A gauge the Federal Reserve employs for inflation rose a bit in November and edged nearer to the central bank’s aim.

The main private usage expenditures value index, which excludes risky food items and vitality selling prices, elevated .1% for the month, and was up 3.2% from a year in the past, the Commerce Division claimed Friday.

Economists surveyed by Dow Jones experienced been expecting respective increases of .1% and 3.3% respectively.

On a 6-thirty day period foundation, main PCE greater 1.9%, indicating that if present traits go on the Fed primarily has reached its purpose.

“Adding in the further sharp slowdown in lease inflation however in the pipeline, it is really challenging to see any credible reason why the once-a-year inflation amount will not also return to the 2% concentrate on over the coming months,” wrote Andrew Hunter, deputy chief U.S. economist at Funds Economics.

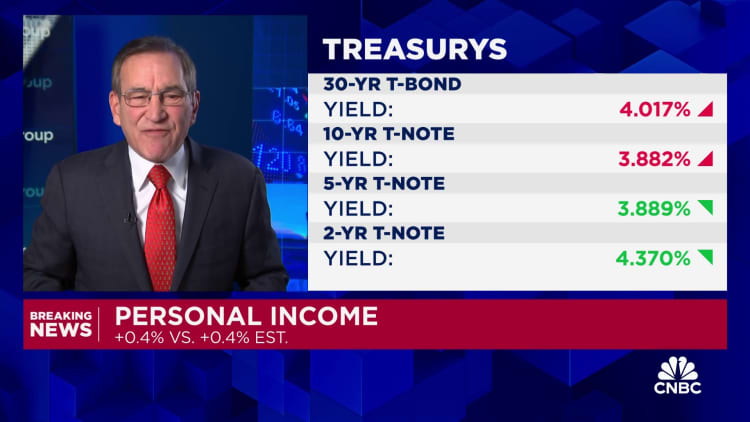

Elsewhere in the report, buyer expenditures in November enhanced .3% when revenue rose .4%, numbers that were in line with expectations and indicative that paying was continuing apace irrespective of ongoing inflation pressures.

Like foods and vitality fees, so-named headline PCE truly fell .1% on the month and was up just 2.6% from a 12 months ago, after peaking earlier mentioned 7% in mid-2022. That was the 1st regular monthly decrease considering that April 2020, according to Fed info.

The 12-thirty day period quantities are substantial in that both equally display inflation generating continued development toward the Fed’s 2% target.

The Fed prefers PCE as an inflation measure more than the much more extensively followed CPI as the former focuses a lot more on what individuals essentially shell out somewhat than the latter’s measure of what merchandise and services value. The central lender is much more concerned with core costs as a longer-operate inflation gauge.

November’s report mirrored a shift in buyer urge for food, as selling prices for products and services greater .2% when goods slumped .7%. A 2.7% slide in vitality costs and a .1% reduce in foodstuff aided keep back inflation for the month.

Much of the market’s target lately has been on the Fed’s inflation view and what that will imply for desire fees.

For just about every of its previous a few meetings, the Federal Open Marketplace Committee has heled the line, retaining its benchmark overnight borrowing rate specific between 5.25%-5.5%. At its meeting final 7 days, the committee indicated it is finished elevating prices and expects to put into action cuts totaling .75 proportion place in 2024. Marketplaces expect the very first charge slice to materialize in March.