U.S. Federal Reserve Chairman Jerome Powell testifies through the Senate Banking Committee hearing titled “The Semiannual Monetary Plan Report to the Congress”, in Washington, U.S., March 3, 2022.

Tom Williams | Reuters

Federal Reserve Chairman Jerome Powell appears in advance of Congress with a tall activity: Convince legislators that he is dedicated to bringing down inflation although not pulling down the relaxation of the economic system at the very same time.

Markets have been on tenterhooks wondering whether he can pull it off. Sentiment in recent days has been extra optimistic, but that can swing the other way in a hurry should really the central financial institution chief stumble this 7 days through his semiannual testimony on financial policy.

“He has to thread the needle here with two messages. 1 of them is reiterating some of the opinions he has produced that there has been some progress on inflation,” stated Robert Teeter, Silvercrest Asset Management’s head of investment policy and approach.

“The second issue is staying definitely persistent in terms of the outlook for prices remaining substantial. He’ll probably reiterate the information that costs are remaining elevated for some time until finally inflation is evidently solved,” Teeter extra.

Should really he take that stance, he’s most likely to facial area some heat, to start with from the Senate Banking Committee on Tuesday adopted by the Household Economic Providers Committee on Wednesday.

Democratic legislators in unique have been anxious that the Powell Fed threats dragging down the economic system, and in distinct people at the lessen stop of the prosperity scale, with its determination to battle inflation.

Slow out of the blocks

The Fed has lifted its benchmark curiosity amount 8 times over the earlier yr, most lately a quarter percentage point maximize early previous thirty day period that took the right away borrowing level to a focus on vary of 4.5%-4.75%.

Markets also have been torn in between wanting the Fed to carry down inflation and concerned that it will go overboard. The central bank’s sluggish begin in tackling the rising price of living has intensified fears that there is nearly no way it can bring down prices devoid of triggering at the very least a modest economic downturn.

“Inflation is a pernicious problem. It was manufactured even worse by the Fed not recognizing it in 2021,” said Komal Sri-Kumar, president of Sri-Kumar International Techniques.

Sri-Kumar thinks the Fed need to have attacked quicker and a lot more aggressively — for instance, with a 1.25 proportion stage hike back in September 2022 when inflation as measured by the customer price index was jogging at an 8.2% annual rate. As an alternative, the Fed in December commenced lowering the sizing of its price hikes.

Now, he claimed, the Fed most likely will have to just take its funds amount to around 6% before inflation abates, and that will induce economic problems.

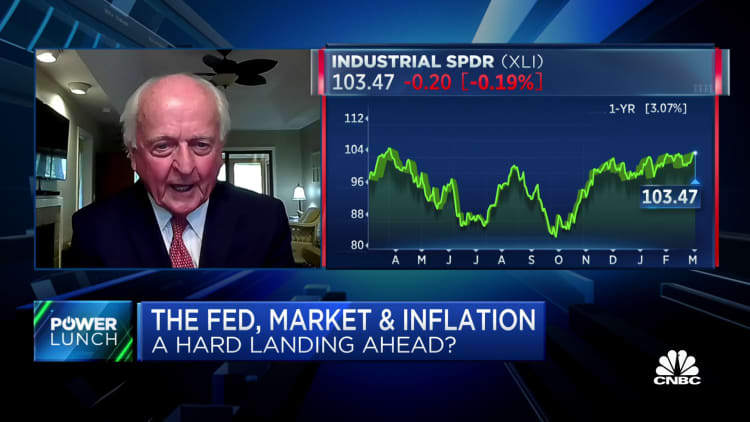

“I you should not consider in this no-landing circumstance,” Sri-Kumar explained, referring to a theory that the economy will see neither a “really hard landing,” viewed as as a steep recession, nor a “gentle landing,” which would be a shallower downturn.

“Indeed, the overall economy is powerful. But that won’t suggest you might be heading to glide by with no recession at all,” he mentioned. “If you’re going to have a no-landing scenario, then you might be going to take 5% inflation, and that’s politically unacceptable. He has to function on bringing inflation down, and for the reason that the overall economy is so potent it is really heading to get delayed. But the a lot more hold off you have in economic downturn, the further it truly is heading to be.”

‘Ongoing increases’ in advance

For his section, Powell will have to uncover a landing location involving the competing sights on plan.

A financial plan report to Congress the Fed released Friday that serves as an opener for Powell’s testimony recurring oft-applied language that policymakers be expecting “ongoing improves” in costs.

The chair probably “will strike a tone that is each identified and measured,” Krishna Guha, head of world-wide coverage and central lender technique at Evercore ISI, stated in a consumer be aware. Powell will notice the “resilience of the authentic financial state” whilst cautioning that the inflation details has turned increased and the street to taming it “will be lengthy and bumpy.”

However, Guha stated that Powell is not likely to tee up the 50 %-point, or 50 foundation position, charge hike afterwards this thirty day period that some investors fear. Current market pricing on Monday pointed to about a 31% probability for the much larger go, in accordance to CME Group facts.

“We assume the Fed hikes 50bp in March only if inflation anticipations, wages, and products and services inflation reaccelerate dangerously higher and/or incoming details is so robust the median peak rate finishes up going up 50,” Guha wrote. “The Fed can not close a conference more from its destination than it was in advance of the assembly started out.”

Interpreting the information will be challenging, however, heading forward.

Headline inflation essentially could demonstrate a precipitous decline in March as a pop in electricity prices very last yr about this time distorts year-over-12 months comparisons. The Cleveland Fed’s tracker displays all-merchandise inflation falling from 6.2% in February to 5.4% in March. However, core inflation, excluding food stuff and vitality, is projected to increase to 5.7% from 5.5%.

Guha reported it really is likely Powell could guide the Fed’s endpoint for rate hikes — the “terminal” rate — up to a 5.25%-5.5% range, or about a quarter issue greater than predicted in December’s economic projections from policymakers.