectionist procedures, in accordance to Richard Koo, chief economist at the Nomura Research Institute — and those disorders remain.

Trump’s “The united states Very first” financial policies led his administration to institute a slew of trade tariffs on China, Mexico, the European Union and many others, together with slapping 25% responsibilities on imported metal and aluminum.

As the Republican nominee for the 2024 presidential election, Trump has proposed a baseline 10% tariff on all U.S. imports and a minimum amount levy of 60% on imported Chinese goods.

These guidelines have drawn widespread criticism from economists, who argue that tariffs are counterproductive, as they make imported products much more highly-priced for the normal American.

Talking to CNBC’s Steve Sedgwick on the sidelines of the Ambrosetti Discussion board on Friday, Koo explained protectionism was a “terrible issue,” but that Trump’s solution “does have some economic logic.”

“When we researched economics and cost-free trade, in unique, we were being taught…that no cost trade generally results in both winners and losers in the very same financial state, but the gain that winners get is often increased than the reduction of the losers, so the culture as a entire constantly gains. So that’s why the totally free trade is excellent,” he famous.

Koo however argued that this rests on the assumption that trade flows are well balanced or in surplus, even though the U.S. has been working substantial deficits for the very last forty years, which have expanded the number of “losers.”

“By 2016, the quantity of people who take into consideration by themselves losers of absolutely free trade, were being substantial ample to elect Trump president, and so we have to really go back again and say to ourselves: what did we do incorrect to make it possible for this quite a few persons in United States to look at by themselves as losers of totally free trade?” he mentioned.

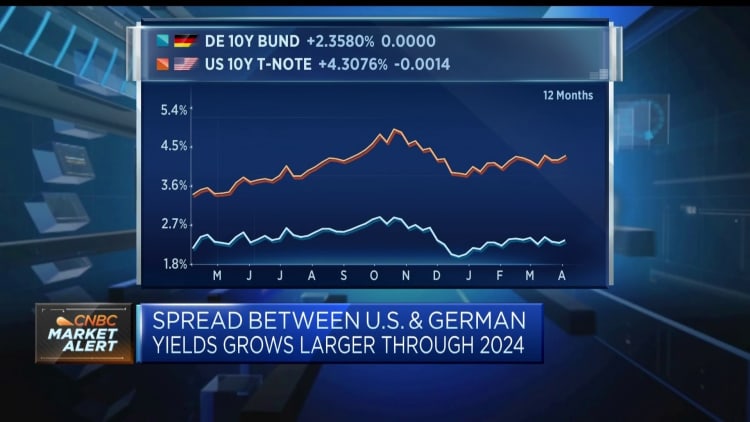

For Koo, the crucial challenge was the exchange amount, as the power of the U.S. dollar incentivized international imports and harm U.S. corporations exporting around the planet.

“We kind of enable the trade amount be resolved by so-termed market forces, speculators, my shoppers, Wall Avenue styles, but the foreign trade amount has to be established in a way that the quantity of losers does not expand to a position the place the absolutely free trade alone is dropped,” Koo stated.

He pointed to a equivalent pivotal moment in 1985, when President Ronald Reagan faced the exact concern of a sturdy greenback and growing protectionism. At the time, Reagan responded by facilitating the Plaza Accord with France, West Germany, Japan and the United Kingdom to depreciate the U.S. dollar versus the respective currencies of these countries via intervention in the international exchange market.

“Which is the form of factor we must have been a lot more conscious of executing. As an alternative of letting [the] greenback to go anywhere the market place will take [it], and then these people who are not as fortunate as we are in the economical marketplaces, finish up struggling and conclusion up voting for Mr. Trump,” Koo included.

He argued that economists need to have to move outside of the idea that the trade deficit is just down to “also considerably expenditure” and “too couple personal savings” in the U.S., as this signifies deficit can only be diminished by remaining in recession till domestic demand weakens so a great deal that U.S. businesses can export a lot more items, which would not be possible in a democracy.

Koo yet again pointed to earlier dealings with Japan, suggesting that if the argument held that overseas businesses are just filling in where by U.S. businesses cannot satisfy domestic need, then the American providers preventing Japanese corporations in the 1970s and 70s need to have recorded big profits thanks to excessive need.

“But that did not truly happen. It can be the opposite that transpired. So numerous of them went bankrupt, so quite a few losers of cost-free trade ended up remaining in the streets, since it was not price savings and investment problem, it was the exchange rate issue,” he reported.

“The dollar ought to have been much weaker, and Reagan comprehended that that’s why he took that action.”