A Federal Reserve formal stated Monday that the sector might have misunderstood the central bank’s supposed information final week right after shares and bonds rallied sharply.

The Fed voted past 7 days to hold fees regular as soon as yet again, and its updated projections showed an expectation of 3 rate cuts in 2024. That triggered a rally in stocks and bonds, with the Dow Jones Industrial Typical leaping to a file higher.

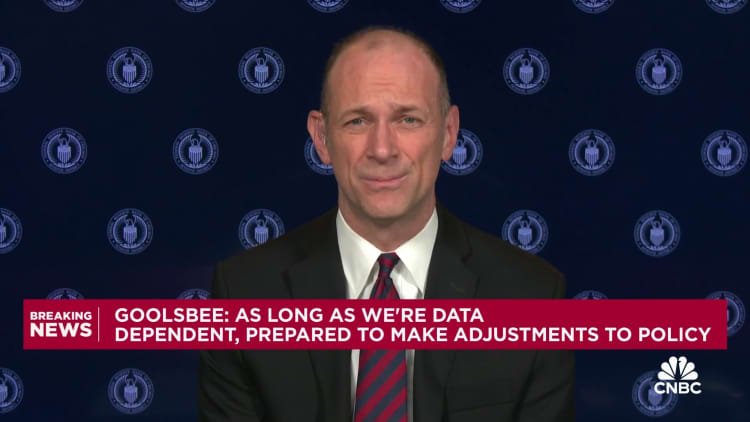

“It is really not what you say, or what the chair claims. It really is what did they listen to, and what did they want to hear,” claimed Chicago Fed President Austan Goolsbee mentioned on CNBC’s “Squawk Box.” “I was confused a little bit — was the marketplace just imputing, here’s what we want them to be saying?”

The Dow strike a record superior final 7 days.

The Fed president also pushed back again in opposition to the notion that the Fed is actively arranging on a sequence of price cuts.

“We you should not discussion specific procedures, speculatively, about the future. We vote on that conference,” he reported.

Investing in the possibilities industry implies that traders see 3.75% to 4.00% as the most likely range for the Fed’s benchmark fee at the conclude of 2024, in accordance to the CME FedWatch Instrument. That would be 6 quarter-level cuts under the present Fed funds level, or double what was forecast in the central bank’s summary of economic projections.

Goolsbee did not explicitly say that the market pricing was erroneous, but did highlight this variation.

“The sector expectation of the selection of level cuts is larger than what the SEP projection is,” Goolsbee explained.

Goolsbee is not the only Fed formal who has downplayed the meeting in the wake of the current market rally. New York Fed President John Williams claimed on CNBC’s “Squawk Box” on Friday that “we aren’t truly speaking about rate cuts correct now.”