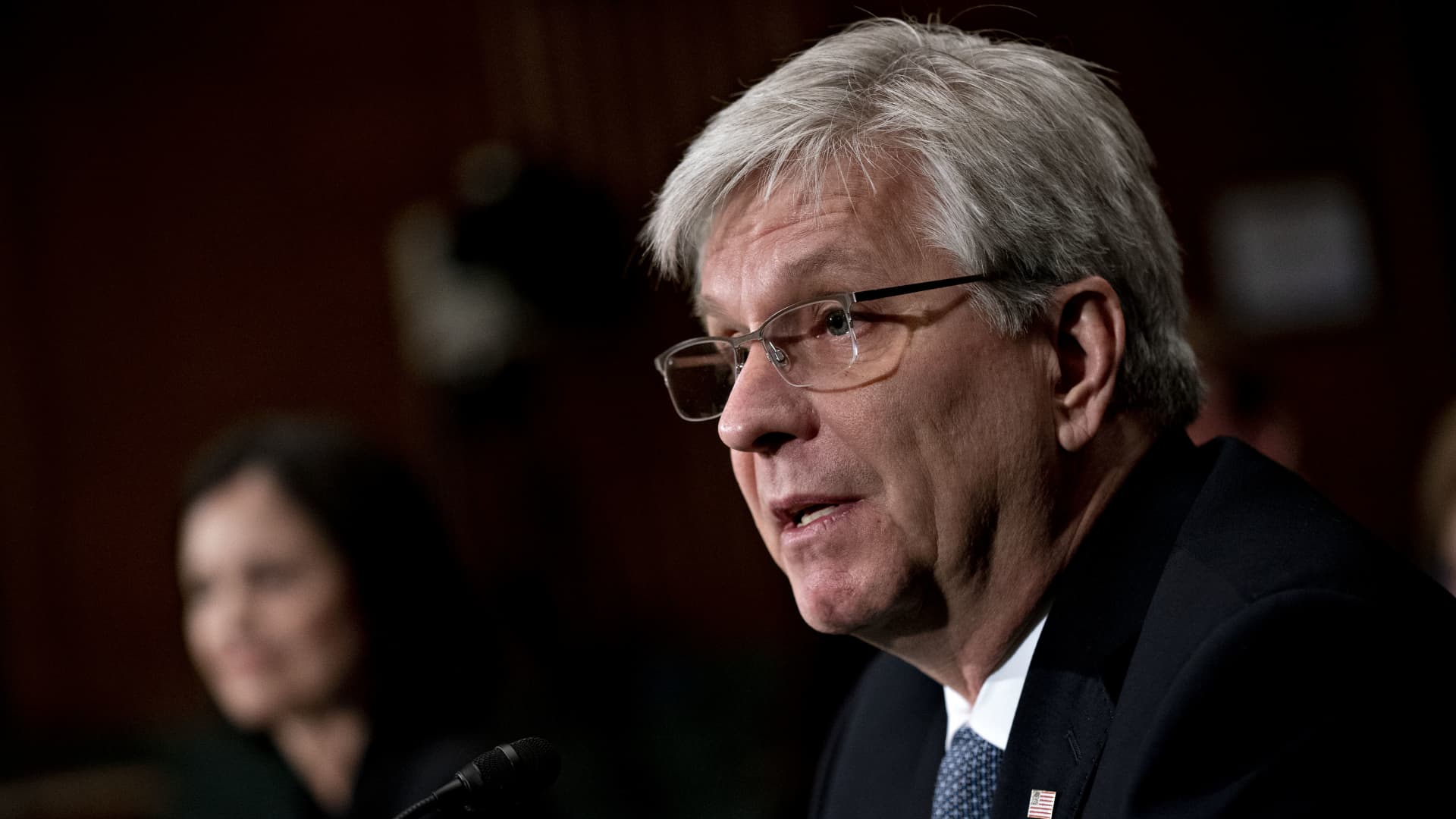

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks during a Senate Banking Committee confirmation hearing in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Photos

Federal Reserve Governor Christopher Waller on Friday echoed new sentiments from his colleagues, declaring he expects a big desire level boost later this month.

He also claimed policymakers really should prevent making an attempt to guess the future and as an alternative stick to what the information is declaring.

“Wanting in advance to our up coming conference, I aid a further considerable increase in the coverage charge,” Waller said in remarks ready for a speech in Vienna. “But, seeking even further out, I can’t inform you about the correct path of plan. The peak vary and how fast we will go there will rely on information we will obtain about the financial system.”

Individuals reviews are very similar to current remarks from Fed Chair Jerome Powell, Vice Chair Lael Brainard and other people, who claimed they are resolute in the effort and hard work to bring down inflation.

Markets strongly expect the central lender to get up its benchmark borrowing rate by .75 % issue, which would be the third consecutive transfer of that magnitude and the speediest pace of monetary tightening due to the fact the Fed commenced making use of the benchmark resources amount as its chief policy software in the early 1990s.

When Waller did not commit to a distinct boost, his feedback had a largely hawkish tone that indicated he would help the .75-point transfer, as opposed to a half-position maximize.

“Dependent on all of the information that we have been given given that the FOMC’s very last meeting, I imagine the policy selection at our upcoming assembly will be clear-cut,” he explained. “Simply because of the potent labor sector, suitable now there is no tradeoff amongst the Fed’s work and inflation targets, so we will keep on to aggressively struggle inflation.

If the Fed does put into action the 3-quarter point hike, it would take benchmark rates up to a vary of 3%-3.25%. Waller explained that if inflation does not abate by means of the rest of the year, the Fed may perhaps have to consider the charge “perfectly higher than 4%.”

He further recommended the Fed get absent from its observe of offering “forward direction” on what its future path would be and the variables that would come into play to dictate those moves.

“I imagine forward assistance is turning into fewer handy at this stage of the tightening cycle,” he claimed. “Foreseeable future conclusions on the dimension of additional price increases and the location for the coverage fee in this cycle ought to be only established by the incoming details and their implications for economic activity, employment, and inflation.”

Waller pointed out welcome indicators that inflation is moderating from its maximum peak in much more than 40 many years.

The own use expenditures rate index, which is the Fed’s favored inflation gauge, rose 6.3% from a yr in the past in July — 4.6% excluding meals and strength. Which is however very well over the central bank’s 2% prolonged-operate aim, and Waller said inflation continues to be “common” even with the recent softening.

He also noted that inflation appeared to be softening at one particular point past year, then turned sharply bigger to where the customer value index rose 9% on a year-more than-12 months foundation at just one position.

“The repercussions of being fooled by a non permanent softening in inflation could be even increased now if an additional misjudgment damages the Fed’s believability. So, till I see a significant and persistent moderation of the increase in main charges, I will guidance having sizeable additional ways to tighten monetary plan,” he said.